The explosive growth of the New South Wales startup ecosystem

Over the past five years, the enterprise value of New South Wales startups has accelerated quickly. There are currently over 2,900 startups born or HQ in NSW, and startups in the Southeastern Australian state have a combined value of an estimated AUD283B. In 2017, that same ecosystem was worth an estimated AUD22.2B, a colossal 84% average year-over-year increase over the past five years.

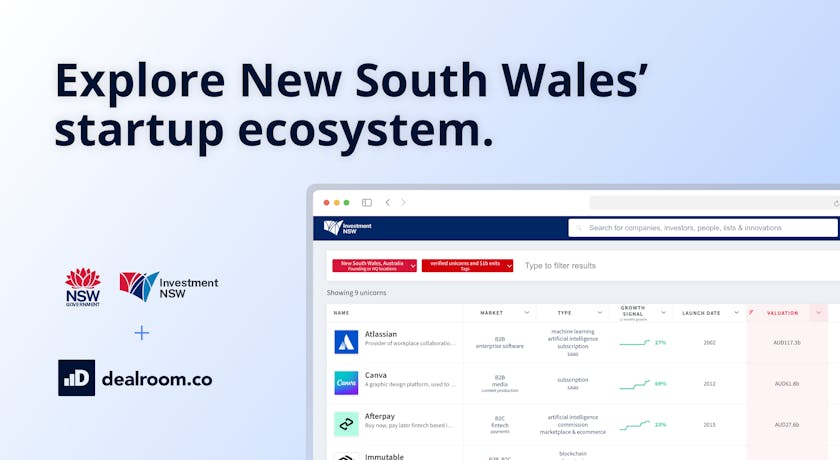

However, more than its ecosystem value and impressive growth, the region’s notable global success stories set NSW apart. To map it all out, Investment NSW, the NSW Government’s economic development and investment attraction agency, launched its own online startup ecosystem database, powered by Dealroom.

Global successes are driving the surge in value.

There are currently 30+ Australian unicorns, of which almost a third were born or are presently HQed in New South Wales. This growing group of measurably successful companies is driving this surge in value. In fact, over 80% of the value of the NSW ecosystem comes from its unicorns; together, they are worth an estimated AUD239B.

Led by global success and pandemic game-changers Atlassian, Canva, and Safetyculture and fintech successes Afterpay and Zip, New South Wales’ unicorns are a hard act to follow.

Australian unicorn Canva, led by exceptional co-founder Melanie Perkins, is valued today at an estimated AUD61.8B. The scaleup, which recently joined the ranks of the Fortune 500, raised a late VC round in September 2021, which was one of the largest in Australian history, bringing the total funding raised since its 2013 launch to almost $570M. Led by one of the world’s youngest female tech unicorn founders, Canva is breaking the trail for the up-and-coming cohort of female-founded or co-founded startups in NSW.

Growth in recorded funding rounds

In 2021 alone, NSW’s startups raised a total amount of AUD4.7B, almost double that of 2020. The total amount raised doesn’t tell the whole story, though, as NSW has also seen significant growth in both the number of recorded funding rounds (a 19% increase) and the average deal size (a 65% increase), based on Dealroom data(link). This performance tells an inspiring story of overall ecosystem growth both at the early and later stages and signals that while companies are maturing, new companies are also demonstrating healthy growth.

Fostering an economy with diverse industries

New South Wales’ startups and unicorns are active in emerging industries that generate positive impact and add value for the broader economy and people of NSW and existing industries with high trade exposure such as fintech, foodtech, healthtech or media.

Last but not least, the new database aims to facilitate connections, improve transparency and increase the visibility of the NSW ecosystem both locally and globally. Encouraging collaboration and innovation in existing industries and enhancing growth in emerging sectors.

This new database not only offers the most detailed picture of the New South Wales tech scene up until now, but it’s also an ongoing collaborative project. Any startup, investor, or ecosystem stakeholder can add their own company and organization details and enhance their profile – providing open access to real-time data for the community. More accuracy and transparency in tech and investment industry data will not only improve local ecosystem connectivity but will also help put the region on the map internationally as a promising new hub for tech and innovation.

Gain more insights on world-leading and emerging startup ecosystems

Subscribe to our Ecosystem Update newsletter. Stay ahead of the curve with key insights, trends and best-practices from around the globe. Every two weeks.

Interested?