Beyond crypto, why blockchain matters

We recently hosted an expert panel on the future of blockchain, in partnership with Sifted. While blockchain-related headlines often focus on the wild west of volatile crypto prices, memecoins and token crazes, we wanted to explore how startups are leveraging blockchain technology for diverse applications beyond crypto, why the European Commission are excited about decentralised systems, and what the investment landscape can tell us about what innovation is happening where.

Report - Is a decentralised future possible?

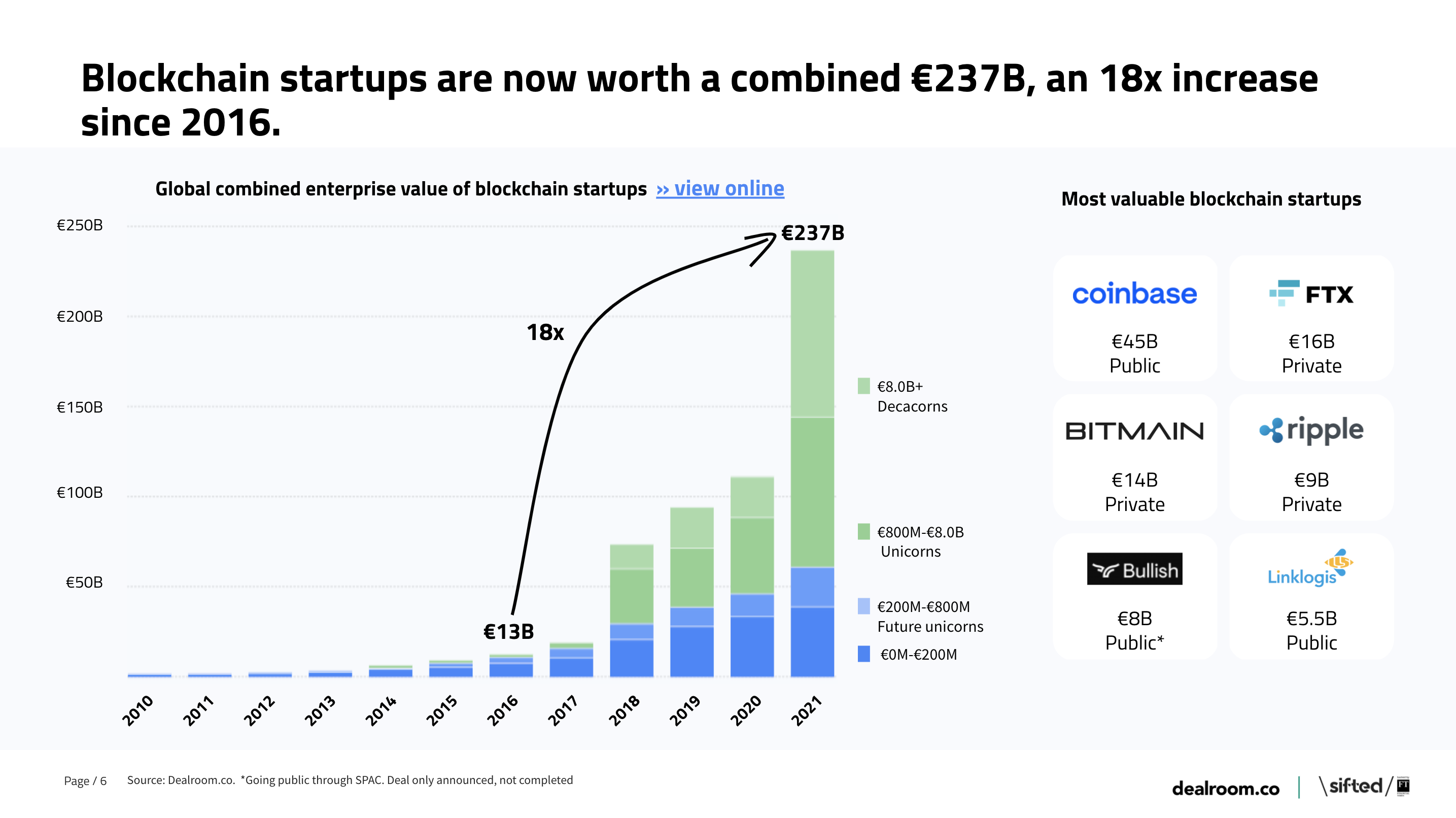

Blockchain startup value has soared in the last five years, up 18x since 2016 to a combined €237B. But as investment is really only now hitting its stride, we can expect this value to accelerate. Large high-profile public success stories such as Coinbase who IPOd in 2021 (more on that here), have brought validation and increased institutional interest to the technology and its applications.

Blockchain backing

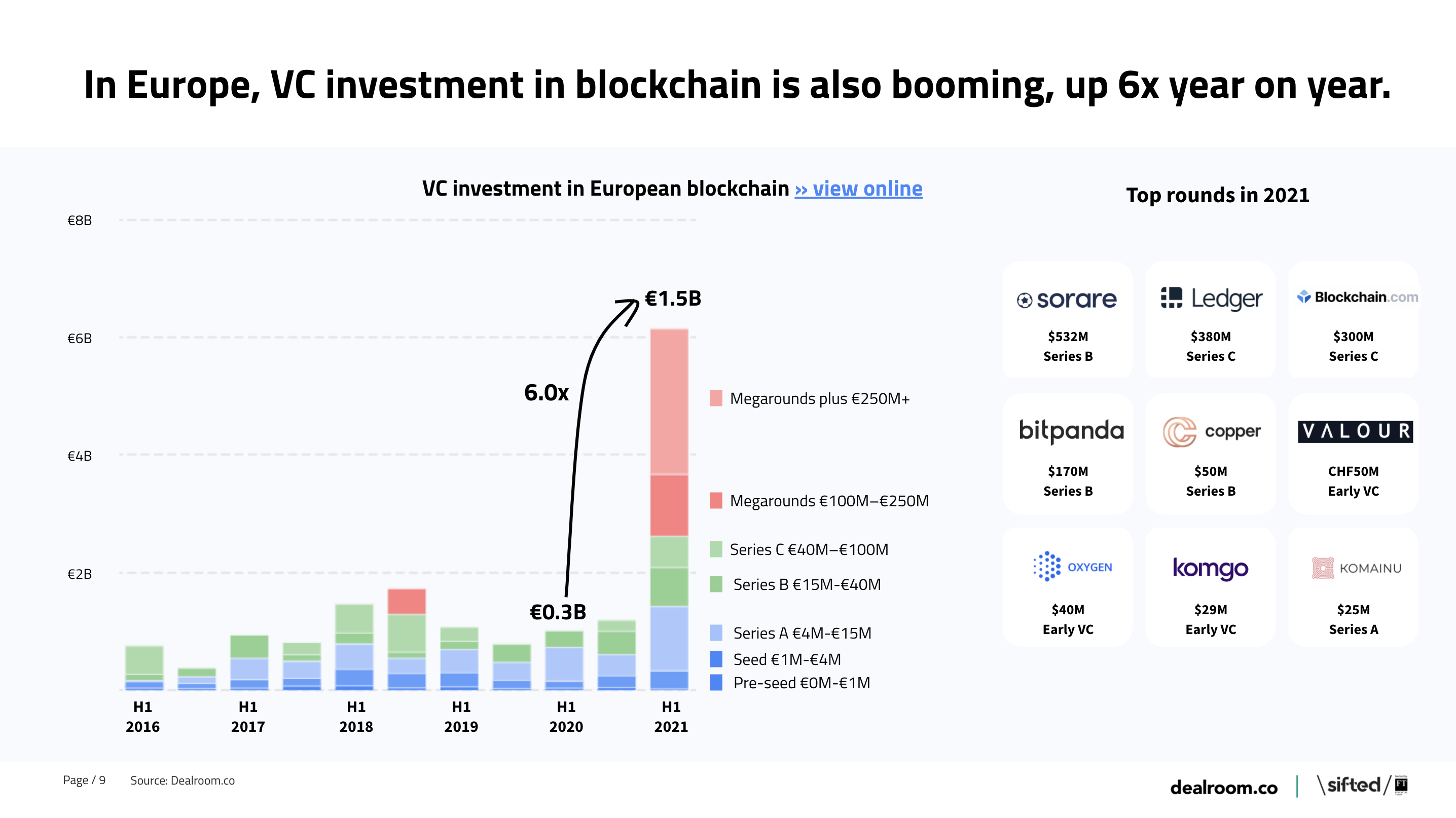

Startup investment and innovation in blockchain is undergoing a step change in Europe and around the world. European blockchain startup investment increased 6x year on year in H1 2021 to €1.5B.

Of course fintech and cryptocurrency is where the most blockchain activity has taken place to date, but this disruption to an enormous industry is perhaps overdue. As Nicholas Brand (Partner, Lakestar) said: “Where Blockchain is currently causing the most amount of havoc is around the question “What is money?”. Most of our societies work with the idea of a central bank and commercial banks. That is over 100 years old, and we would expect some change in a 100 year period.

Indeed 87% of value created by blockchain startups has so far been in fintech. But fintech is just the tip of the iceberg for blockchain applications. “Everything is going to be tokenized, but the we have to think beyond just the digital world”, according to Jessi Baker, CEO and founder of Provenance who are using blockchain in sustainability and supply chains.

International land grab

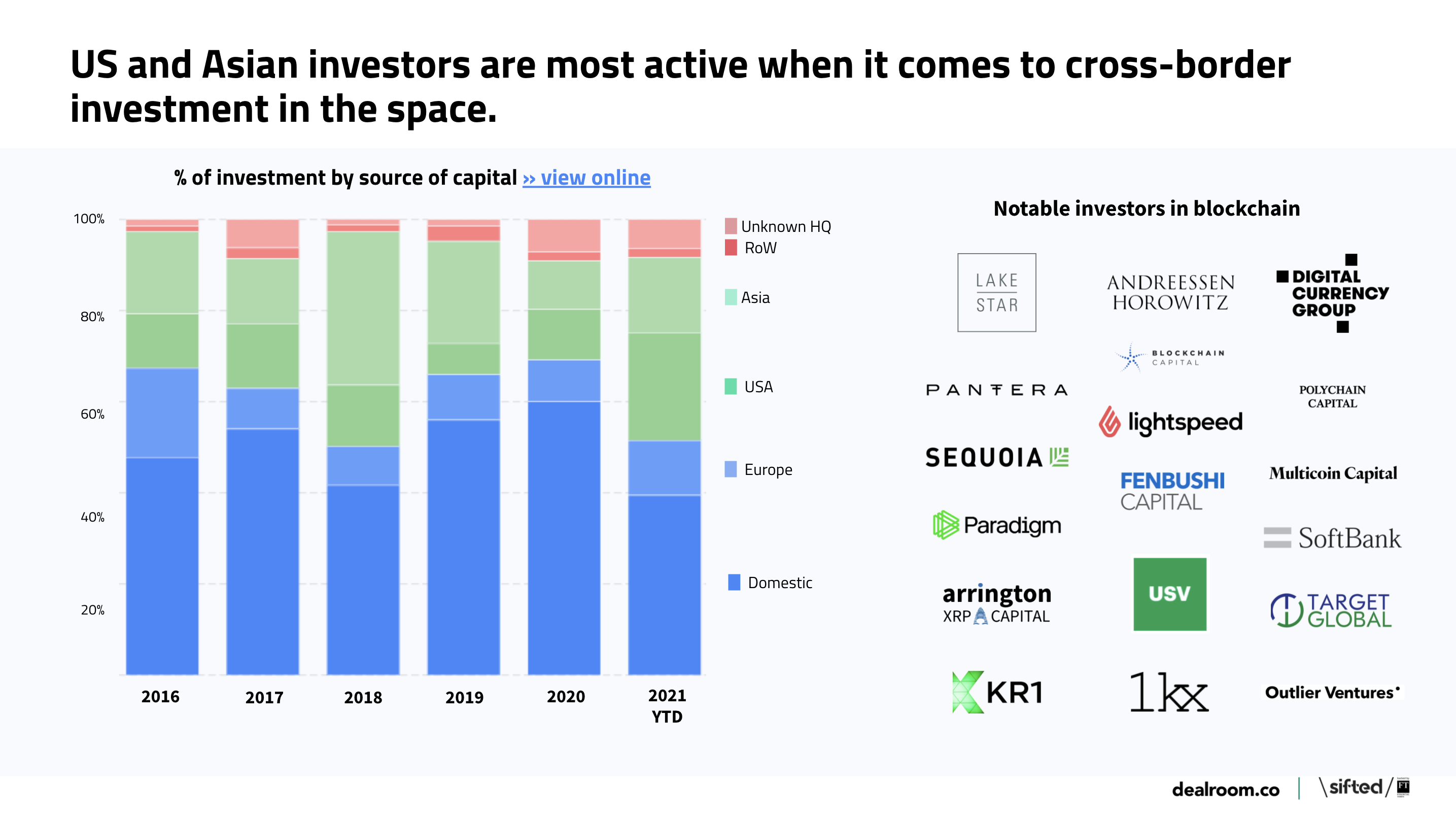

Investment is international, and it’s US and Asian investors who are most likely to look beyond their own borders for startup investment opportunities in blockchain. Investors are interested in a piece of the future pie, no matter where it’s being built.

Decentralized Europe

As the European Union itself is a largely decentralized community, the European Commission understands more than many the potential of blockchain technology for our future. As Peteris Zilgalvis (Head of Unit, Digital Innovation and Blockchain DG CONNECT) put it, “blockchain is the ideal technology for the EU because it is multilevel, and enables multilevel distributed governance.” The European Blockchain Services Infrastructure (EBSI) has applications for notorization, educational qualifications, self-sovereign identity and trusted data sharing.

The ecosystems that can successfully connect public and private realms, as well and digital and physical worlds, will be the first to capitalize on the freedoms, efficiency and transparency of a decentralized future.

Report - Is a decentralised future possible?

Interested?