Fighting financial crime with tech

Around $1–2 trillion is laundered every year globally, around 2–5% of the global GDP. And only 1–3% of laundered funds are identified and possibly stopped. With many of the most prominent global banks having been fined due to anti-money-laundering (AML) scandals, totalling $10.6B in 2020, it’s an expensive problem waiting to be solved.

But AML compliance costs are even more burdensome for smaller fintech organisations, such as challenger banks. Just in September, German challenger bank N26 was fined €4.25 million over AML failings.

How is that possible when the global spend on financial compliance in 2020 was an enormous $180.9 billion and projected to rise?

Several factors come into play. Costs for AML are mainly increasing due to increasing regulation and evolving criminal threats, which coupled with a culture of over-cautiousness leading to over-reporting translates into strong growth in the volume of AML activity. The pandemic also increased the burden due to remote working, e-commerce and huge shifts in customer behavioural patterns.

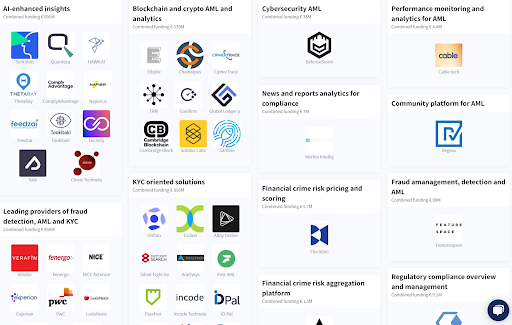

But above all, 70% of AML compliance spend is on people rather than technology. Is it about time to rebalance this? We identified 60+ startups working to do so

Subscribe to Dealroom’s Fintech newsletter, for weekly insights on finance-focused startups and investment:

Changing AML through AI

Typical AML processes follow rule-based approaches. The consequence is that more than 90% of the alerts are false-positive, which over-burden the teams and make the real AML go unnoticed. This approach needs Intelligence-led, data-based analytics and AI to augment it.

However, this is a highly regulated industry where typical “black box” models cannot work. Transparent and interpretable solutions, to be deployed alongside rule-based existing processes, are getting ground. Several startups such as Sentinels AI, Hawk AI, Quantexa, ThetaRay, ComplyAdvantage and many others have all raised significant funding in the last months. In 2021 AML startups have already raised almost $1B.

Data quality is also becoming increasingly important, with startups like kompany offering real-time access to official commercial and banking registers for KYC and compliance.

Making money with AML

But is AML a basket big enough? Where could companies expand to justify this funding?

The market for AML software sales is limited, but there is potential to sell additional tools such as advanced analytics and data-gathering tools for other types of fraud. Another opportunity is to apply these new AI tools for AML and counter fraud towards finding new revenue generation opportunities. ThetaRay, for instance, proposes their AML solutions to banks to expand their cross-border payments to new countries where they could not operate before and takes a cut from each new transaction enabled by this.

Blockchain AML, an emerging opportunity

Another space to watch carefully is blockchain and crypto monitoring startups which raised more than $300M in 2021, led by the rounds of Chainalysis, Elliptic, Ciphertrace and TRM.

With the increased adoption of crypto services by traditional financial companies, fintech and crypto startups we can also expect more partnerships between traditional and blockchain-focused compliance solutions. For instance, ComplyAdvantage, a global data technology company transforming financial crime detection, and Elliptic, the global leader in crypto asset risk management solutions, just announced a partnership for a new blockchain analysis and transaction monitoring tool that will help crypto firms detect and avoid financial crime.

but that’s a story for another day.

Subscribe to Dealroom’s Fintech newsletter, for weekly insights on finance-focused startups and investment:

Interested?