Blog

€4.9 billion invested in European venture capital rounds in Q1 2018

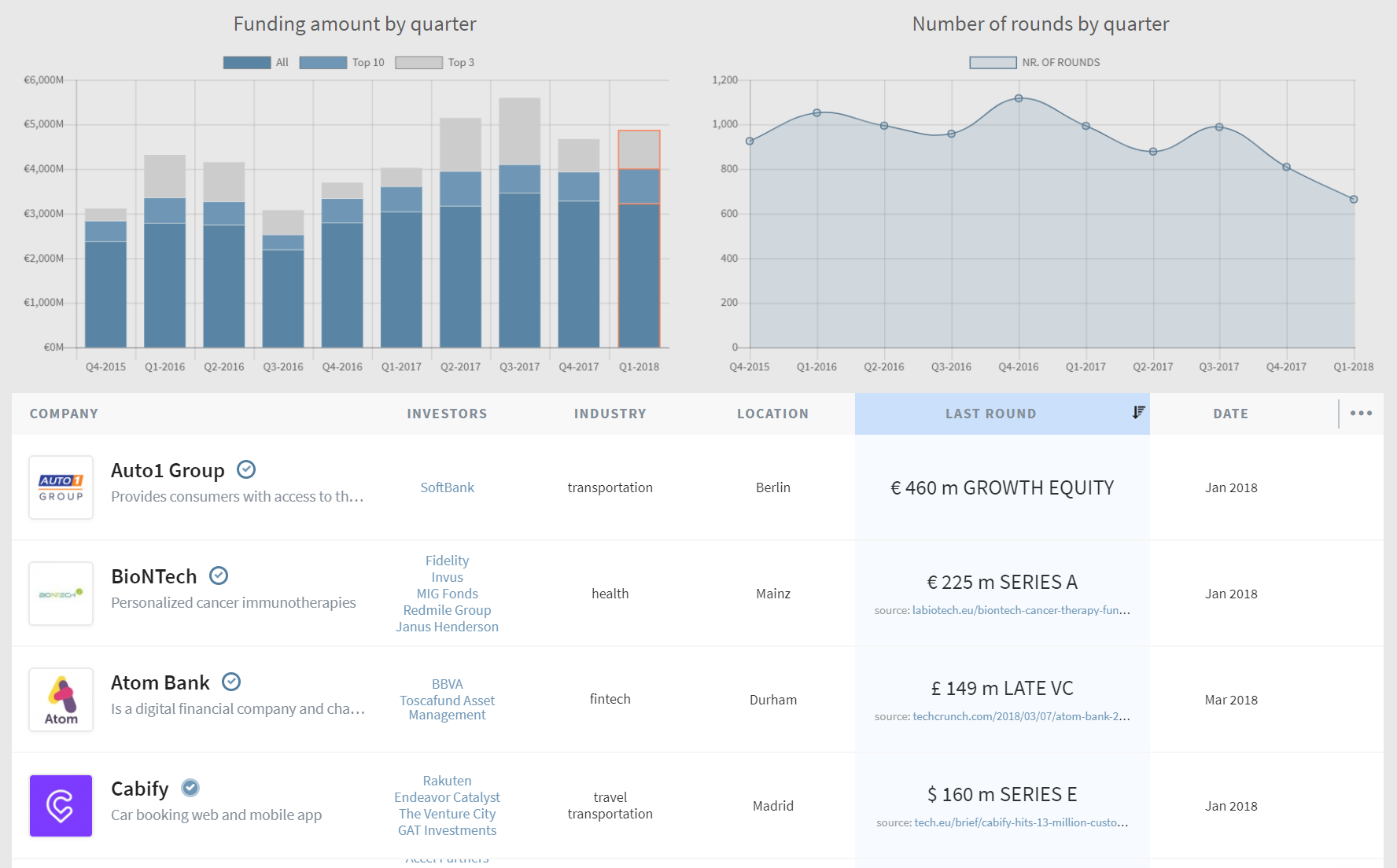

In Q1 of 2018, European companies received €4.9 billion of investment from investors globally. Compared with previous quarters, this was the third most active quarter ever, as the below interactive chart shows. To view the underlying rounds, click on the chart columns.

Are you a journalist? Request free press access by contacting us via Intercom.

Note: the decline in number of rounds shown above will reverse to a large degree, as many smaller rounds are reported later.

What’s included in the €4.9 billion figure?

- €4.9 billion includes all venture capital rounds where new capital is going to the companies. It includes biotech;

- Excludes are buyouts, secondary rounds, IPOs and acquisitions, all of which we count as exits. Debt rounds and ICOs are also excluded;

- Including Isreal, investment is €5.4 billion;

- Excuding Biotech, investment would be €4.4 billion;

- The above numbers still excludes ICOs. If Telegram’s $1.7 billion ICO was included, Q1 would be an all-time record quarter. Follow this link to review all the largest rounds in Q1 2018.

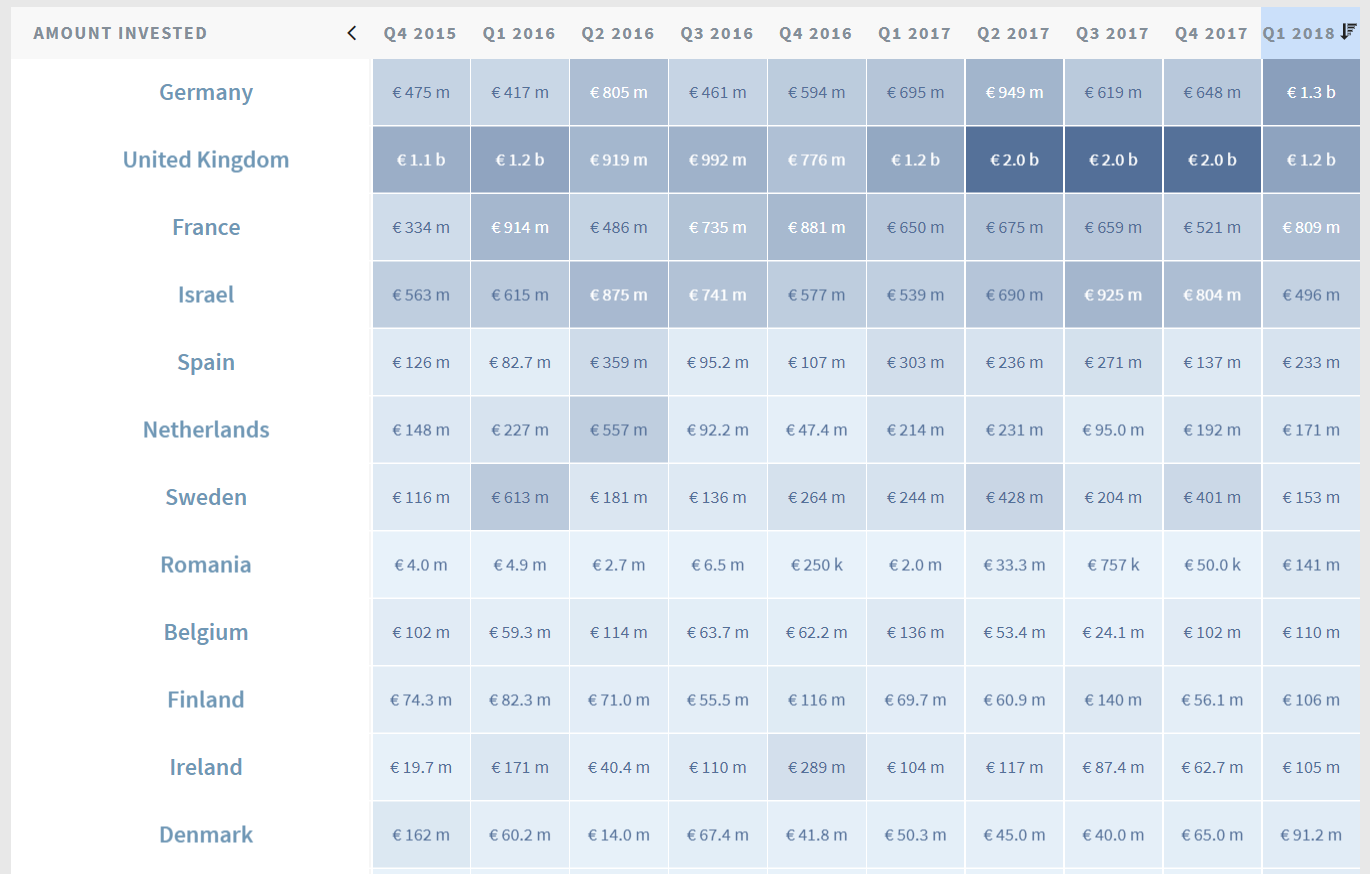

Germany and UK in the lead

Germany was leading in Q1, with mega rounds like Auto1, Number26 and BioNTech. But the UK is not far behind and leads by number of rounds. Use the interactive heatmap to compare investment activity across Europe:

Venture Capital investment heatmap

Interested?