European mobility startups – electric vehicles and corporate funding in the fast lane

Investors hit the breaks on European mobility startups in 2022, but electric vehicles are still charging up. In partnership with Via ID x Mobility Club, we’ve once again taken a look at the state of European mobility tech, startups and venture capital.

After a strong first half of the year, mobility startup funding slowed significantly in 2022 and IPOs dried up after a high set in 2021. But not all of European mobility is stuck in traffic from the market slowdown. Sectors like Electric Mobility and Logistics & Delivery are speeding ahead the pack with some their best performing half-yearlies, showing Europe is defying the odds.

Download the full report.

Report - The State of European Mobility 2023

Lifting off the gas in H2 2022

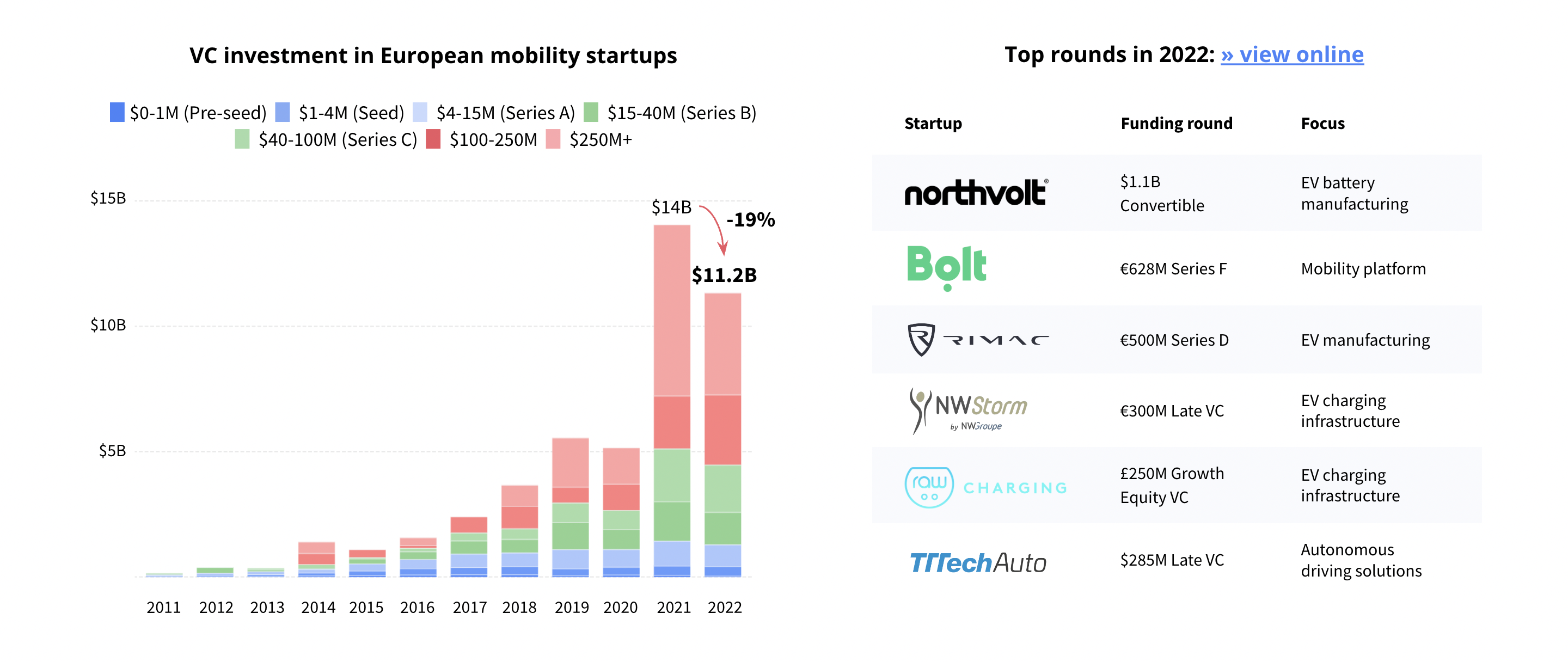

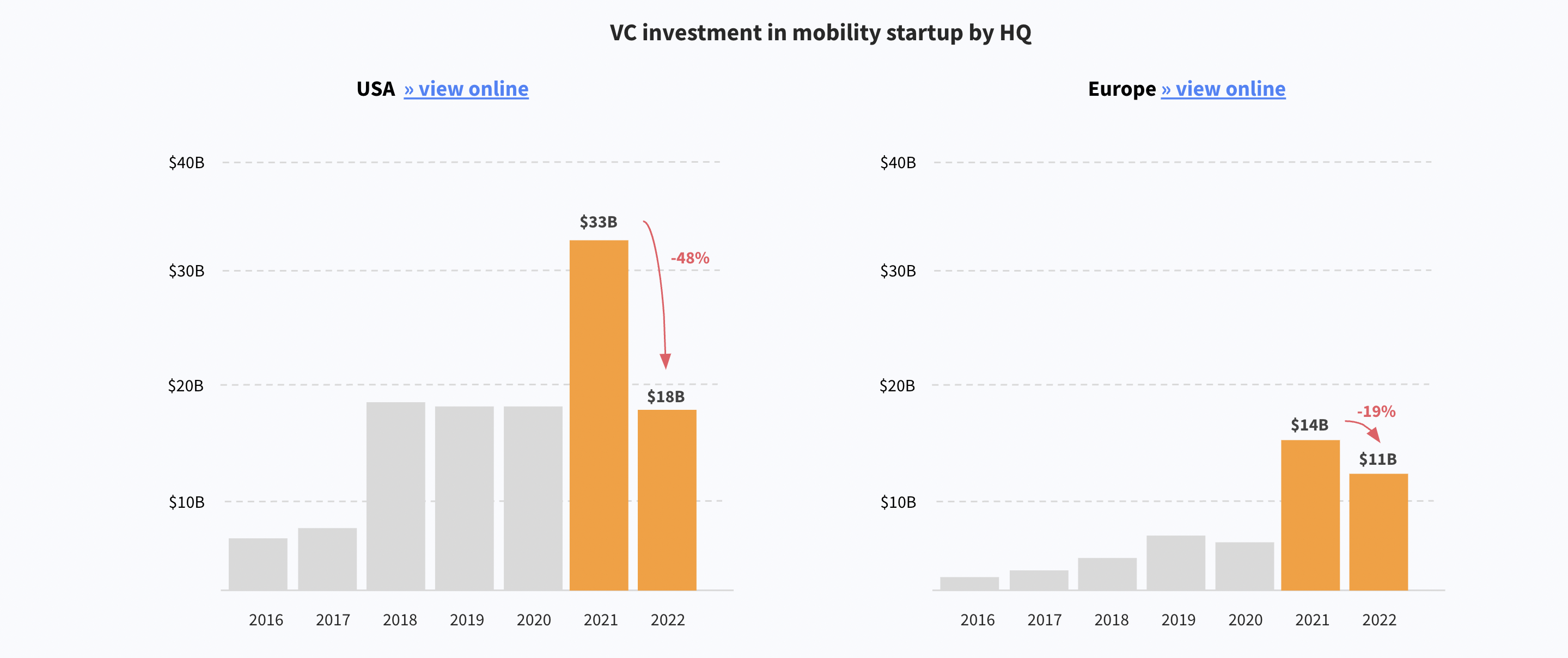

VC investment in European mobility startups totalled $11.2B in 2022, down 19% from 2021, but by far the 2nd most active year to date. But when looking closer, after a strong first half of 2022, funding decreased significantly from August onwards.

Corporate investors have been pouring more funding than ever before into European Mobility startups, totalling $3.0B for 2022.

Electric mobility and Logistics & Delivery are defying the market slowdown

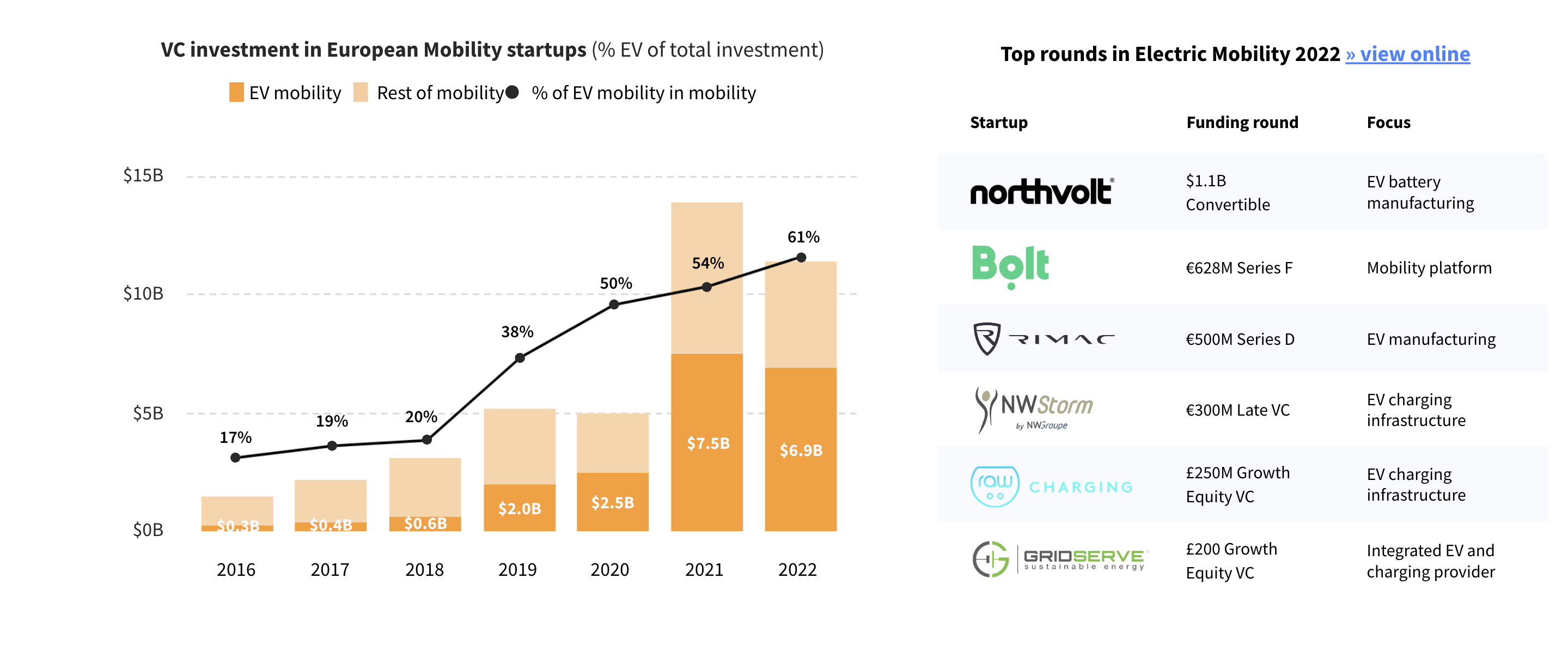

Electric mobility VC funding in Europe had its second most highest yearly total in 2022, and the all time highest share of total mobility investment, at 61%.

A maturing segment, 73% of the electric mobility funding came from megarounds last year, compared to 46% for the rest of mobility. EV charging saw huge growth in the last two years and still attracts the most early stage funding.

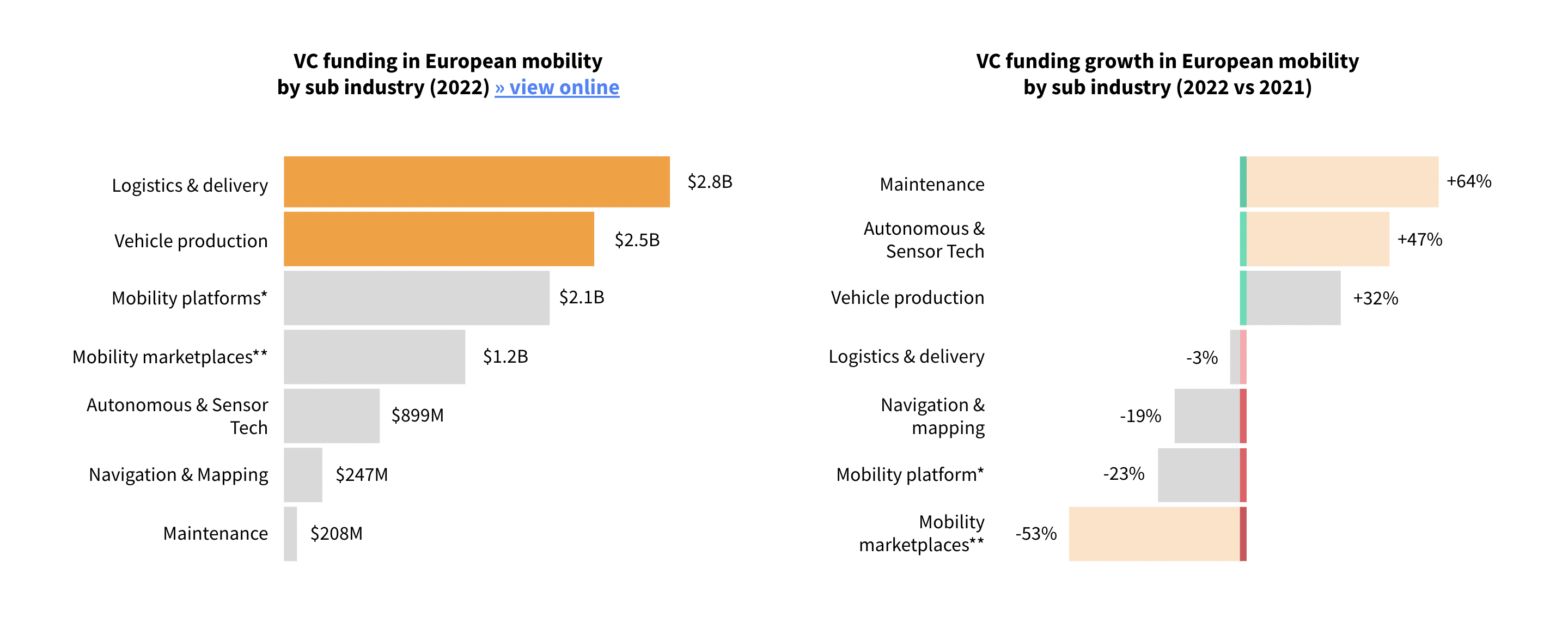

Electric mobility wasn’t the only sector performing well in 2022. Logistics & Delivery ($2.8B), and Vehicle production ($2.5B) startups attracted the most funding in 2022. After a strong 2021, investors swerved Mobility platforms and marketplaces in 2022.

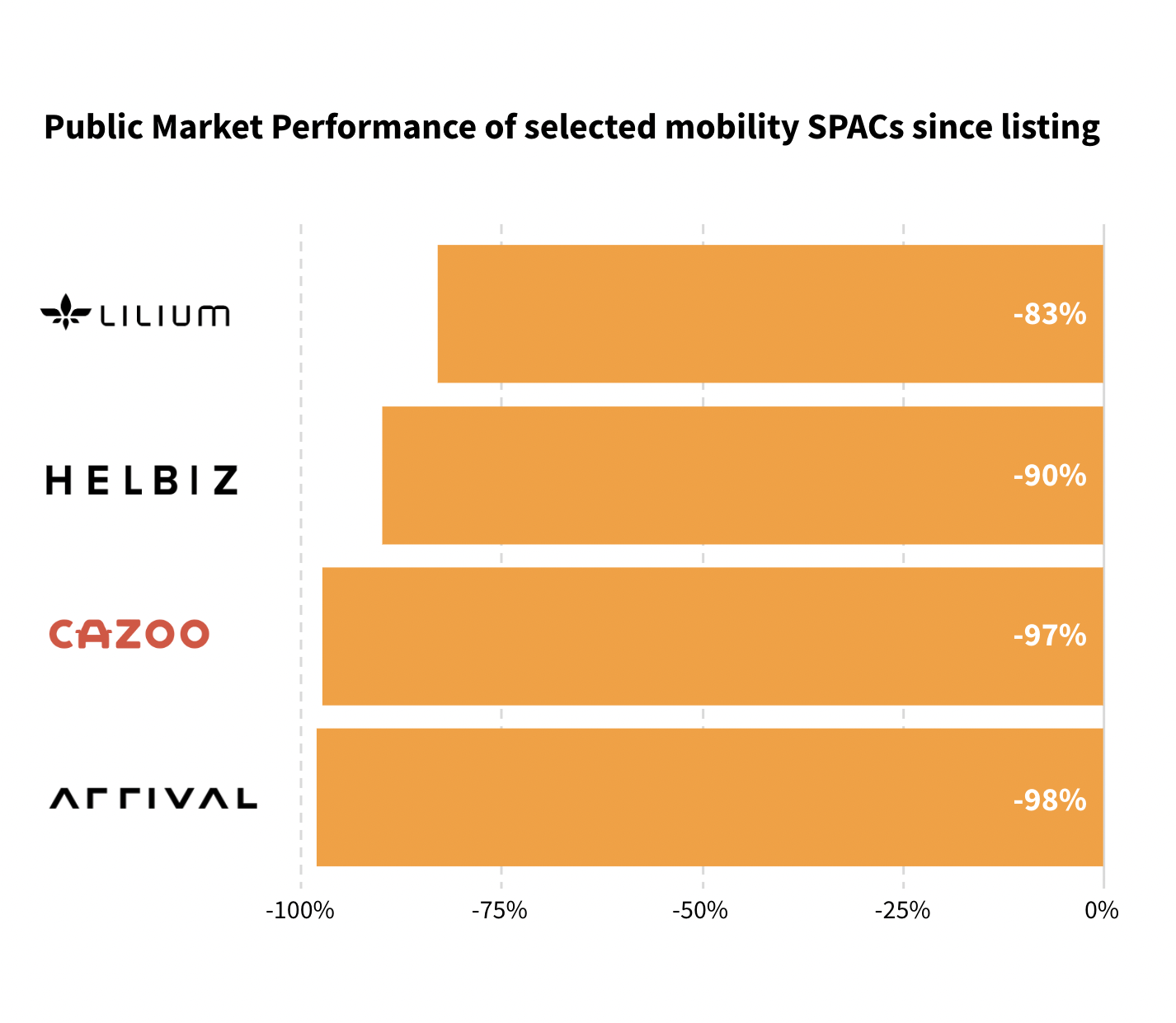

The window for going public has closed

After a record-breaking 2021, the window for (SPAC) IPOs closed in 2022. There were 4 public listings in 2022, compared to 22 in 2021.This was partially driven by the discouraging performances of 2021 mobility listings, some down 90% since listing.

A renewed focus on profitability also proves challenging for growth-driven companies. However, private M&A remained stable at around 30 transactions per quarter.

European Mobility competes on the global stage

Europe increased its share of global VC investment in mobility from 16% to 25% this year. Europe is also the leading geography at early stage, attracting over 34% of global funding. European mobility startups continue to compete strongly internationally, while US mobility startup funding fell to its lowest level since 2017.

Zooming in on the region, the United Kingdom leads European VC investment in Mobility, due to >50% decrease in funding for Sweden and Germany year on year. While Stockholm remains the number one hub for Mobility funding in Europe, with $2B raised in 2022, while emergent hubs in Croatia and Austria entered the top 10.

Interested?