London tech posts high targets for 2022

After a blockbuster year for global venture, in collaboration with London & Partners, we’ve taken a look back at how Europe’s leading tech hub performed in 2021, and how it matches up against the world’s most powerful startup cities.

Report - 2021: London tech reaches new heights

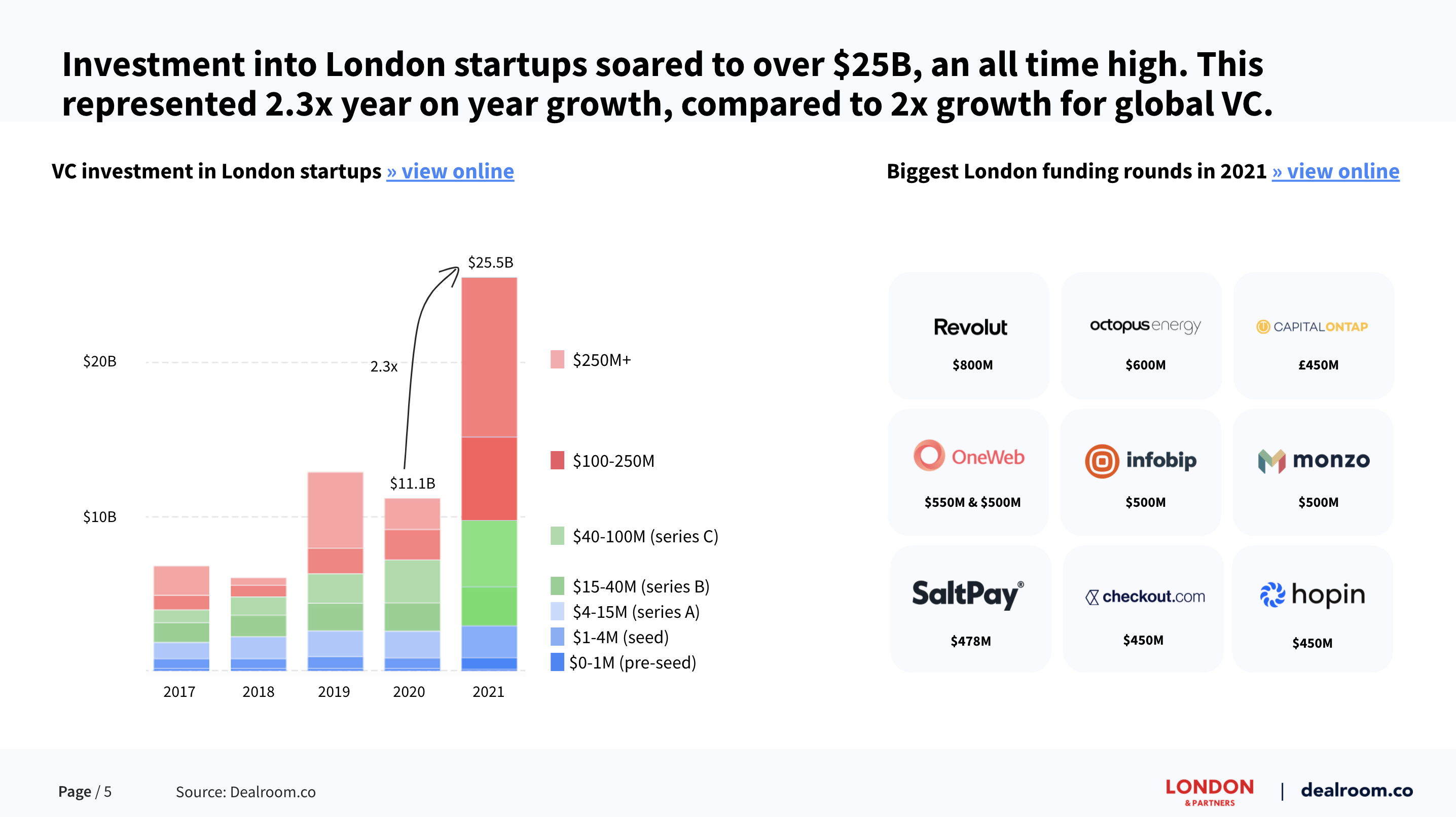

- London tech firms raise $25.5B in 2021 – over double 2020 investment levels

- London ranks fourth globally for number of new unicorns in 2021

- Startups raised $675B globally in 2021, double the previous record

A global tech hub

2021 set new records for on almost every measure for London startups. Funding, megarounds, exits and unicorns all hit new highs in the last 12 months, and London competes among the most mature tech hubs globally. The UK capital’s tech firms raised an all-time high of $25.5B in VC funding, 2.3x investment levels in 2020, growing faster than global venture capital, which also hit new heights, up 2x year on year to $675B.

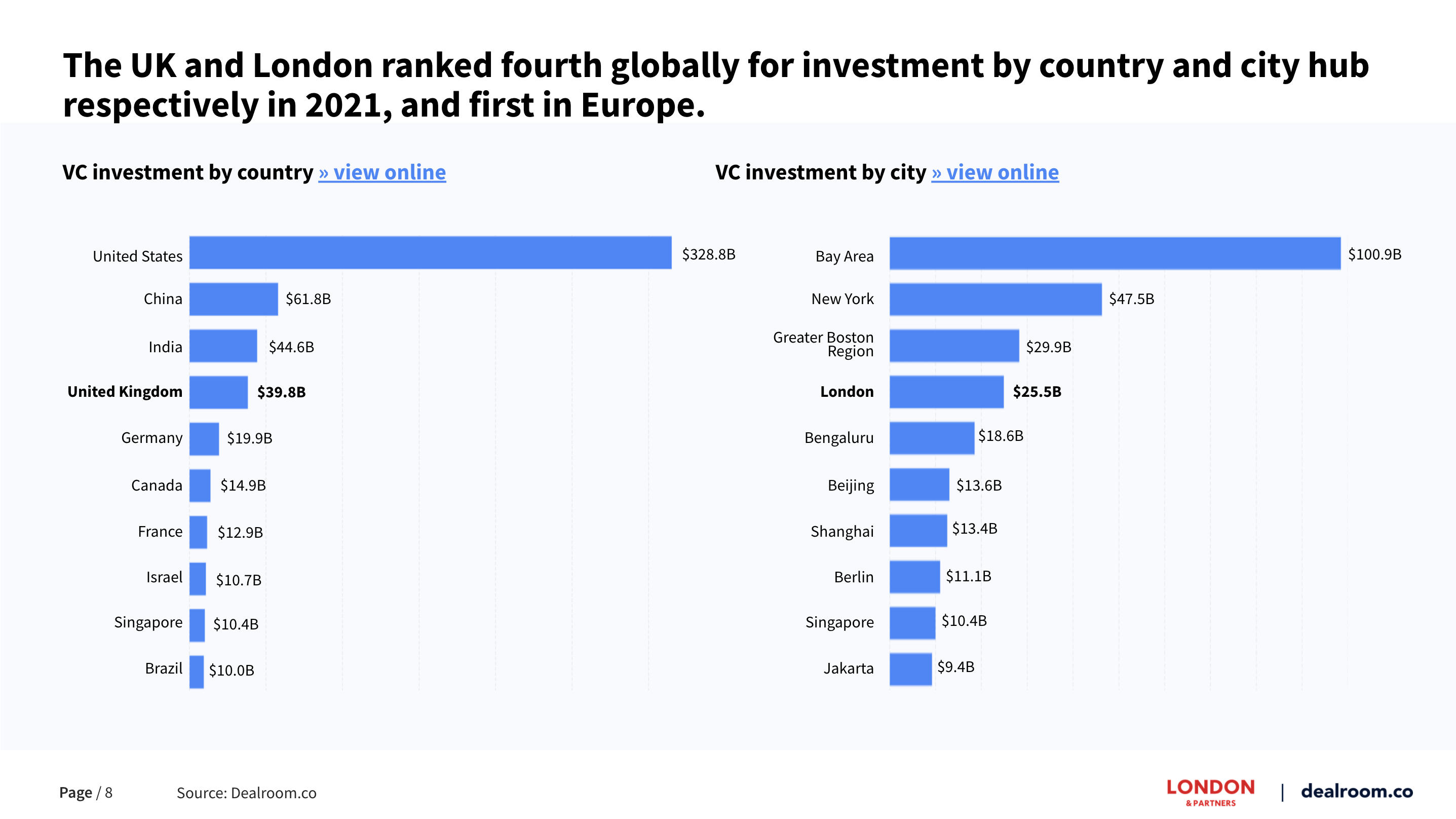

London ranked fourth globally for VC investment in 2021, behind the Bay Area ($98.5bn), New York ($46.3bn) and Greater Boston (28.3bn). On a national level, the UK also ranked fourth globally following another record year of funding ($38.1bn), behind the United States ($315m), China ($57.9bn) and India ($44.2bn).

Late-stage funding surge

2021 saw a huge surge in megarounds of $100m+ in London, accounting for over 60% of all funding. There were 64 megarounds in London last year, up from 19 in 2020 and 18 in 2019. Some of the largest deals involving London companies included: a $800m Series E for London fintech firm Revolut, two funding rounds totalling $900m for clean energy supplier Octopus Energy ($600m in September and $300m in December) and two deals for online events platform Hopin of a combined $850m ($400m in March and $450m in August).

Enterprise value of London’s tech companies (founded since 2000) passed half a trillion dollars in 2021, growing +70% in value on the previous year. VCs saw their investments realized to the tune of $88bn in exit value for London-based startup in 2021, up from just $3.5bn in 2020, and driven by major IPOs for Wise, Deliveroo and Darktrace, while Cazoo, Babylon and Arrival exited via SPACs.

London set up for growth in 2022

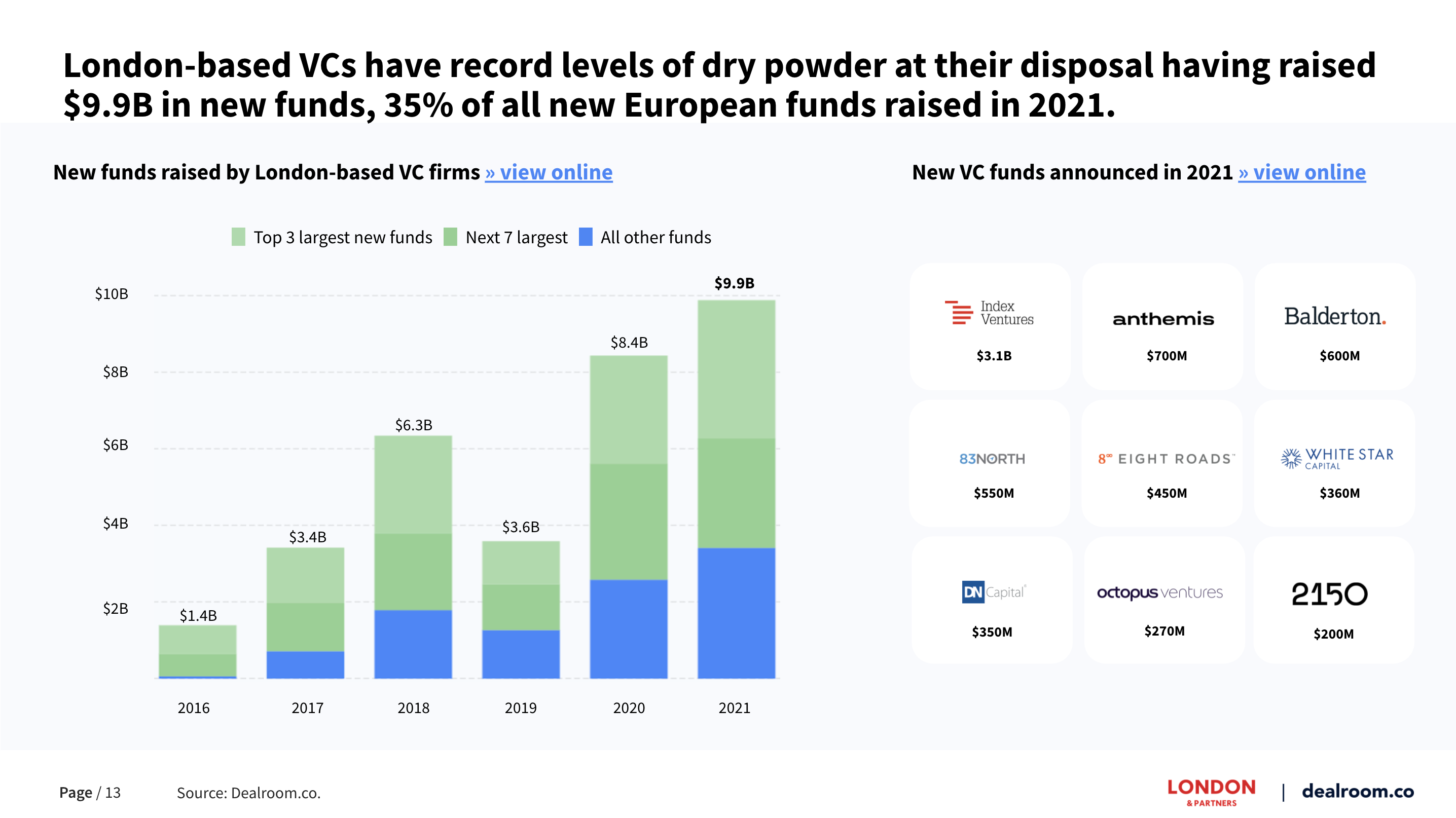

London-based VC firms raised $9.9B in new funds in 2021, providing record levels of dry powder to pump into London-based tech companies this year. This accounts for 35% of all new European VC funds over the last year. Major new London-based VC funds announced in 2021 included Index Ventures ($3.1B), Anthemis ($700M), Balderton ($600M) and 83North ($550M). 2021 also saw US VC firms Lightspeed and General Catalyst expand their footprint into Europe, choosing London as their European base and joining Silicon Valley based VC Sequoia Capital amongst other US VC firms in the UK capital.

US investors are also increasingly looking at London’s tech sector, with 39% of all capital coming from the US into London in 2021, more than any other region and up from 30% in 2020.

Fintech dominance, and Tech for Good emergence

While fintech remains the biggest sector for London funding, accounting for 46% of all London investment ($11.7B), telecoms, health and enterprise software all saw significant growth over the last year as well. London and the UK are also at the forefront of the global boom of investment into impact tech companies, with London-based impact tech firms raising a record $2.3B in 2021.

Report - 2021: London tech reaches new heights

Interested?