Top tech ecosystems

Introduction

Insights on 288 tech ecosystems

Our dataset for this startup ecosystem research covers 288 cities unicorn cities, across 69 countries.

Each “hub” is a metro area. For instance, Greater Boston includes Boston, Cambridge, Waltham, Burlington, Somerville, and many other towns. Tens of thousands of municipalities are included within these 288 ecosystems.

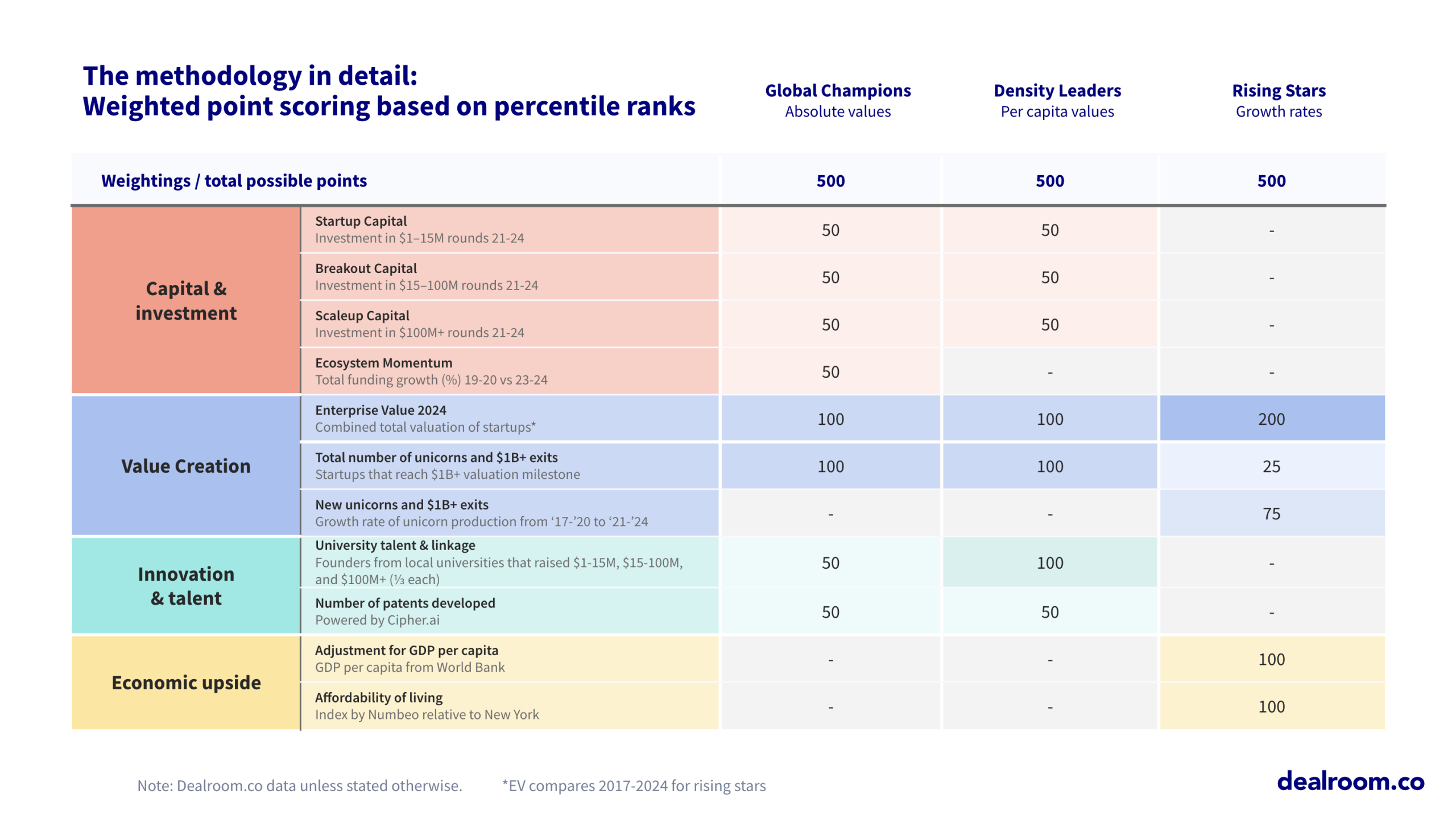

The analysis takes a look at ecosystems through three lenses

🏆 Global Champions (Scale Lens)

The worldʼs largest and most successful startup ecosystems, identified by VC investment, enterprise value, ecosystem momentum, unicorns, university linkages and patents.

💎 Density Leaders (Per Capita Lens)

The worldʼs densest startup ecosystems, identified by VC investment, enterprise value, unicorns, university linkages and patents. These cities have high output relative to their size.

⭐ Rising Stars (Growth Lens)

The fastest-growing, emerging tech ecosystems by emphasizing growth in enterprise value and unicorns, adjusted for local GDP per capita and cost of living.

The results

Unsurprisingly, the Bay Area is firmly locked at the top Global Champion tech ecosystem, as well as the number one Density Leader, which includes enterprise value, unicorns, university linkages and patents. New York, Boston and Austin followed the Bay Area as Global Champions, with Paris the only non-US city in the top five.

Many academic hubs form the core of the “Density Leaders” – hubs that are punching above their weight – including Cambridge, Munich and the NC Research Triangle.

Lagos tops the list of Rising Star tech ecosystems, followed by Istanbul and Pune. These are hubs that are still earlier in their maturity, but growing fast.

Explore the data

A key objective of this work is to make the findings as transparent as possible.

With that in mind we’ve published all the data in an open data dashboard, for custom exploration, comparisons and bespoke benchmarking. It’s a super powerful tool and fun to play around with.

Explore the data dashboard on Dealroom.

Methodology

The below slide from the report describes the exact points system for each lens.

And more can be found on definitions of terms like unicorns and thoroughbreds in our Glossary.