Momondo acquisition by Priceline: a closer look

Momondo Group was sold to Priceline, owner of rival Kayak, in a $550 million deal. The two Momondo Group brands, Momondo and Cheapflights, will fall under the Kayak division. Another impressive European travel tech success story, made even more impressive by the fact that Momondo underwent major strategic transformations during its development (acquisition, merger and strategic shift by Cheapflights into meta-search).

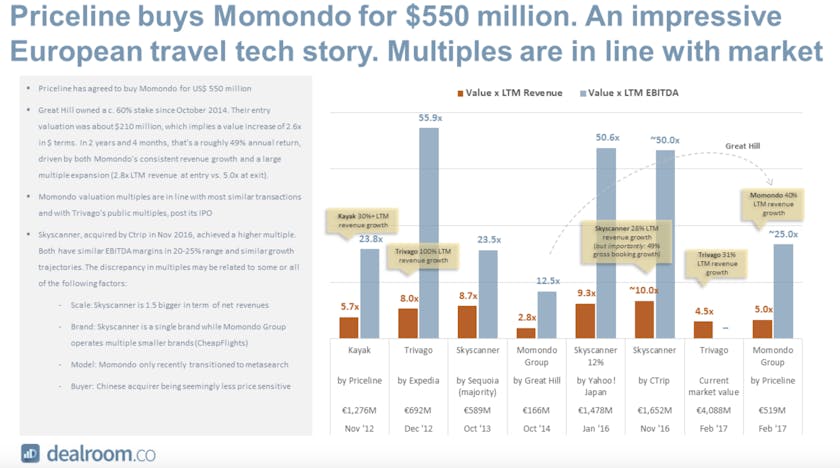

Growth investor Great Hill owned a majority stake of about 60% in Momondo Group since October 2014. Great Hill’s entry valuation was about $210 million; this implies a value increase of 2.6x in $ terms. In 2 years and 4 months, that’s a roughly 49% annual return, driven by both Momondo’s consistent revenue growth and a large multiple expansion (2.8x LTM revenue at entry vs. 5.0x at exit).

Momondo’s valuation multiples are in line with most similar transactions and with Trivago’s public multiples, post its IPO. However, Momondo’s valuation multiples are below Skyscanner’s, which was acquired by CTrip in Nov last year in a £1.4 billion deal. Both companies have similar EBITDA margins of around 20-25%. And both companies have had roughly similar growth trajectories in the last twelve months. The discrepancy in multiples may be related to some or all of the following factors:

- Scale: Skyscanner is 1.5x larger in term of net revenues, therefore receives a market leader premium

- Brand: Skyscanner is a single brand while Momondo Group operates multiple smaller brands (CheapFlights)

- Model: Cheapflights only recently transitioned to metasearch

- Buyer: Chinese acquirer being seemingly less price sensitive

Travel tech saw many exits and funding rounds recently. Most of them (if not all) had been previously tipped as “to watch” in our Travel Tech Deep Dive report (free download). So you’ll want to check that out!

Also check the complete data table of travel search and travel deal companies.

Notes:

- LTM = last twelve months

- Thanks to Yannick Roux for providing some valuable input!

- Great Hill return based on public info and excludes impact from financial leverage

Interested?