Are we entering a European VC slowdown?

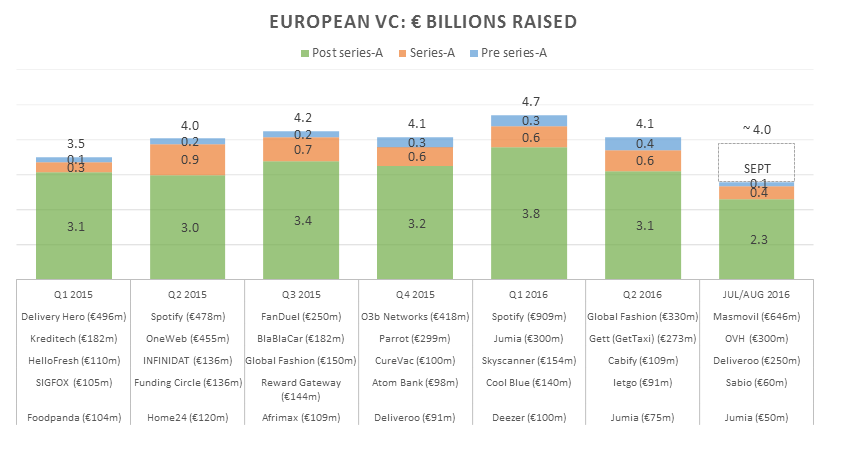

Just a few days ago we released our European VC Q3 Flash Update, which showed solid headline stats. But digging slightly deeper, a clearer picture emerges.

While total Q3 funding is on track, a significant chunk (€646 million) is acquisition financing raised by Masmovil (part of a public entity). Another €300M is from OVH‘s growth equity deal which likely involves a lot of secondary shares (i.e. not new capital invested in the company). If we choose to subtract those, July/Aug funding is only €1.3 billion, a much less impressive figure. A similarly sobering message emerges by looking at the number of rounds.

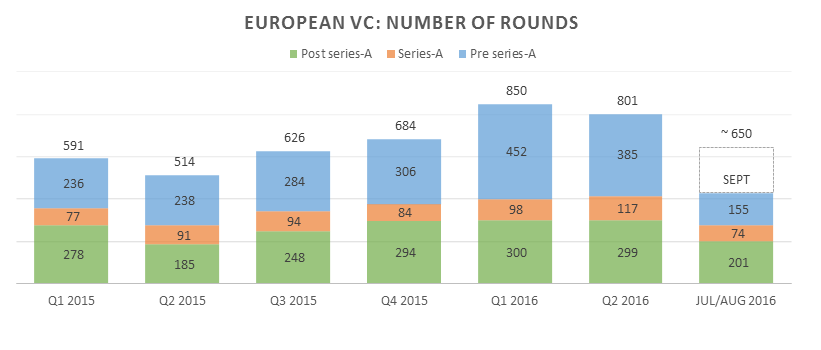

There’s a significant drop in seed / angel rounds, while series-A and later are roughly flat (adjusted for an extra month still to come). However, it is important to note here that seed rounds may take longer to show up, as many founders add seed rounds directly on our database, but with a delay of a few weeks. So the number of pre series-A rounds may still increase significantly.

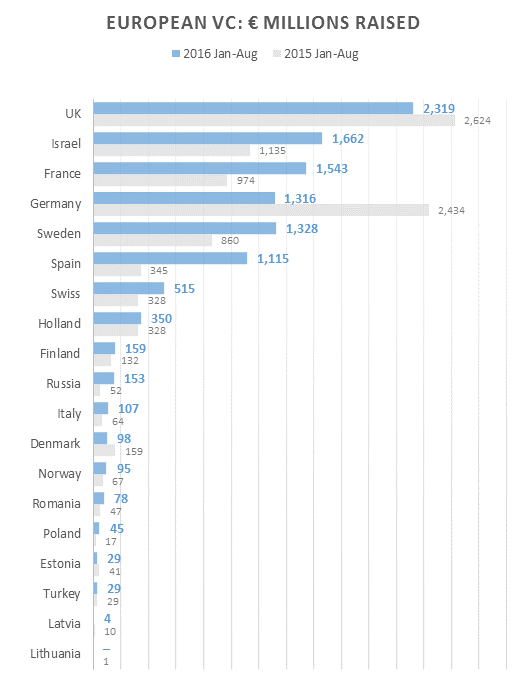

Finally, what do the numbers look like per country?

German funding dropped significantly in 2016 thus far compared to 2015, mainly resulting from a drop in funding activity from Rocket Internet and affiliated companies. Within the Rocket circle, it was Jumia‘s turn to raise capital (= Africa Internet Group). Jumia, based in Paris, raised €425M this year.

To say Paris is taking over from Berlin, as Omar Mohaut recently suggested in an otherwise interesting and useful post, seems exaggerated and premature. We must take into account many other facts, such as the presence of large digital players like Axel Springer, Burda, ProSiebenSat1, source of capital, and more. Nevertheless, an impressive shift within Europe took place this year. France‘s importance in Europe increased significantly, thanks to a wide range of other rounds including OVH, Parrot, Deezer, Teads, and many others, as well as many local initiatives and a strong network of serial-founder angels.

Interested?