Discover the world's most promising companies

Discover the world's most promising companies, perform in-depth company research and analysis, and keep your deal pipeline full with Dealroom.

Dealroom for Venture Capital & Private Equity

Here are a few examples of how Dealroom can add value to your work:

Discover & connect with promising companies

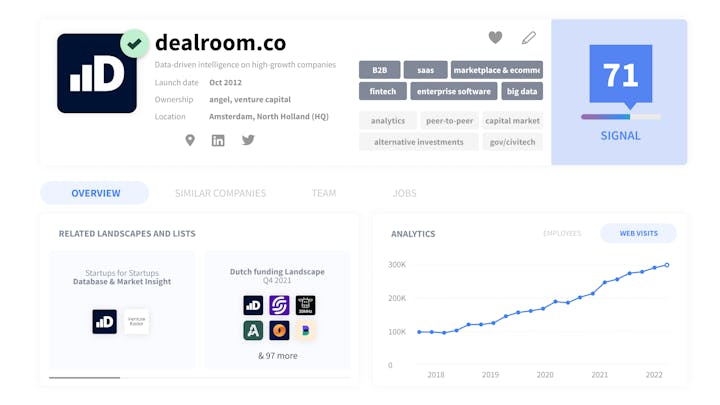

- Identify under-the-radar companies with Dealroom Signal and smart search module

- Expand your search with our suggested similar companies’ algorithm

- Build targeted lists with advanced tags and filters

- Access verified contact information on over 50k founders and easily connect with companies you’ve discovered on the platform.

Conduct in-depth company research & analysis

- Look up similar companies & deals

- Get details on individual funding rounds and exits

- Easily create aggregated reports on specific markets

- Use powerful data visualisation tools to understand your markets

Find suitable co-investors for your next round

- Search the most comprehensive database of investors

- Locate your peers and competitors across the globe

- Find investors based on their performance, focus or strategy

- Connect with the right investors and expand your network

Identify emerging sectors & trends

- Stay at the forefront of technology

- Evaluate the bigger-picture, spot trends by location, industry or business model

- Visualize macro-developments of the market with heatmaps

- Create a data-driven culture by objectively identifying trends in your industry

A solution with global coverage

Quickly identify under-the-radar companies to fill your deal pipeline.

-

Access the most comprehensive database of startups & scaleups

Global data coverage includes:

- 2.5M+ companies globally

- 2.1M+ startups and 640K+ rounds

- 150K+ investors and 605K+ people

- 100+ data points on each company

- And more

-

Up to 2.5x more data on European venture capital rounds

What’s driving the superior data coverage:

- Founded in Europe, with a vast network in the ecosystem

- We work directly with top governments in Europe, North America, Asia, and Australia and trade registers around the globe

- The vast majority of top-tier VC investors are clients and contribute

Trusted by leading VCs around the world

Dealroom works with many of the world's most prominent investors, entrepreneurs, corporations, and government organizations to provide transparency, analysis, and insights on venture capital activity around the world.

-

“Dealroom is a trusted source for intelligence on high-growth companies. We made extensive use of both their data and in-depth analytical support during the preparation of our State of European Tech report. And hope to continue to do so for years to come.”

-

“I’ve checked a lot of databases like CrunchBase, PitchBook, and Dealroom. And I really feel that for the European markets, you have the best coverage and the most intuitive platform to find the startup data. Dealroom is the best choice for European investors.”

Products & Services

As our client, you can use one or more of our products and services to gain valuable insights into your market.

-

Global Data Platform

Global Data PlatformGlobal Data Platform

Comprehensive database on startups, growth companies, and tech ecosystems.

-

Ecosystem Platform

Ecosystem PlatformEcosystem Platform

Measure and promote your ecosystem with your own dedicated startup database

Make data your competitive advantage

Access the most comprehensive database of startups, growth companies, and ecosystems, trusted by world-class VCs & PEs around the globe.