Impact startups and venture capital – Q1 2022

After a record year for impact startups in 2021, followed by some public market jitters at the start of 2022, as the first quarter of the year comes to a close we’ve looked back on what the last three months have meant for impact startups, venture capital, and purpose-driven innovation.

Report - Impact startups and venture capital – Q1 2022

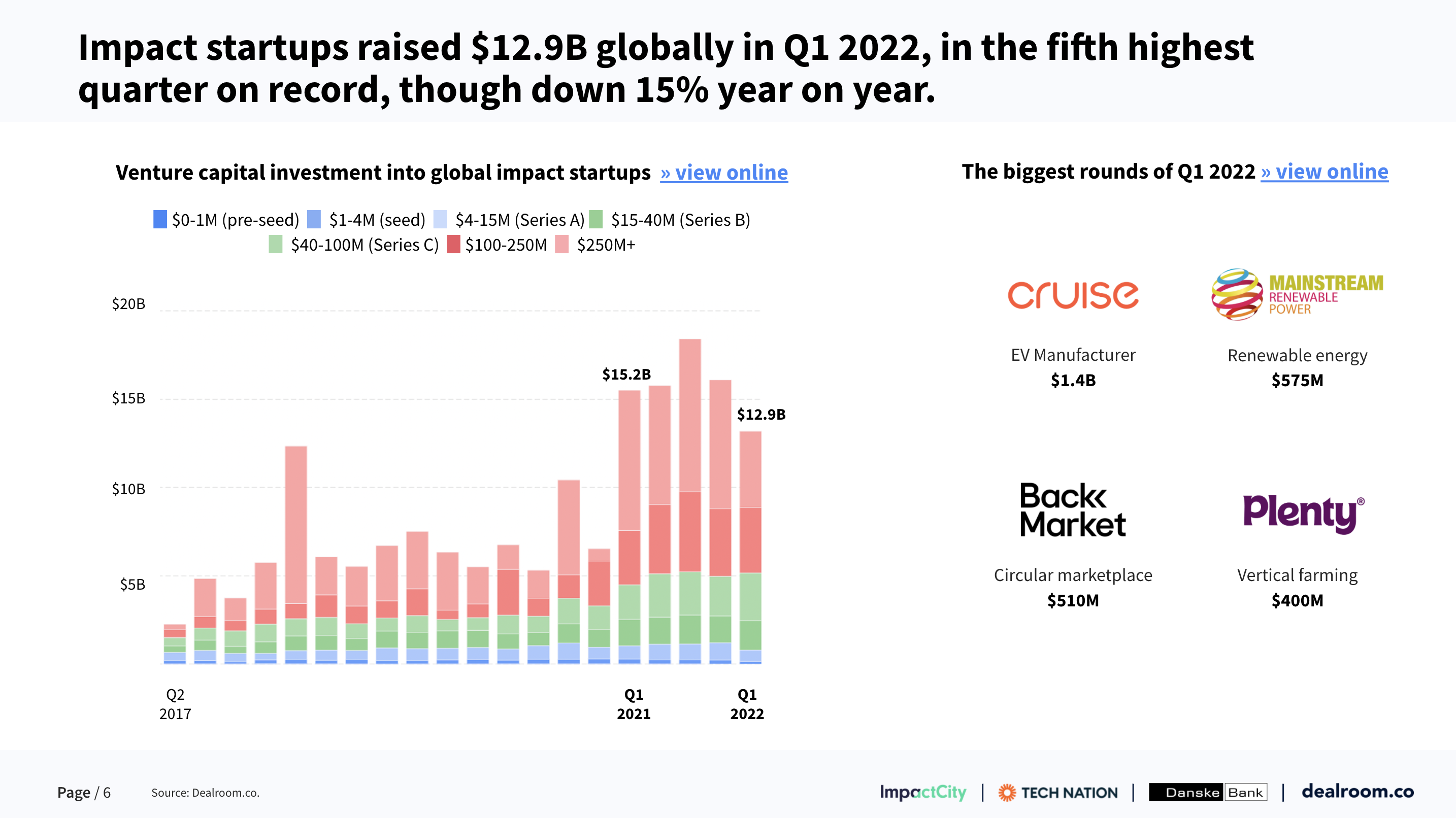

Q1 2022 was the fifth highest quarter for impact funding of all time (after all four quarters of 2021). While the Q1 2022 total is down 15% year on year, it still reached double the total from Q1 2020.

A maturing impact ecosystem

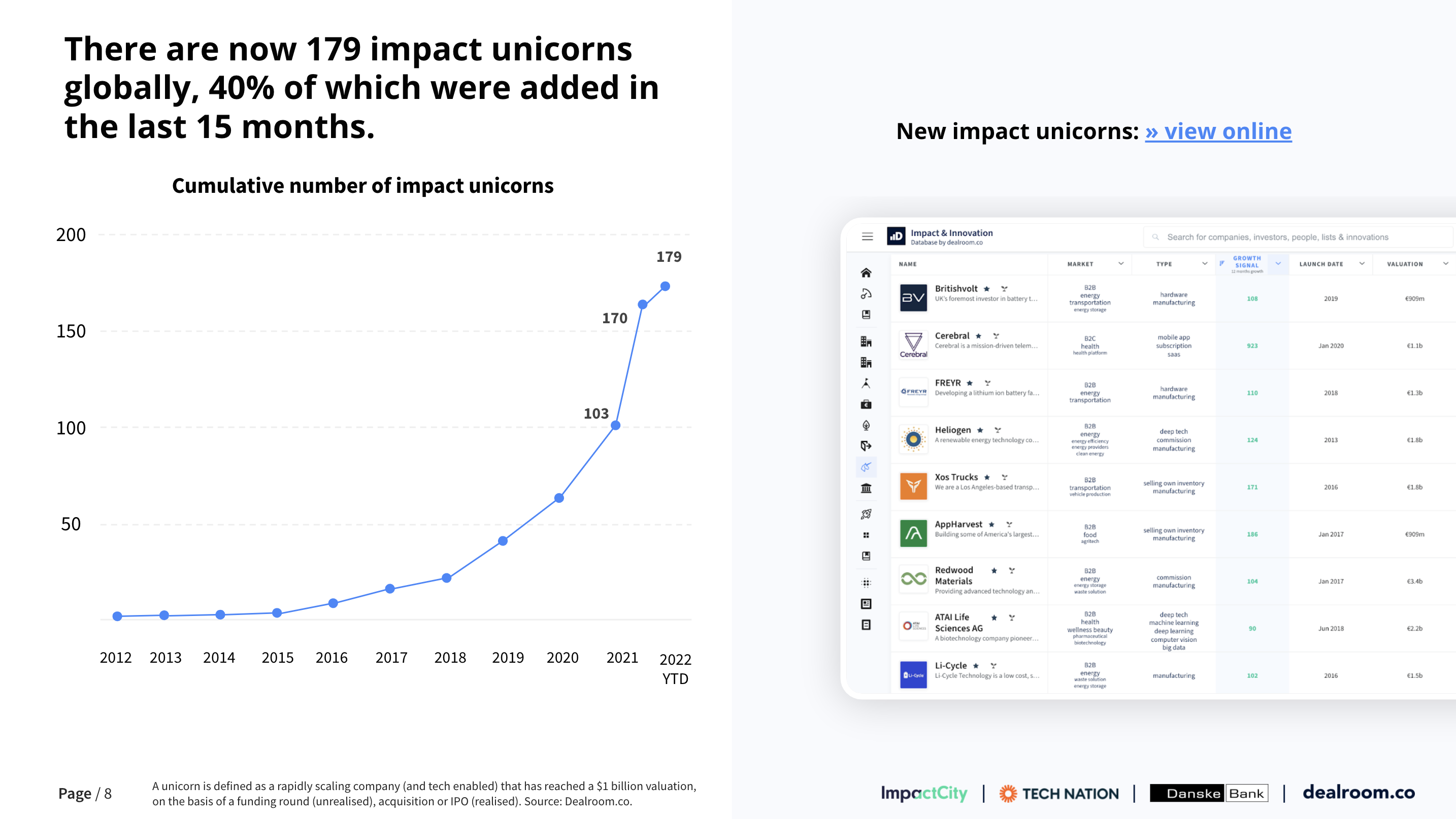

There are now 179 impact unicorns globally, 40% of which were added in the last 15 months.

Europe punches above its weight

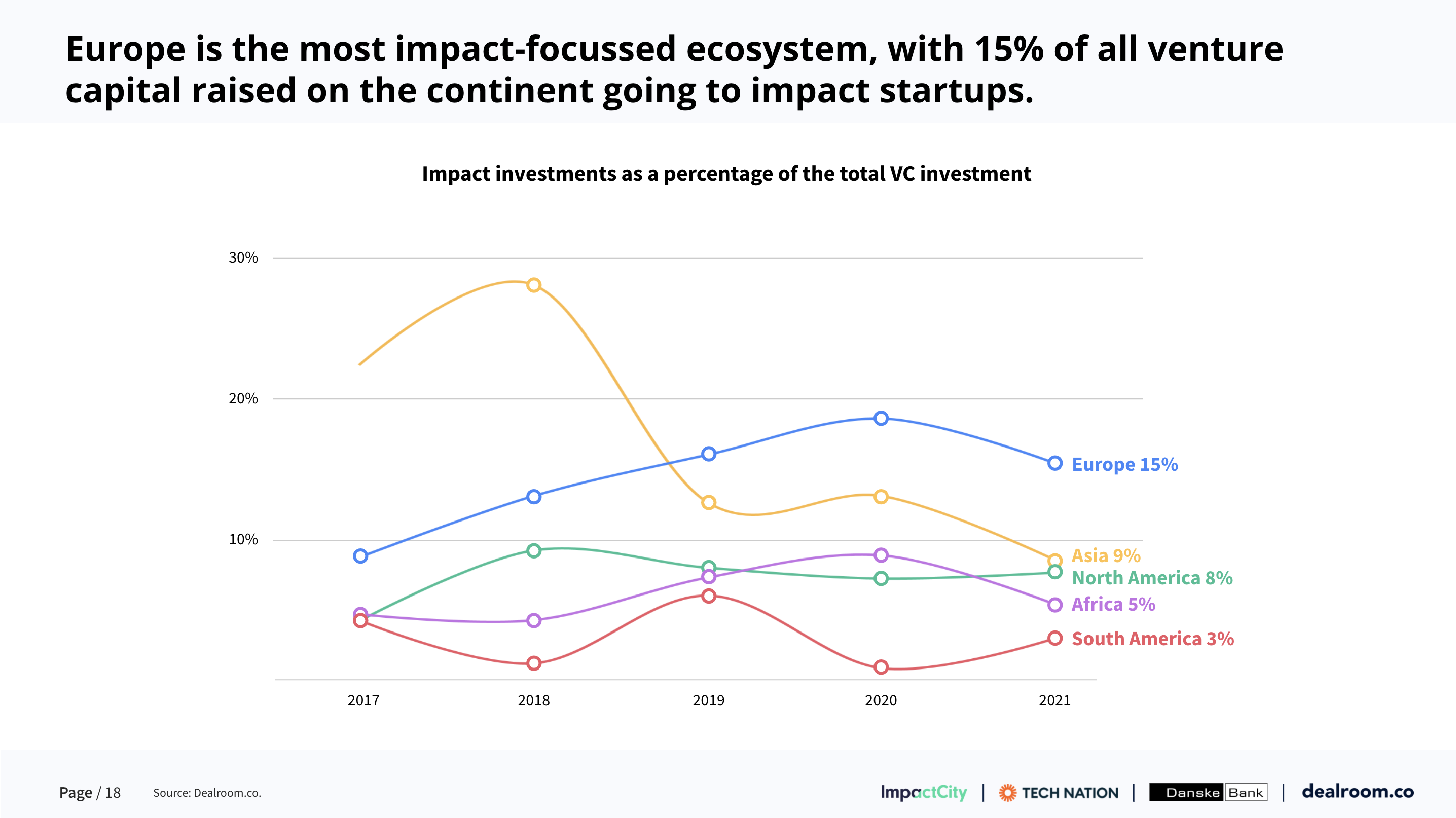

North American impact companies attract more than twice as much funding as European-based ones. In comparison, impact companies in the global south attract next to no venture capital.

Even though North America leads in absolute terms for impact startup funding, Europe punches well above its weight. Europe attracts half the level of impact funding of North America, but this compares to a third of North American funding in overall VC.

Europe is also the most impact-focussed ecosystem, with 15% of all funding going to impact startups.

Clean energy startups dominate impact funding

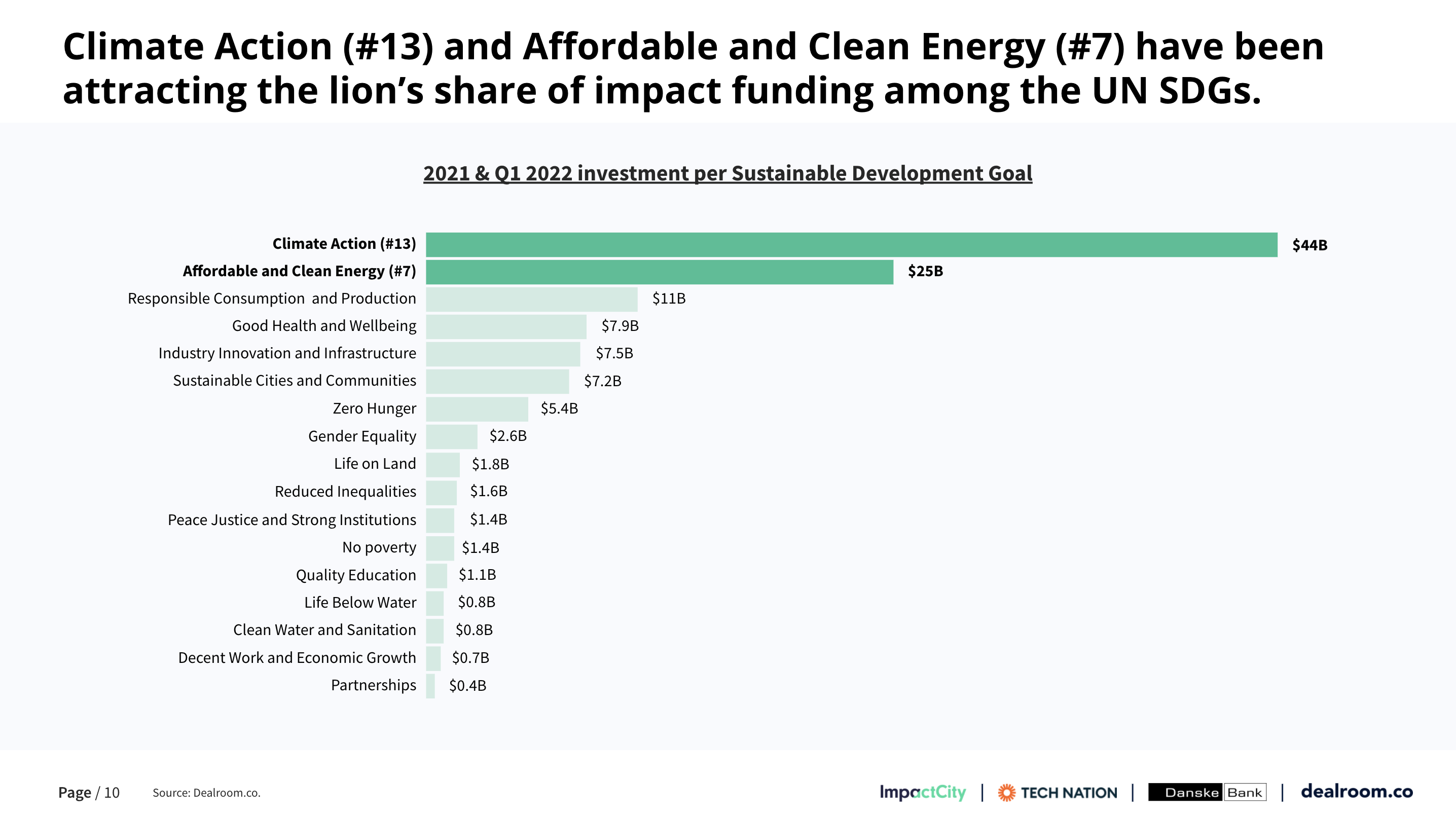

Startups tackling Climate Change, and Affordable and Clean Energy raised a total of $47B in funding in 2021 and the first quarter of 2022.

With war in Ukraine, Russian sanctions, and supply shortages putting a strain on energy security, pricing and demand, this segment of startup innovation could well further benefit from renewed focus on affordable and clean energy solutions, which we’ll be keeping an eye on in Q2 and through 2022.

Report - Impact startups and venture capital – Q1 2022

Interested?