The future of digital healthcare: patient first?

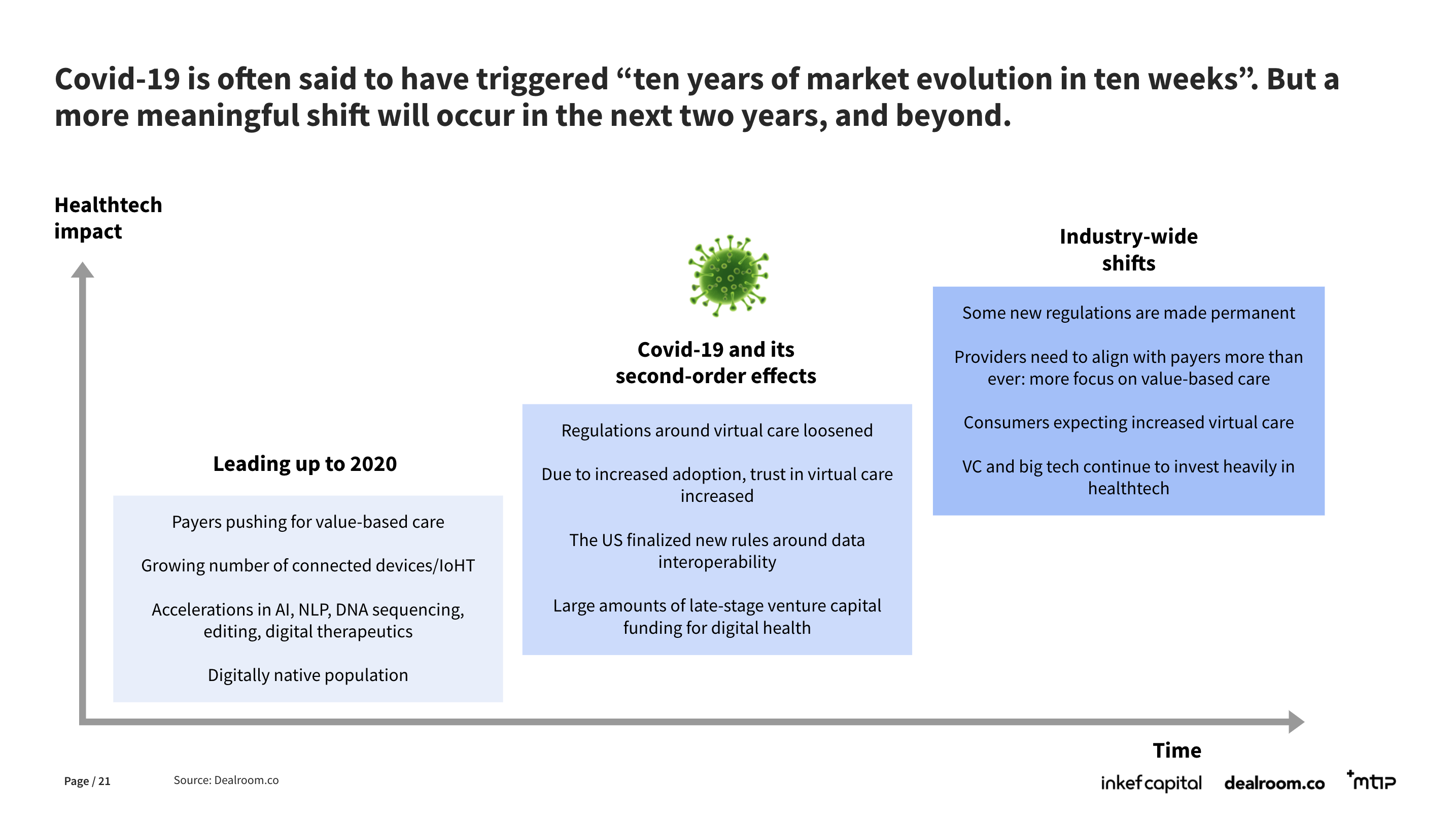

It’s been said that Covid-19 brought “10 years of market evolution in 10 weeks” for healthtech. Our new report in partnership with Inkef Capital and MTIP, looks at what shifts have happened in the last year at the engagement layer of healthcare (e.g. telehealth), the more profound industry-wide shifts still underway, and the startups leading the innovation.

Report - Digital healthcare: patient-first?

The report is powered by a brand new database dedicated to mapping and tracking the health innovation ecosystem. We’ve catalogued 76,275 startups, 38,907 funding rounds, and 8,821 exits of innovative companies addressing all parts of the healthcare value chain and patient journey. This open-access platform initiated by in partnership with MTIP and INKEF Capital, draws on the partners’ collective health innovation expertise, to create a new online home for digital health.

Spending more for less

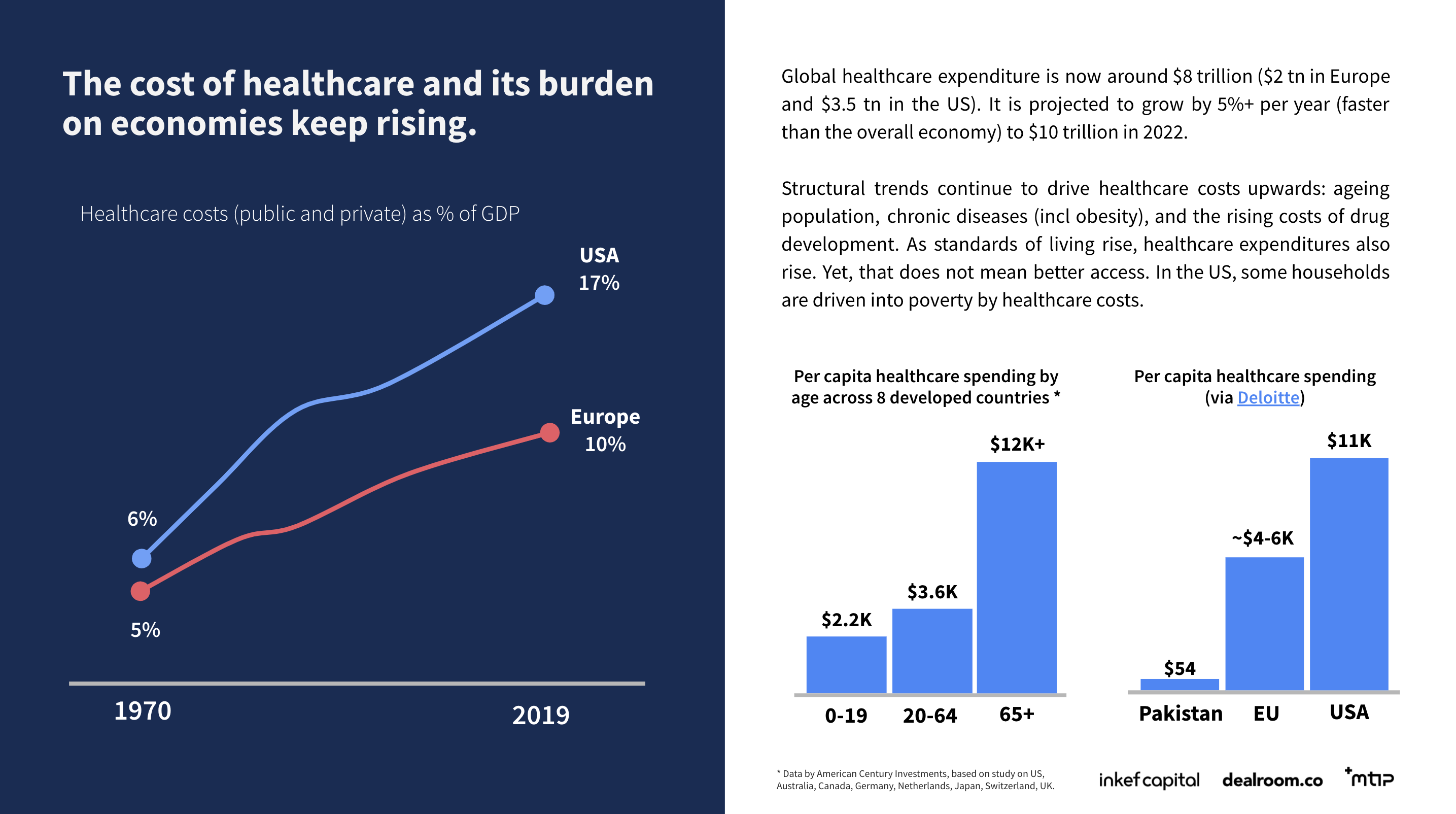

Global healthcare expenditure is now around $8 trillion, of which $2 trillion in Europe and $3.5 trillion in the US. Ballooning healthcare costs are putting a strain on government finances, but also on the outcomes of patients.

Patients increasingly receive lesser outcomes, at higher direct (out-of-pocket, insurance) and indirect (tax, co-payments) costs.

An ageing population, chronic diseases, obesity, and rising costs of drugs, met by a complex market that has been slow to adopt technology, means there are potentially huge savings to be made in the largest consumer category. VCs are certainly betting on Healthcare being the next big digital frontier.

5x in 5 years

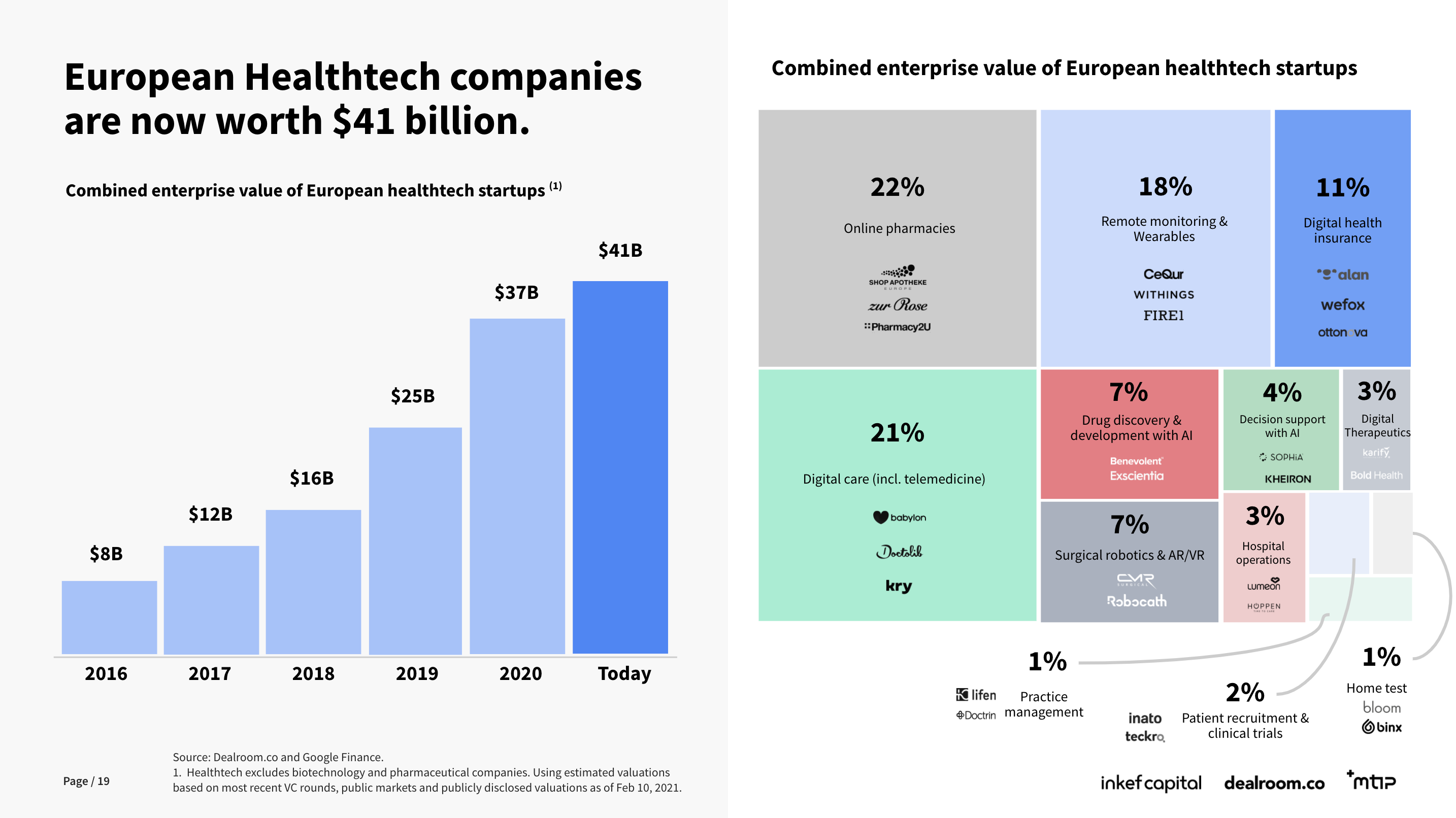

Europe’s healthtech companies are now worth a combined $41B, up from $8B in 2015. Drug discovery, telehealth and online pharmacy startups have so far accrued the most value in European healthtech.

A herd of healthtech unicorns

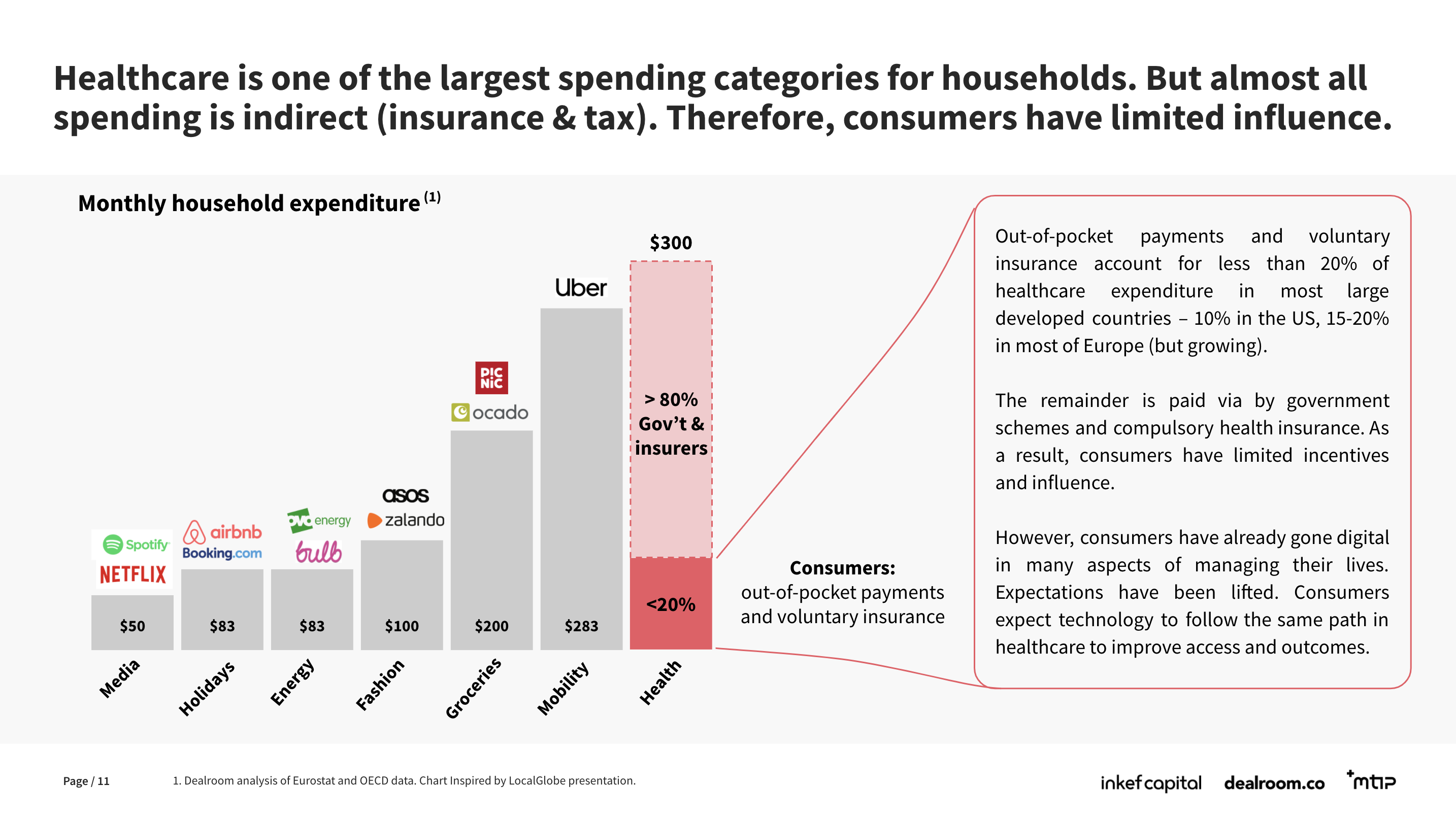

So far some of the world’s most successful startups have emerged in markets where consumers direct relatively low amounts of their spending. Healthcare by comparison is one of the largest consumer categories, yet remains largely undigitized at almost every level of the value chain and patient journey.

Europe is already starting to see big Healthtech companies emerge in telehealth (Babylon, Kry), operations software (Doctolib, Docplanner) and insurance (wefox). And any market in the trillions could certainly support a European multi-decacorn.

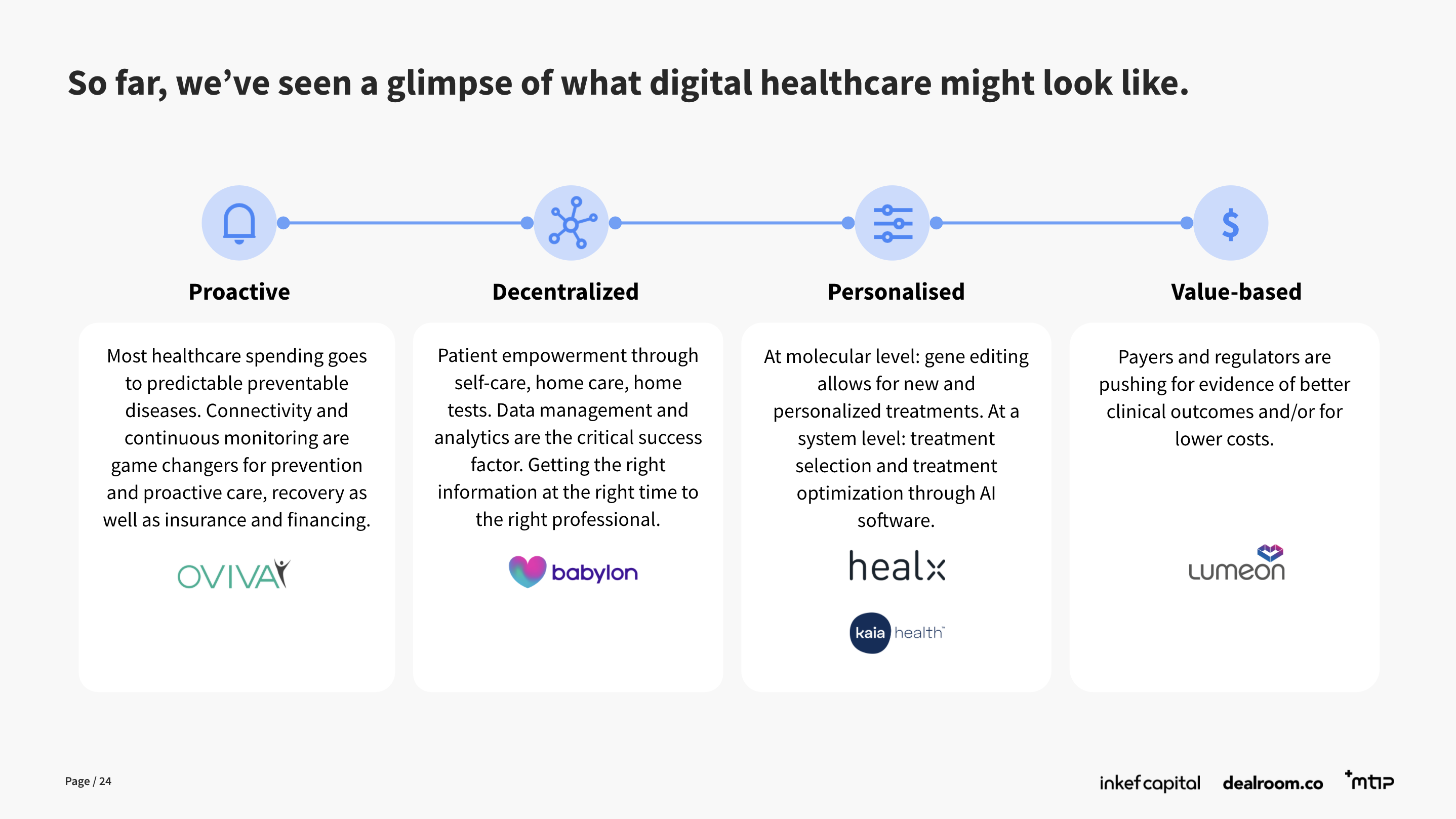

The future of healthcare

Of course the pandemic has had a drastic effect on healthcare and healthtech, in particular accelerating the adoption, demand and trust for telehealth and other patient-interface level solutions. But there are broader industry digitization shifts that will have bigger impact still on our collective healthcare.

Political and regulatory innovation, combined with technological advances can enable improved outcomes and cost-efficiency in healthcare, well beyond the pandemic. Our healthcare is set to become more proactive, looking to prevent illness or catch and diagnose ailments earlier. We’ll be empowered through personalised, decentralized care, with more power being put in the patient’s hands along the patient’s journey. And outcomes will become a focus of spending. Digital solutions can enable evidence-based outcomes and drive value-based spending.

Healthcare may have been slow to adopt digitization, but its impact here has the potential to be more meaningful than anywhere else. Digitalization will literally save lives.

Report - Digital healthcare: patient-first?

Interested?