Germany’s venture capital and corporate investment climate

On 19 September, Dealroom will present new insights about German venture capital at the 0100 Conference in Berlin. 0100 Conferences is a new generation conference company specializing in high-profile, networking type meetings for the key players in the Venture Capital and Private Equity ecosystem, mainly focused on investors – Limited Partners and General Partners.

Dealroom subscribers receive a special Last Minute Summer Discount off registration for the event (from €1,199 to €899) using code: BE18DEAL

Click here to learn more about the 0100 Conference.

In advance of the event, we already provide a report with some initial insights (link provided at bottom of this post).

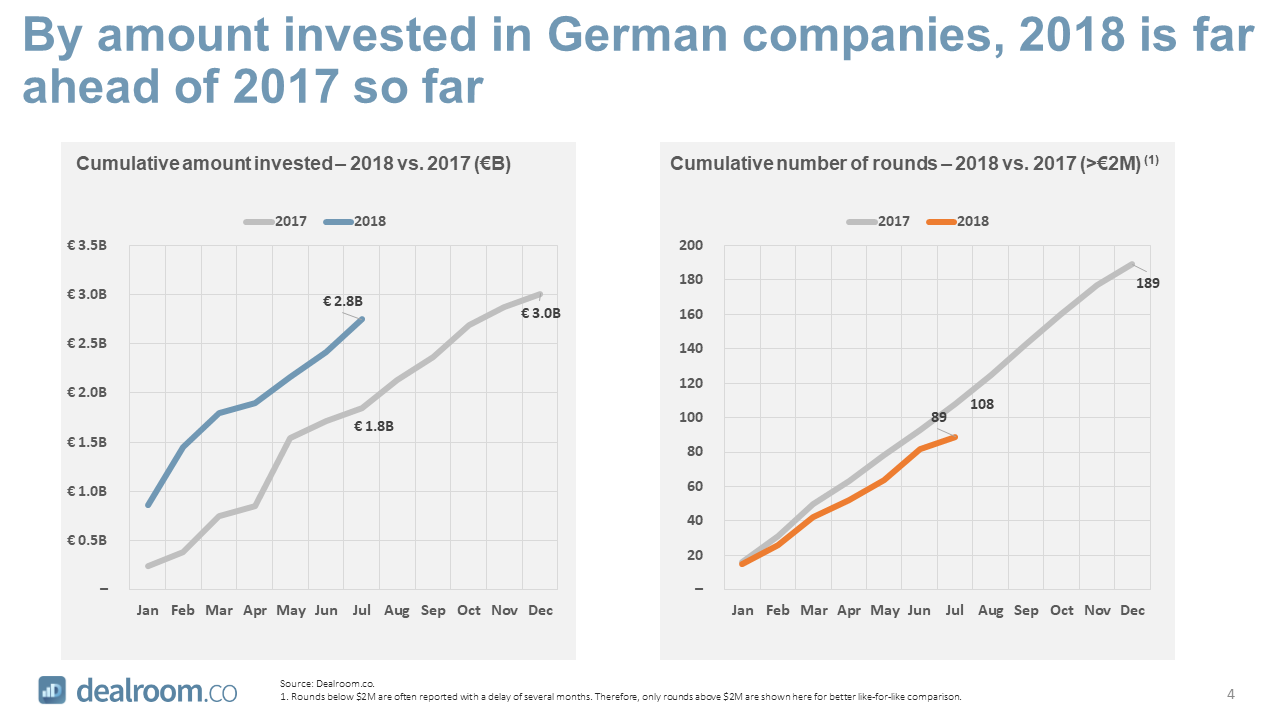

Germany is on track for a record year

Germany has consistently been a leading venture capital hub in Europe, alongside the UK and France. In 2018, venture capital investment in German companies is on track to be a record year. The report contains also comparisons with the UK and France.

German Big Tech is on the rise

To a very large extent this is driven by mega rounds, which have become more frequent and bigger in Germany. The impact of mega rounds has been more significant in Germany than in the UK or France. Charts in the report (link below) illustrate this point. The following link allows you to analyse 2018 and previous years in more details:

Germany’s largest investment rounds (interactive chart)

In 2018 also seven (!) many new $billion+ companies were created or identified: BioNTech, Flixbus (Dealroom estimate), SumUp (Dealroom estimate, implied from iZettle), Celonis, N26, NuCom, Just You.

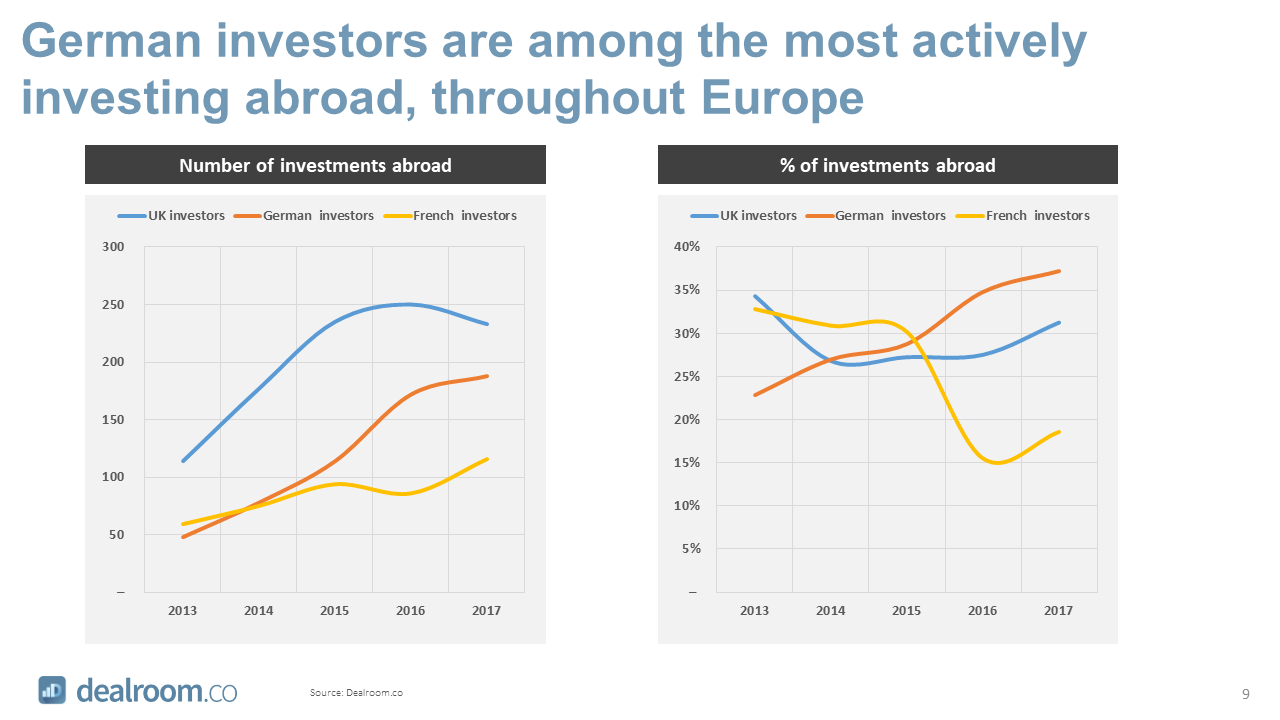

German VCs have a more pan-European investment style

As can be seen below, German VCs have become increasingly active outside of Germany across Europe. In 2017 more than 35% of their European rounds were invested abroad. This is a higher proportion than most of its major European counterparts.

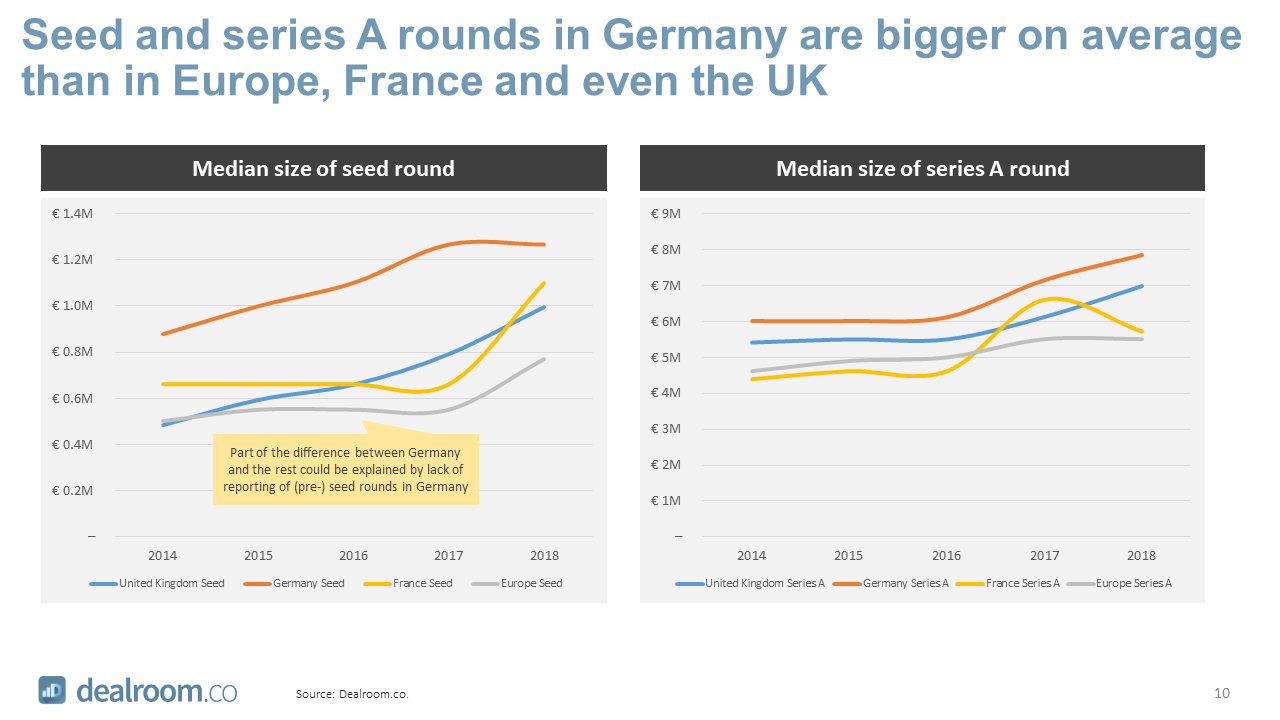

Seed and series A rounds tend to be bigger

As can be seen below, the median size of seed and series A rounds in Germany are higher than the UK, France and Europe. And it’s not just because of labelling: investment in Germany really is more weighted towards bigger rounds, when compared with the UK, France and Europe.

Now enjoy the report, packed with even more insights.

Report - Germany’s venture capital and corporate investment climate

Interested?