Dealroom Talks: what makes a great investor?

How does the current market environment affect the startup fundraising journey? What will the future of VC look like and, ultimately, what makes a great investor?

Our latest Dealroom Talks event with Saul Klein (LocalGlobe) and Christoph Janz (Point Nine), coinciding with the release of Dealroom’s annual Investor Rank, sought to tackle just these topics.

The current market environment

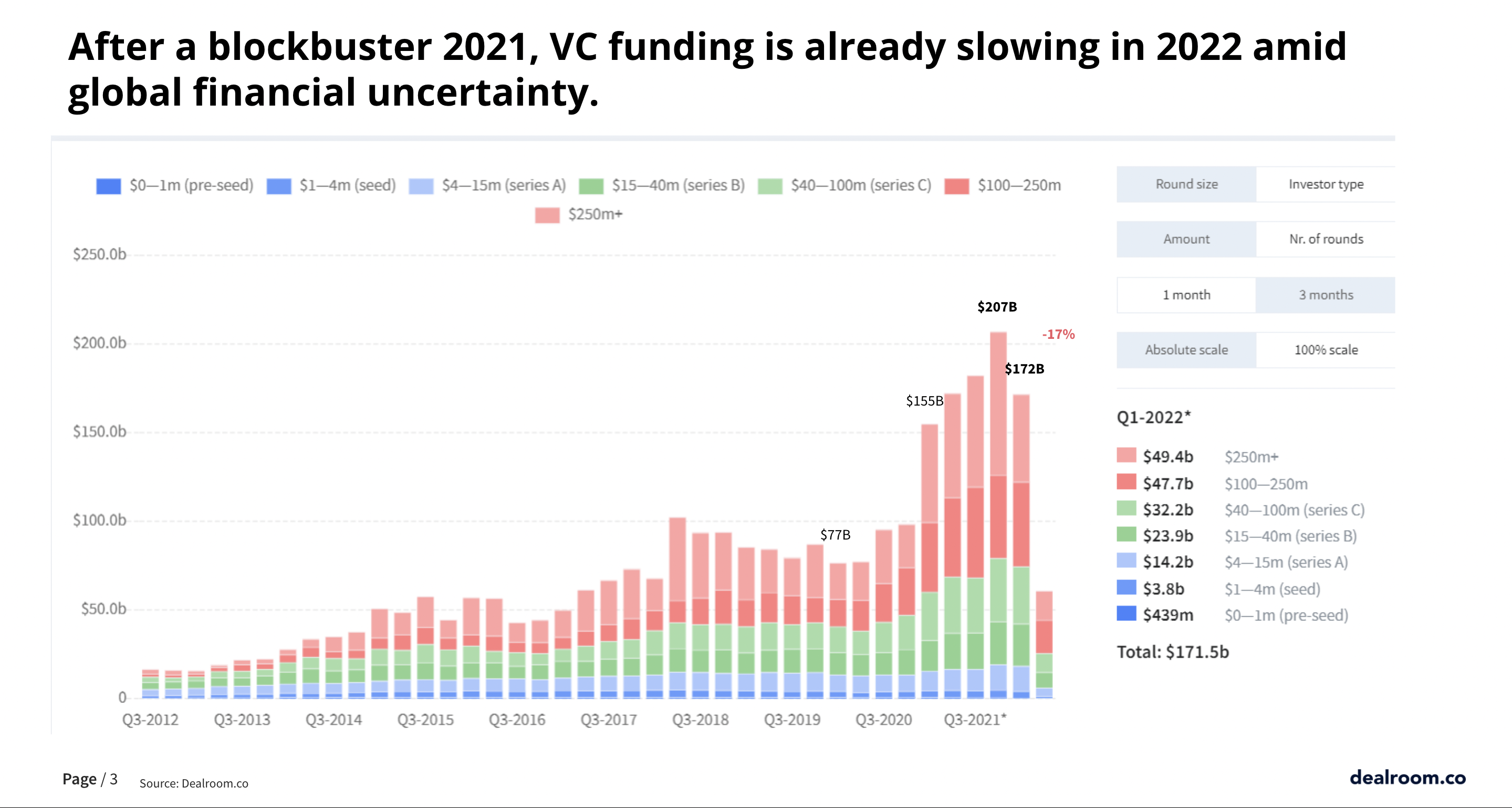

After a blockbuster 2021 for venture capital, VC funding is already slowing in 2022 amid global financial uncertainty. Q1 2022 did outpaced Q1 2021, with $172B raised compared to €155B in the same period last year. However, Q1 also saw the first quarter to quarter fall in global VC since the first three months of 2020, and the biggest percentage fall since 2016, with investment down 17% from Q4 2021.

Late-stage funding is being particularly squeezed, contracted at more than twice the rate of early-stage funding.

VC firms have also raised hundreds of billions from new and existing LPs. Where will that go?

- First, and to rule it out (hopefully) – there’s a disaster scenario where the broad market enters into deep recession and LPs renege on commitments.

- Use more capital to support their existing portfolio.

- Bifurcated market. Companies perceived as “best” attracting the lion share of new capital. One rationale will be that, in a slowing market, those companies will have an opportunity to acquire weaker competitors and become industry consolidators.

- Slower fund deployment times.

Approach to finding the best startups to invest in

"Something that's really important in all weather is alignment. The alignment between founders and investors got very stretched in the last 3 or 4 years. And the best results come when there is good alignment."

As there’s more murmurs of an impending recession, there’s concern amongst investors how to approach investing during a downturn. Our guest-speaking investors have had first-experience of investing during multiple downturns, helping startups navigate them along the way.

According to Dealroom’s latest count, together, LocalGlobe and Point Nine have invested in 25 unicorns and even more future unicorns in the pipeline. So what’s their secret to finding the best startups to invest in?

One word kept popping up through their discussion, alignment. Alignment is the shared understanding between a company and those looking to invest in their business and seeing eye to eye on some of the most critical areas of a startup. Like any business partnership, there has to be a focus on long-term milestones (rounds and their sizes) and how long their revenue runway will last.

Doing this can help avoid misalignment, which – from Janz – doesn’t come from round sizes not being determined in founders plans and how much they want to raise, but by pressure from investors. Companies end up raising more than they need because there is desire from large funds to deploy more capital. Investing becomes less about getting ahead of a trend and more about aligning with startups to collaborate together.

Approach to helping startups post-investment

"Picking is very important, but networking is fundamental. If you are picking from a larger pool, compared to a smaller, you're more likely to pick a winner."

Dealroom research has found considerable differences in graduation rates from Seed to Series A. The average is about 25%, but it’s below 10% for bottom tier investors. Meanwhile, P9 and LG are in the top tier with a 40% graduation rate. In other words, there is a 4x higher chance of them graduating to series A, and those that do graduate have a much higher chance of becoming a unicorn.

But what’s the secret for graduation rates? How do you guarantee a startup or scaleup will get from Seed to Series A?

According to Klein and Janz, helping a company manage capital is a huge piece of the graduation process. Not enough companies have enough capital to get from Seed to Series A, and revenue runways vary depending on a company’s industry and timeline. In order to avoid running out of financing before they reach Series A, companies need capital and investors need to help companies think about how they manage it.

Managing capital can also be a sign of how a company grows internally and either make or break them. Investors don’t only funnel money, but they also help companies be better companies and more successful than they otherwise would have: by managing a company’s capital better, making sure they go into the right segments, and pushing to increase the bar when it comes to hiring (larger and more diverse talent pools). If a company doesn’t make it Series A, it’s a sign the company isn’t improving or growing internally.

Interested?