Space Tech: Europe

In partnership with

Introduction

This guide provides an overview into the Space Tech ecosystem in Europe, exploring the latest trends, key segments, prominent hubs, active investors, and the crucial support provided by enablers like ESA, EUSPA, and E. Amaldi Foundation.

Space innovation had, for decades, been dominated by governments and competition between countries. But since the early 2000s, space has become increasingly commercialized, and the role of private investors, companies and startups has grown massively, giving birth to the “New Space Economy”.

The global Space sector was worth over $469B in 2021, up 2.5x from $180B in 2005, and is projected to grow up to 11% per annum till 2030. Notably, 77% of the market is today commercial(1,2).

Globally, over $44B have been invested in Space Tech startups in the Upstream sector (operating in space or developing products for space), peaking in 2021.

European Upstream Space Tech also peaked in 2021 at $2.5B due to megarounds raised by OneWeb, but looking beyond that, 2024 has been one of the most active years ever.

Space transportation and Satellites attracted the most funding in 2024, especially launch vehicles and earth observation satellites. Since 2016, Earth observation satellites and Communication and connectivity satellites has been the segment attracting the most funding driven by OneWeb.

1) The Space Report 2022 Q2

2) Expanding frontiers: The down to earth guide to investing in space

European VC funding

Upstream investment

European Upstream Space Tech peaked in 2021 with over $2.5B raised due to megarounds raised by OneWeb, but looking beyond that, 2023 has been the most active year. The rest of the commentary on trends always excludes OneWeb from the considerations. 2024 is projected to fall slightly short of 2023 total due to lack of megarounds.

Looking at the number of rounds, 2024 is nearly on par with last year, with a slight decline from 2022 but still significantly more activity than pre-pandemic levels. The number might rise slightly due to a few undisclosed rounds.

Early Stage

Breakout Stage

Late Stage

Looking more broadly at the Downstream sector (space or space-derived technology applied for use on Earth), we see instead funding peaking in 2022.

Upstream and Downstream space follow, in fact, different trends.

The Upstream trend is increasing as it is a product of industrial planning and strategic positioning. At the same time, the Downstream trend is decreasing because of macroeconomic trends that have impacted other industries globally (such as inflation and interest rates ramp-up, energy crisis) which led to a decrease in VC funding in a broad range of sectors.

Comparison with other industries

In 2025 Space Upstream funding is projected to decrease in line with the overall European VC market.

Space Tech is still a small part of VC funding, attracting just 10% of the funding going to Deep Tech in 2025 to date

Global comparison

Europe has attracted one-fifth of the global VC funding in Space Upstream since 2020, the highest share after the US, which still boasts a ~3x lead.

Overall, Europe is relatively stronger in Space Tech than in overall VC funding and other Deep Tech segments, especially Defense, Semiconductors and AI.

However, this varies widely by segment. Europe is notably trailing behind in launch vehicles, space utilities and space resource exploration; while showing strength in mission planning and control, communication and connectivity satellites (OneWeb), earth observation satellites and ground infrastructure for satellites.

Europe also excels in Space Science research, claiming 40% of the highest cited research in the segment, almost on par with the 42% of the US.

This is nearly double Europe's share in Computer Science and Physics, and four times more than Material Science.

Top countries and hubs in Europe

Germany has attracted the most Upstream Space funding in 2024 in Europe, led by The Exploration Company, Isar Aerospace and OroraTech, followed by Spain, the UK, France and Finland.

The UK is still the leading country by funding raised since 2019. Germany, France, and Finland follow.

Looking at the top 100 most valued European Upstream space startups, we see Munich as a key hub for space in Europe for VC-backed startups, home to companies like Isar Aerospace and The Exploration Company.

The London, Cambridgeshire and Oxfordshire area is also home to OneWeb, Open Cosmos, Satellite Vu and many others.

Notably, Toulouse emerges as the key French hub for space tech startups (along with Paris) thanks to its heritage in the space industry since the 1960s, with CNES (The National Centre for Space Studies), Airbus, and Thales Alenia Space.

It is worth noticing that great space startups are also being created outside of the main traditional tech and space hubs. For instance, EnduroSat from Sofia (Bulgaria) is a leading nanosatellite prodiver and the only representative from the Balkans.

Valuations

European Upstream Space tech startups are now worth over $21B, up from less than 4 billion one decade ago.

Notably, the vast majority of this value has been created by recently founded startups started since 2010, especially the most recent cohorts of 2015+. This shows that VC Space Tech is still a young ecosystem.

The vast majority of this value is still private. This is coherent with a young ecosystem and the long time to public listing in the tech ecosystem (often over 10 years).

OneWeb, now part of the public space company Eutelsat, accounts for the majority of the public value in the chart.

Looking also at Downstream, Space Tech startups in Europe are now worth over $46B.

Unicorns

There are currently 4 verified unicorns and $1b+ exits of European Space Tech companies (both Upstream and Downstream).

Communication and connectivity satellite operator OneWeb is the only core Upstream unicorn in European Space Tech. The company has had a bumpy ride from being valued $2.5B by Softbank and other investors in 2016, to being rescued by The British government and Indian mobile network operator Bharti Global in 2019, and the merger with Eutelsat at a $3.4B valuation completed in September 2023.

Carbon ratings provider BeZero is the only privately-held space downstream unicorn in Europe.

There are also two Downstream Space Tech $1b+ exited companies, eVtol maker Lilium and navigation, and mapping company TomTom. They are now considered as Zebra status since their valuations dipped below $1B in the public market (as of 16th Sep 2024).

To be noted that TomTom is an edge case since the company has been bootstrapped.

There is a strong pipeline of future unicorn candidates such as German launch vehicle maker Isar Aerospace, Earth observation provider ICEYE, in-space logistics, transportation provider D-orbit and several others.

There's also a promising pipeline of rising stars (defined here as startups founded after 2018, valued below $250M and with strong DR signal).

Exits (IPOs and M&A)

2022 and 2023 have seen by far the highest exit activity for European Space tech, largely driven by acquisitions & buyouts consolidation due to the new cash-constrained funding environment driving consolidation. Public listings have instead come to a complete halt after the notable activity in 2021. 2025 is showing a slowdown in the exit pace but is still projected to be more active than any year apart from 2021-2023.

Space Downstream accounts for most of the exits in recent years.

Notable upstream exits include: IPOs of GomSpace (CubeSats and Nanosatellites provider), WiseKey (upstream and downstream IoT connectivity provider with proprietary connectivity satellites), Mynaric (wireless laser communication systems for satellite constellations), and Astrocast (nanosatellite IoT network operator).

Acquisitions of OneWeb ($1B rescue acquisition in 2016 and $3.4B merger with Eutelsat in 2022, communication and connectivity satellites), Nanoavionics (turnkey smallsat manufacturer and mission integrator), Hubs (on-demand manufacturing platform, non-core space), and IDQ (quantum cryptography chips for satellites, non-core space tech).

Notable downstream exits include: Lilium's $3.3B SPAC IPO in 2021 and acquisitions such as Preligens acquired for €220M by Safran in June 2024 (a leader in artificial intelligence for aerospace and defense), StormGeo (weather intelligence - satellite data), Sequans Communications (IoT connectivity provider), Hiber (IoT connectivity provider), Deveryware (geopositioning for cybersecurity and public safety), Hummingbird Technologies (satellite imagery for MRV in the carbon market), Odin Vision (using space technology to improve the early detection and diagnosis of bowel cancer).

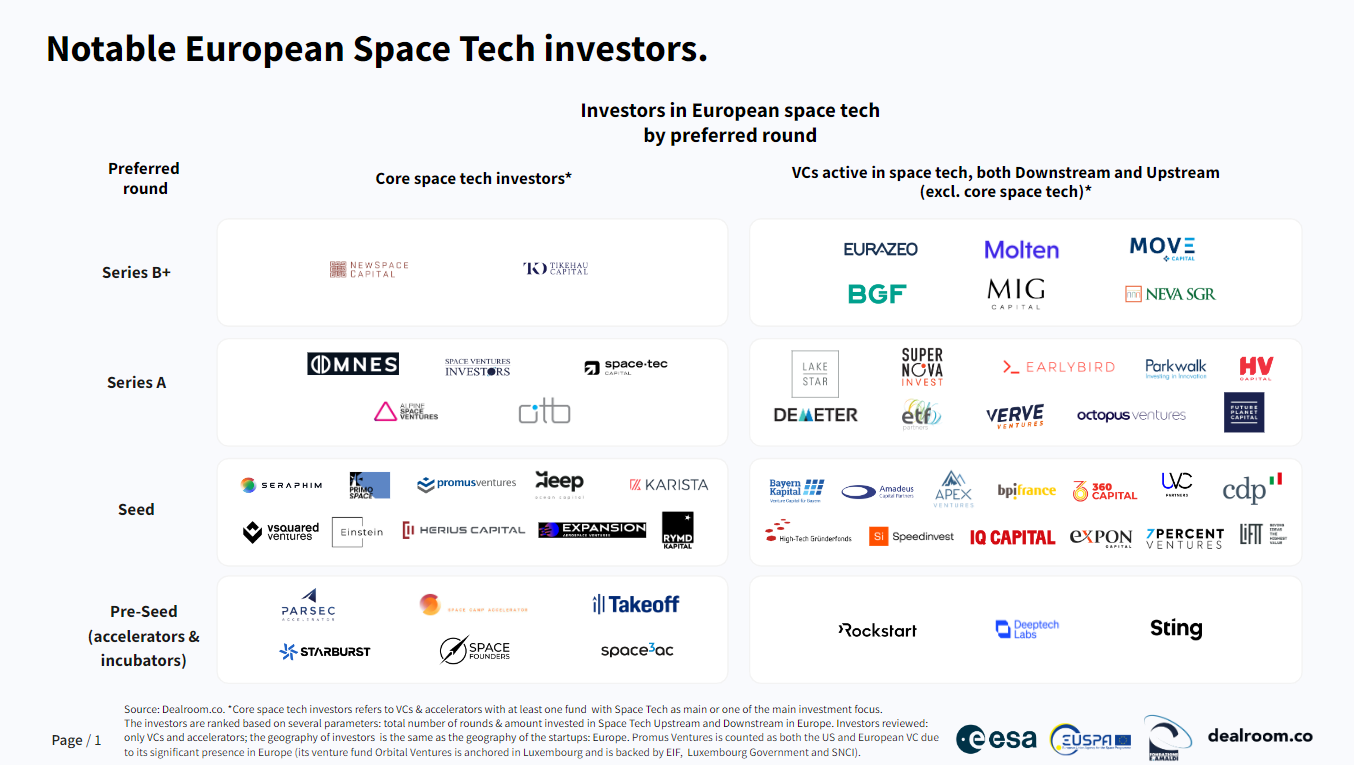

Investor analysis and top investors

The universe of space tech investors is expanding.

The number of investors participating in at least one funding round to upstream Space tech startups in Europe in the 2024 was the highest ever. 2025 is projected to produce less investors by the end of the year.

Notably, the number of active corporates investing in space tech was at its highest in 2024 and increased more than threefold since 2020, faster than other segments.

Top investors

The interactive table below shows the most active investors in European Space tech, with info on their stage focus, as well as how much of their portfolio is allocated to space tech (and space upstream) so to identify leading specialists and generalists fund.

Space specialist VC Seraphim Space is the most active investor and accelerator in European Space Tech, when looking beyond public actors like EIC fund and BPIFrance, and the most active in space upstream.

Tracking data insights into the space economy is vital to understand investment trends and provide visibility on what companies to invest in. Seraphim have been tracking these insights since 2016 in the ‘Seraphim Space Index’ which is a barometer of all investment activity, showing the volume and value of VC deals globally. Last year was a unique year for Europe, where in Q1, early-stage investments outpaced the US for the first time, it’s great to see this growth in Europe. We look forward to continuing to support and engage with companies in Europe and globally through our accelerator activities

The rest of the most active investors show a variety of actors, from public and governmental actors (e.g. EIC Fund, Bpifrance), Deep Tech VCs (e.g. IQ Capital, Voima Ventures), Generalist VCs (e.g. High-Tech Gründerfonds), Space VCs (e.g. E2MC Ventures, Primo Space).

Swisscom Ventures, the venture capital arm of the leading telecommunications and IT provider in Switzerland, has been the most active corporate investor in European Space upstream since 2019, backing in 2023 four companies, including space debris removal and spacecraft servicing company Clearspace.

German space and technology group OHB followed with two investments, backing its 2018 launch vehicles spin-off RFA (Rocket Factory Ausburg) and satellite connectivity and navigation venture UNIO.

Airbus Ventures has also notably backed Isar Aerospace from its Series A to the latest Series C.

Sources of funding

Looking at the number of rounds, we can see the European Space tech maturing, with the share of domestic funding decreasing from 76% in 2019 to 43% in 2024, as later-stage companies tend to raise more internationally.

The share of US and Asian investors is oscillating around 15-20% in the latest years.

US and Asian investors are much more present at later stages, deals above $40M have almost 3x more participation from US investors and 6x more from Asian ones.

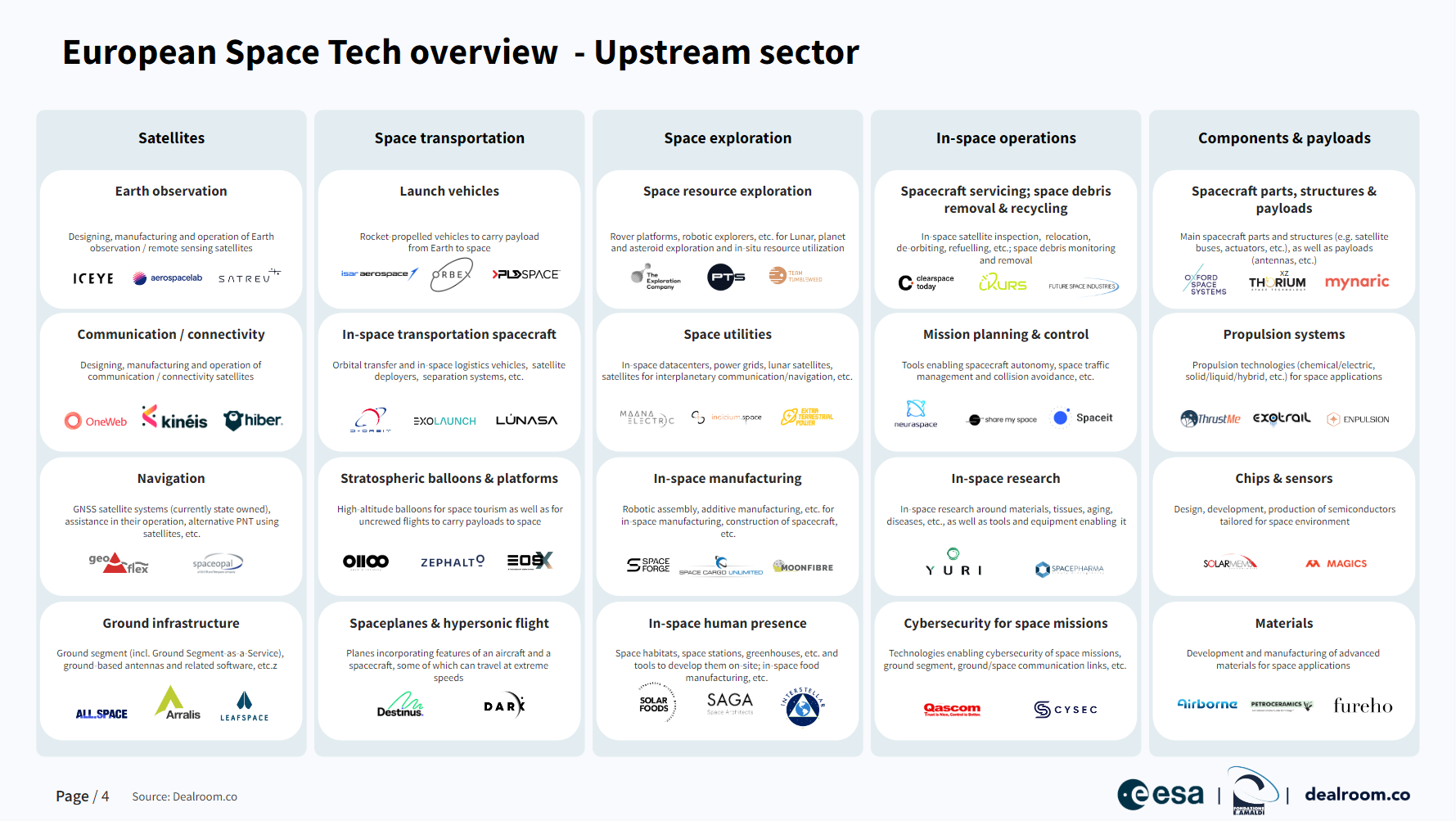

Segments deep-dives

Space transportation and Satellites attracteded most funding in 2024, especially Launch vehicles and Earth-observation satellites. Since 2016, Communication and connectivity satellites have been the segments attracting the most funding, followed by Launch vehicles and Earth observation satellites

Launch vehicles

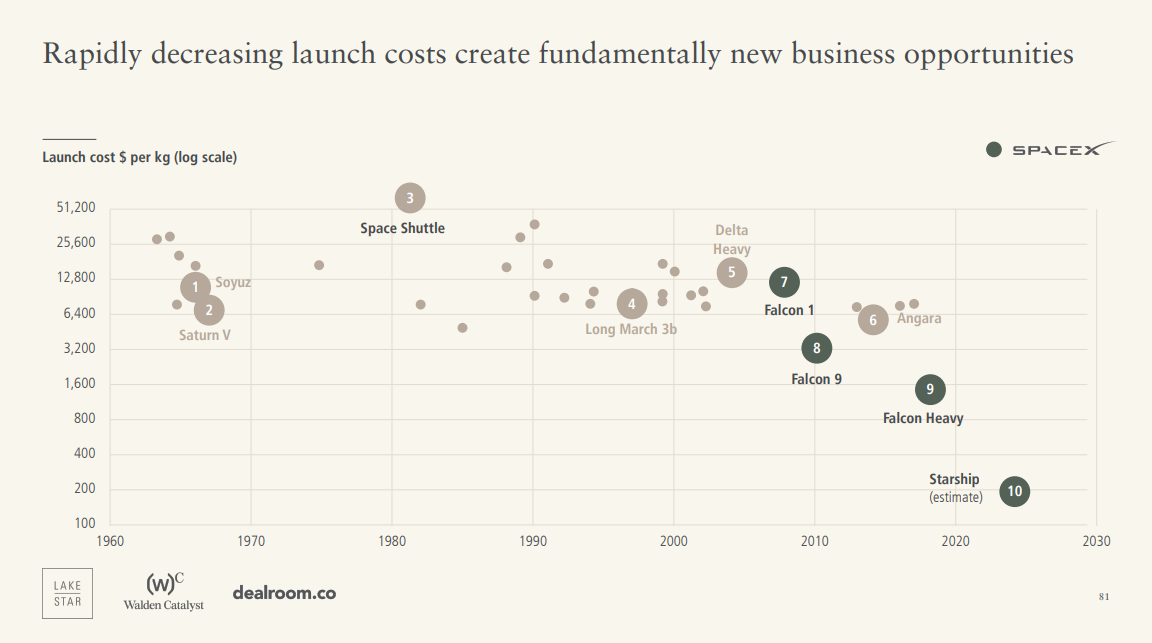

Launch vehicles are the key enablers of the space economy. By strongly reducing launch prices, they enable models previously deemed as financially unsustainable. For instance, there are around 5,000 active satellites today, and this number is projected to become 100,000 by 2030.

Constellations of connectivity satellites, Earth observation satellites for use cases ranging from agriculture to methane and carbon monitoring, up to more futuristic in-space economy use cases such as in-space manufacturing and resource extraction, are enabled by advances in the launch segment.

Launch costs have indeed plummeted 10x in the last few decades, from $50,000 per kilogram during the space shuttle era to $5,000 per kilogram, with further 10x reductions expected with the advent of Starship.

Launch vehicles are therefore critical for sovereignty in the space domain, and we are likely to see the emergence of regional and national champions.

In Europe, Launch vehicles attracted record funding in 2023, led by Isar Aerospace megaround and the renewed focus on space sovereignty.

Still, Europe accounted for just 5% of global VC funding in launch vehicles, one of the relatively most underinvested areas for Europe.

The US strongly dominates the sectors thanks largely to SpaceX but also to Relativity, Rocketlab and Firefly Aerospace, among others.

China also invested more than twice as much as Europe in launch vehicles.

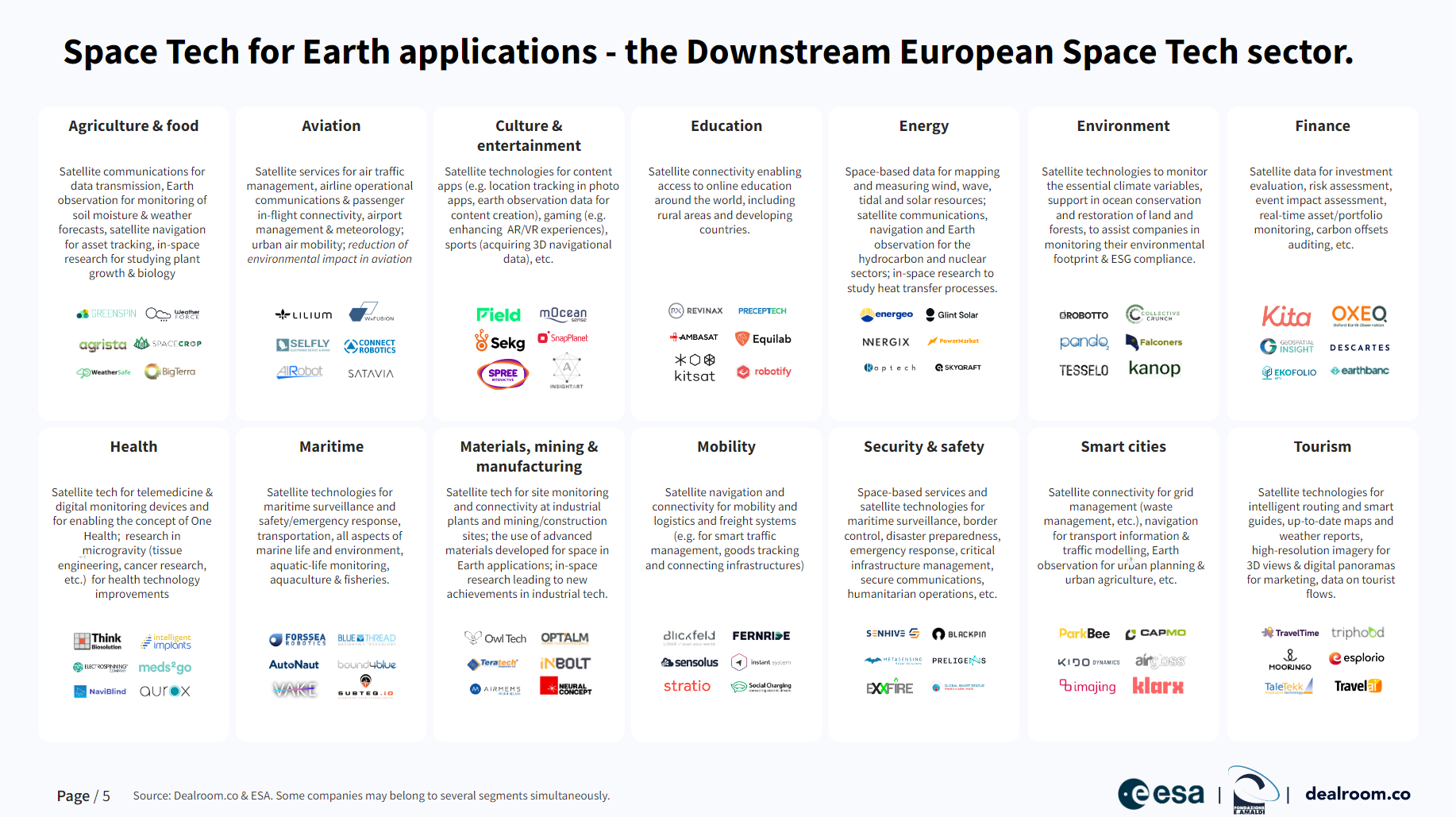

The impact of space downstream

Many of today's ubiquitous technologies depend on space infrastructure (especially satellites) or derive from the adaptation of space technology to Earth use (from tap water filters to smoke detectors, from memory foam to baby formula).

Space-enabled solutions are projected to represent approximately €1.25 trillion by 2040, up from €320B in 2021, according to EUSPA and Roland Berger.

Today’s space-enabled solutions areas are predominantly derived from Positioning, Navigation & Timing (PNT), Earth Observation (EO), Meteorology, and Satellite Communication.

GPS, in particular, has been a key enabler of a massive wave of innovation in the tech space in the last few decades. Examples include Mobility and logistics apps, such as ride-sharing (e.g. Bolt), navigation (e.g. TomTom), asset tracking (e.g. Kinexon); and more recently, drones (e.g. Wingcopter).

New frontiers for GPS applications also include hyper-precise positioning in combination with ground sensors, lidars or computer vision (e.g. Naurt), and the combination of AR with GPs for navigation or gaming (e.g. Wayray).

The GPS system, although created and maintained by the US government, is freely accessible to any GPS receiver.

Due to this and its ubiquity we do not include every startup using GPS in space downstream, but only the ones making GPS a key and fundamental part of their business (e.g. TomTom)

Different is the case of communication and connectivity satellite infrastructure and earth observation, other key pillars of space-enabled applications.

Communication and connectivity

The communication and connectivity satellite segment is dominated by a handful of massively capitalized venture-backed companies such as SpaceX (Starlink), OneWeb (Eutselat now), Astranis and Kaficic. As well as corporate initiatives such as Amazon Kuiper project.

These players are racing to build and deploy constellations of thousands of mass-produced small satellites in low Earth orbit (LEO) to provide high-speed internet service to underserved and remote areas around the world.

The European Union is instead working towards IRIS² ( (Infrastructure for Resilience, Interconnectivity and Security by Satellite), its proposed multi-orbit connectivity constellation to complement the satellites Europe has in geostationary orbit (GEO) and use quantum cryptography to protect communications to be deployed by 2027. The constellation should consist of up to 170 satellites to secure communications for the EU government and open new commercial broadband services for underserved areas.

Europe issued a request for competing bids in March 2023, after approving plans to fund 40% of the 6 billion euro project, with commercial companies expected to cover the rest of the costs. ESA will help ensure that the industry will deliver as per the requirements of the European Union and assist the Commission in defining future generations of systems. To carry out its mission, ESA has been delegated a budget of 380 million euros.

The main bidding group is led by satellite operators Eutelsat, SES, and Hispasat; and satellite makers Airbus Defence and Space and Thales Alenia Space. Satellite operator Hisdesat, spaceflight services company Telespazio, small satellite manufacturing specialist OHB, and terrestrial telcos Deutsche Telekom and Orange are also part of the group.

The European Union has pledged that 30% of EU-funded parts of IRIS², valued at 2.4 billion euros, will be awarded to small companies.

Such coverage would significantly boost global connectivity by minimizing latency and increasing data transfer speeds, as well as bringing the lack of infrastructure in certain regions or in remote areas (maritime, aviation, agriculture). As well as guarantee connectivity in case of natural disasters or emergencies where the traditional (ground) infrastructure might be compromised.

Satellites are also key to IoT connectivity for use cases ranging from logistics to various industrial applications. IoT connectivity providers vary in business model, from the ones having proprietary constellations of small satellites (e.g. Kineis) to pure downstream players using third-party constellations (e.g. Hiber).

Earth observation (EO) and satellite imagery

Within the last two decades, the number of commercial Earth observation (EO) satellites has increased from 11 in 2006 to more than 500 in 2022. The Earth observation accounts today for just around 4% of the $464B commercial space market, but the sector is undergoing significant growth.

European Earth observation startups raised a record of around $500M in VC funding in 2022, with most driven by downstream-only use of satellite imagery data. Overall, in the last few years, a nearly equal amount has gone in players with proprietary satellites and players focused exclusively on the analysis and applications derived from satellite imaging data.

Examples of startups with proprietary earth observation satellites include ICEYE and Constellr, among others. The choice of building a proprietary constellation is a tradeoff between more advanced capabilities (the possibility to quickly react and shift observation focus or innovative imaging technology/spectrum of observations such as infrared) and the considerable costs involved in deploying such a network.

ICEYE launched 15 satellites as of January 2024, equipped with SAR (synthetic aperture radar) technology to be able to quickly zoom in on areas of interest and take high-resolution images to analyze.

This is key to its business model focused on situational awareness of catastrophic events (especially flooding). Similarly, Constellr uses proprietary high-precision thermal satellite imaging for water and carbon management in agriculture.

For most other applications or quick go-to-market, the use of 3rd party satellite data is enough. Use cases include finance and insurance, agriculture and foodtech, environment, to energy and mining, mobility, aviation and maritime and many other segments.

Discover 200+ Earth observation and satellite imagery startups in Europe.

Startups and companies often rely on data from Copernicus satellites, which are available to any organisation worldwide on a free, full, and open basis.

The Copernicus project headed by the European Commission (EC) in partnership with the European Space Agency (ESA) is the most ambitious Earth observation programme to date, consisting in the delivery of satellite data. It provides accurate, timely and easily accessible information to improve the management of the environment, understand and mitigate the effects of climate change and ensure civil security.

Space-derived technologies

The impact of space can also be less evident but equally important in many other space-derived technologies.

Space-derived technology is often used to develop urban air mobility vehicles (eVTOL) and drones (e.g. Lilium, Xsun), but also applications from health to farming.

For instance, Odin Vision is using space technology to improve the early detection and diagnosis of bowel cancer and Entocycle is using space technologies and assets used for environmental control in space to create modular and automated indoor insect farming systems.

The role of enablers (ESA, EUSPA, E. Amaldi Foundation)

Space is a key priority for the European Union and Europe’s strategic independence in an increasingly volatile world and establishing the region as a global space power.

ESA (European Space Agency) and EUSPA (European Union Agency for the Space Programme) have supported over 5100 European companies (and over 400 international ones).

Among this, they jointly supported over 3000 tech startups worth over $35B and that raised nearly $7B in VC funding since 2016.

ESA (European Space Agency)

Changes in the commercial space services arena are happening rapidly, yielding new technical and business approaches to building, launching, operating space systems, and selling private space systems capabilities as commercial services.

The ESA is supporting the Space Tech ecosystem by exploring and supporting the development of these new business models to better understand how they might complement the Agency’s current offerings.

Europe grapples with societal, economic, and security challenges. Space holds vast potential to address these and future crises, fuel job creation, drive innovation in the European space industry. With a substantial allocation of €1.3bn over three years, ESA is engaging with the commercial space sector in the New Space context in three main roles: Enabler, Partner & Customer. Collaborating with European and national partners, ESA aspires to position Europe as a hub for space commercialisation, nurturing global space companies aligned with future goals.

Overview of the programmes

Nurturing and growing new space businesses

Incubation Centres (ESA BICs) form a continent-spanning network, dedicated to nurturing and elevating space startups. Each centre relates to local industries, universities, research institutions, government bodies, and investor communities. These centres also establish regional and national links, creating a collaborative environment for startups to thrive.

The ESA BICs actively seeks entrepreneurs developing applications utilizing space-based systems, integrating space technologies into non-space domains, or innovating products and services for the space sector.

Explore all the 1500+ starts up supported by the ESA BIC Incubatees and Alumni.

ESA BIC insights

ESA BIC, the largest network of space incubators in Europe, supports Space Tech startups, which are now worth $12.6B, up from less than $0.5B in 2016.

ESA BIC has supported Space Tech startups across a wide range of Upstream segments, with launch vehicles attracting the largest share of funding.

Aviation leads the Downstream sector among ESA BIC supported startups in Europe, followed by Mobility and Energy.

Developing new disruptive technologies to enable commercial products and services

- ESA InCubed spearheads Earth observation commercialization, operating through a Public-Private Partnership co-funding arrangement via ESA Phi-lab. This program supports entrepreneurs with innovation co-funding, providing equity and IPR-free assistance. The programme has a very wide scope and can be used to co-fund anything from building satellites to ground applications.

Explore 100+ Earth observation startups supported by ESA InCubed. - ESA NAVISP: acts as a key enabler for precision navigation technology. NAVISP focuses on positioning, navigation, and timing and aims at upgrading and replacing current technologies, as well as facilitate the exchanges between space-based and earth-based territorial technologies.

Explore the 160+ companies innovating Positioning, Navigation, and Timing with ESA NAVISP. - ESA Boost! - Strategic Space Transportation ESA Boost! strategically fosters opportunities for European industry in space transportation by preparing the new transportation services for economic operators targeting end customers. This initiative also assists Participating States in achieving space transportation objectives, including the establishment of spaceports and test infrastructures.

Explore the 10+ transportation startups supported by ESA BOOST! - ESA’s Business in Space Growth Network Accelerators (BSGN)– ESA BSGN Accelerators aims to catalyse the commercialization of space services and applications in Low Earth Orbit (LEO) and beyond. BSGN engages fresh players, stimulates demand, and fosters collaborations in diverse sectors like agriculture, healthcare, manufacturing, and sustainability.

Discover more on ESA BSGN Accelerators. - ESA Technology Transfer: The ESA Technology Transfer Programme actively supports entrepreneurs in transforming innovative space technologies into commercially viable products and services, contributing to both space exploration and terrestrial innovation. Dedicated teams of specialists, ESA Technology Broker, provides a wide range of tailored support to both young and well-established companies looking to create new products and services. They are part of the regional and national innovation ecosystems of their country, but act as a network to ensure a pan-European reach.

Discover more on ESA Technology Transfer and Technology Broker programs - Business Applications and Space Solutions (BASS) - Space Downstream Business Development Dedicated to sustainable businesses, ESA BASS aids startups across various sectors. Offering co-funding, private finance access, and leveraging a network of Business Incubation Centres, its mission is to support entrepreneurs in Europe in the development of business using satellite applications and space technology.

Explore 1400+ Space Downstream startups supported by ESA BASS.

Stimulating the Market Growth in the Space Industry

- ESA Marketplaces – Scale Up Invest: ScaleUp Invest fosters the development of the most promising European space industrial players – both upstream and downstream – that have the potential and business maturity to scale up their operations. By tapping into co-investment for B2B deals, established companies can achieve sustainable commercial growth faster than ever before. If your company has the vision to grow horizontally or vertically, then you can join the Marketplace.

Explore the 21 start-ups companies currently in ESA ScaleUp Invest Marketplace.

- ESA Investor Network is an initiative to increase the relations among space start-ups, potential space investors and the European Space Agency. This network allows ESA to give its companies more visibility when fundraising and a better access to finance.

It lowers the barrier to entry to the space sector for investors and organise matchmaking sessions with companies, thematic training sessions and ad-hoc discussions to support investment decision processes.

Explore over 50 members in the ESA Investor Network on the platform.

EUSPA (European Union Agency for the Space Programme)

The European Union Agency for the Space Programme (EUSPA) is a space agency managing the European Union Space Programme as one of the agencies of the European Union (EU).

EUSPA provides safe and secure European satellite navigation services, advances the commercialization of Galileo, EGNOS, and Copernicus data and services, engages in secure satellite communications (GOVSATCOM and IRIS2), and operates the EU SST Front Desk. EUSPA is responsible for the security accreditation of all the EU Space Programme components.

European Commission and EUSPA co-manage the CASSINI initiative.

Overview of the EUSPA programmes

- CASSINI matchmaking:

CASSINI Matchmaking connects startups, scaleups and SMEs with corporates and investors to solve their business challenges and address global needs.

Explore the 150+ space tech startups participating in the CASSINI matchmaking since 2022. - CASSINI Business Accelerator:

CASSINI Business Accelerator is the biggest space startup accelerator in Europe. It offers business development support, acceleration services and upscaling of start-ups across all space areas with the objective to make start-ups and scale-ups investment-ready and able to secure venture capital funding.

Explore the 60 startups part of the first three batches of the CASSINI Business Accelerator. - Prizes and competitions: CASSINI Challenges support the development of innovative commercial solutions (such as mobile apps or hardware-based solutions) that are leveraging EU Space data from Galileo and Copernicus. The competition is still open for prototypes and products.

Explore the 97 startups that won prizes or competitions organized by EUSPA. - Research and Innovation:

The development of the EU space downstream sectors and the uptake of space-based solutions is further supported through Horizon Europe calls.

Explore the 100+ startups selected for Horizon2020 programs managed by EUSPA. - CASSINI Investor Network:

The network of investors active in CASSINI and willing to provide support to startups accelerated by the CASSINI program.

Explore 20+ investors in the CASSINI Investor Network.

Fondazione E. Amaldi (Leading applied research and technology transfer foundation)

The support of pan-European enablers such as ESA and EUSPA is complemented by national (space) agencies, institutions and organisations.

E. Amaldi Foundation and the Italian space ecosystem

Italy has a long tradition and expertise in space tech, from being the third country (after Russia and the United States) contributing to the Space Station – with the Leonardo module in March 2001, to being one of the top three contributors to ESA in economic terms.

On the space tech startups side, Italy has been the third country by VC funding in Space in 2023, behind only Germany and the UK. More broadly, Italy has been Europe's 7th country by cumulative space VC funding since 2019.

The E. Amaldi Foundation (FEA) was established on 28th March 2017 by the Italian Space Agency and the Hypatia Research Consortium, as an ambitious project that aims to propose a new way of interpreting applied research and technology transfer in support of the national scientific heritage.

The primary objective of the E. Amaldi Foundation is to promote and support scientific research aimed at technology transfer, starting from the space sector, as a fundamental tool for the country's economic development and as a source of innovation for improving competitiveness, productivity and employment.

Access to the Foundation is open to companies, research institutes and all those entities that wish to share scientific, economic and social objectives.

Overview of the programmes

- Finance for Innovation:

E. Amaldi Foundation supports the Space entrepreneurial ecosystem as a facilitator of networking between entrepreneurs and investors and as an enabler of investment instruments. FEA is part of European and International clusters, such as the European Business Angels Network, to promote and advance Italy’s ecosystem for entrepreneurship, innovation, and investment in the space sector. In 2016, FEA conceived the first Italian VC Fund, now Primo Space, for which it currently operates as its key technology advisor.

E. Amaldi Foundation supports programs and coordinates projects of the European Commission, especially of the European Innovation Council and SMEs Executive Agency, and the European Space Agency to provide the spacetech entrepreneurs up-to-date training and mentoring at European level. - Outreach and promotion:

With the objective in mind to provide the spacetech ecosystem with worldwide opportunities and exposure, E. Amaldi Foundation organizes and promotes participation in events. FEA organizes every year the Spring of Innovation, dedicated to the analysis of the opportunities in the field of space technology transfer, and an international expoforum dedicated to the New Space Economy, with the objective of providing a scientific conference on the state of the art of the spacetech and an expo where entrepreneurs, investors, institutional representatives and businesses can matchmake and network. FEA also organizes the Biz Bites, a series of masterclasses to explore the vast space business (“biz”) opportunities in small bites (bites) to support the Italian entrepreneurial ecosystem interested in working with and in space. - Future trends exploitation:

FEA is active in three research areas: energy, new materials and life sciences. The research teams at FEA can develop specific research, development and innovation programmes with research teams and industrial partners being jointly developed or externally commissioned.

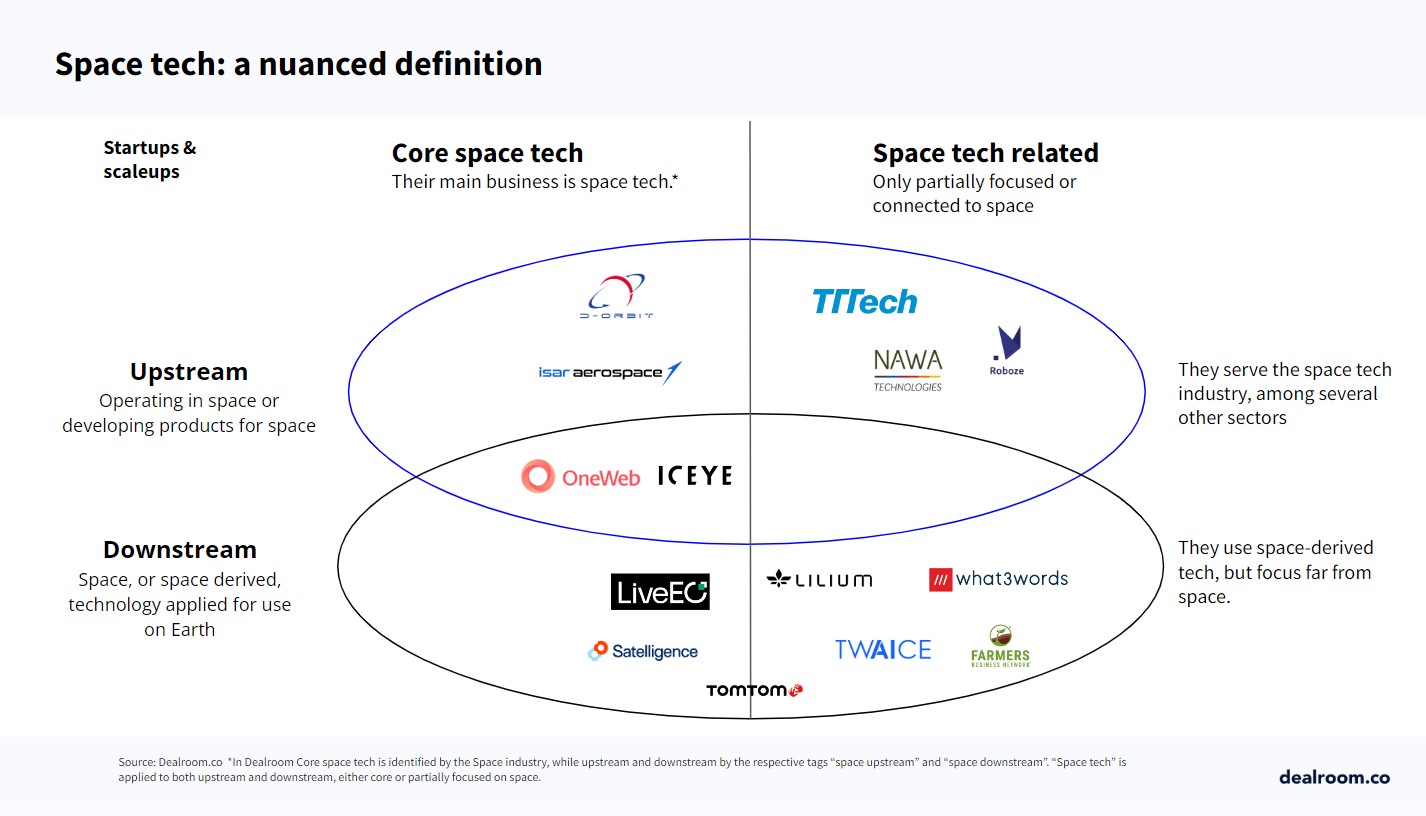

Taxonomy & methodology

Taxonomy

In Dealroom, "Core" space tech (startups whose main business is space)* is identified by the Space industry.

This includes space upstream companies from launch vehicles to

It also includes some space downstream companies where space is a key differentiating characteristic and focus, such as earth observation and satellite imagery companies, which do not have proprietary satellite constellations but use publicly available satellite imaging data.

Space Upstream and Downstream are tracked by the respective tags “space upstream” and “space downstream”. “Space tech” is applied to both upstream and downstream, either core or partially focused on space.

Upstream Space Tech

The Upstream Space Tech segment encompasses companies operating in space or developing products for space: developing and/or operating satellites, launch vehicles, developing spacecraft payloads and components, innovative materials for use in space, etc.

Some of the most innovative areas in this segment include technologies that can enable long-term human presence in space: space resource exploration and in-situ resource utilization, space utilities (in-space datacenters, power grids, etc.) and space habitats, as well as space tourism.

The segment also includes companies where space is not their core business. For example, 3D printing, advanced materials tech companies that target space among several other industries, or those that have participated in space projects, or biotech companies that have sent experiments to space to explore the potential use of their technology in space.

Downstream Space Tech

The Downstream Space Tech segment encompasses technologies derived from space for use on Earth (e.g. materials and sensors initially developed for space but having found use in Earth-based applications) as well as technologies used in space with the primary goal of serving Earth-based applications (mainly satellites: Earth observation, communication, navigation).

The segment also includes companies where space or space-derived tech is not their core tech. For example, companies that mention using satellite data among multiple other data sources.

Some companies belong to both Downstream and Upstream segments. For example, those operating their own satellites to deliver products/services on Earth (Earth observation satellite data for agritech, energy, etc.)

Methodology

Startups, scaleups, grownups and tech

Companies designed to grow fast. Generally, such companies are VC-investable businesses. Sometimes they can become very big (e.g. $1B+ valuation).

This report focuses, unless specified, on companies in the information age, i.e. after 1990.

When startups are successful, they develop into scaleups (>50 people), grownups (>500 people) and result in big companies, like OneWeb or Isar Aerospace.

A unicorn is defined as a rapidly scaling company (and tech enabled) that has reached a $1 billion valuation, on the basis of a funding round (unrealised), acquisition or IPO (realised).

Venture capital investment

Investment numbers refer to rounds such as Seed, Series A, B, C, … late stage, and growth equity rounds.

Venture capital investment figures exclude debt or other non-equity funding, lending capital, grants and ICOs.

Buyouts, M&A, secondary rounds, and IPOs are treated as exits: excluded from funding data.

Investment rounds are sourced from public disclosures including press releases, news, filings and verified user-submitted information.

Related content

- Platform: Space tech platform.