Online groceries – an insatiable foodtech battleground

Some of Europe’s biggest early startup success stories came in food delivery. Delivery Hero, Just Eat Takeaway and Deliveroo have been ferrying prepared meals from restaurants (and latterly cloud kitchens) to our homes for years, with adoption accelerated by Covid-19 (and probably the Euros). But the food delivery battlegrounds are shifting.

If restaurants are a big opportunity, triple it for groceries. If meal delivery accelerated during the pandemic, it’s nothing compared to ingredients. Online penetration of grocery sales is still at less than 10% in Europe, one of the most developed markets. And a whole host of players, from full-stack online supermarkets, to personal shoppers, and instant cloud store deliveries, are muscling in on the space.

Report - The State of European Foodtech 2021

Foodtech unicorns are building war chests

Today, Czech online supermarket Rohlik announced a raise of $119M led by Index Ventures, Partech & Quadrille Capital, at a $1.2B valuation to grow its 2-hour grocery delivery service in Europe. It becomes Europe’s 20th foodtech unicorn, and fourth this year, after Wolt (restaurant discovery and delivery, Helsinki HQ), Gorillas (same-hour grocery delivery, Berlin HQ), and Oda (same-day and next day grocery delivery, Oslo HQ).

€1.7B has been invested in European grocery startups so far in 2021, more than all investment to come before. Grocery startups are competing hard to acquire customers, with user discounts reminiscent of the Uber et al ride-hailing subsidies of circa 2017.

PSA: A bunch of 10-minute grocery delivery services (Dija, Gorillas, Getir) have launched in London and are trying to out-compete each other with discounts. You can get quite cheap groceries atm subsidised by venture capital.

— Shona Ghosh (@shonaghosh) March 10, 2021

And consolidation as well as convergence is already also underway. Today Getir announced its acquisition of Barcelona’s Blok, while Dija acquired Cambridge-based Genie in March.

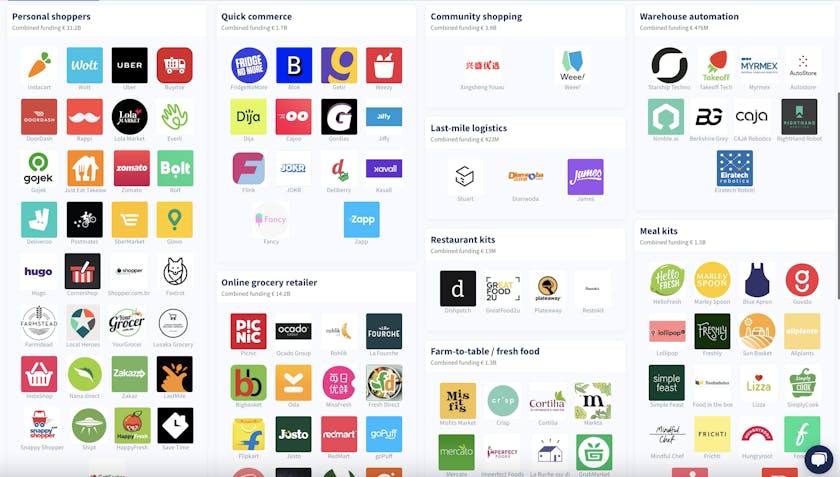

The European groceries landscape

The lines are increasingly blurring between all food startup players.

Deliveroo who started delivering meals from restaurants, now send couriers into shops to select customers’ goods. Wolt now offer HelloFresh-style meal kits. Online supermarkets like Ocado are reducing their delivery times, offering next hour services from automated warehouses. New players like Diji and Getir are taking on the convenience store, setting up in-community own-stock groceries and essentials delivered within 15 minutes.

Restaurants themselves going direct to consumer, productising their service into finish-at-home restaurant kits (some with the help of new intermediaries like Dishpatch and Plateaway).

The way we buy, cook, order and eat is changing. But one of the biggest global industries, is still only digitalized in single digit percentage points. These are the European players, serving up the next course.

Interested?