Venture capital vs. public stock markets

The following chart should be familiar to most of the audience by now. It shows that venture capital performance on a whole has been abysmal. There are notable exceptions of course. Some VC investors have superb track-records over a long period. And at any given time, a number of VCs are clearly “on a roll” in picking winners. More about these out-performers in another post. In this post however, I would like to go into some of the possible explanations for, and solutions to, underperformance of the VC industry as a whole.

Fundamentally, VC fund returns are determined by: (1) prices paid for assets and/or (2) capital allocation (money going to the best companies). I would argue that the main problem, at least in recent years, has been capital allocation. Too much capital has been flowing under-performing funds, where it remained locked for many years. And these under-performing funds invest in not enough champions to make up for the write-offs. VC funds would also point to there not being enough “exit routes” even for successful companies (for example big industrial companies buying up companies), but this should be adjusted for by a lower entry price and picking companies with better exit potential.

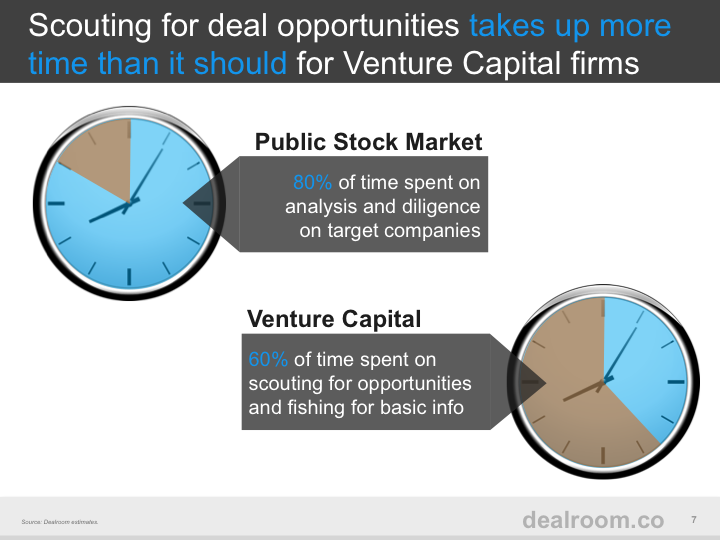

One likely major cause of under-performance must be the rigidity of the market for private companies. One clear example of this is the way VC professionals spend their time. Our own user survey showed that over 50% of time is spent on ‘scouting’ for investment opportunities, which basically means time spent on uncovering of the most basic company information to see if a company is could be a suitable investment. Compare this to public markets, where 80% of time or more is spent on actual diligence of numbers, growth, KPIs.

In the long run, syndication and crowd funding could have a profound and disruptive effect on the venture capital allocation. Both syndication and crowd funding will help VC on the whole by moving away from big money being locked up for 5-10 years into funds, and going into a more dynamic, and therefore hopefully more efficient, model of capital allocation.

In the near term, however, changes can be made by exchanging more information amongst VC funds, their portfolio companies and M&A departments of large companies. This can also increase exit opportunities for funds. Dealroom aims to create an information exchange to promote efficiency and some transparency, while keeping control over sensitive and/or non-public information. More about this in a later post.

Yoram Wijngaarde, Founder

The Dealroom team

Interested?