Deep Tech: Europe

Contributing Partners

Introduction

Deep Tech is one of the biggest VC investment categories in Europe, growing at a rapid rate.

Explore the live-updating funding data in a quarterly format below or here in the app.

Deep Tech encompasses many industries, from Health & TechBio, to SaaS and AI, Space and Robotics.

Deep Tech is not a fixed subset of segments, but it depends on the characteristic of the business being built.

What is Deep Tech and why does it matter?

We classify as Deep tech startups whose technology is based on tangible engineering innovation or scientific advances and discoveries applied for the first time as a product, often aiming to solve society’s biggest issues.

Deep tech startup profile

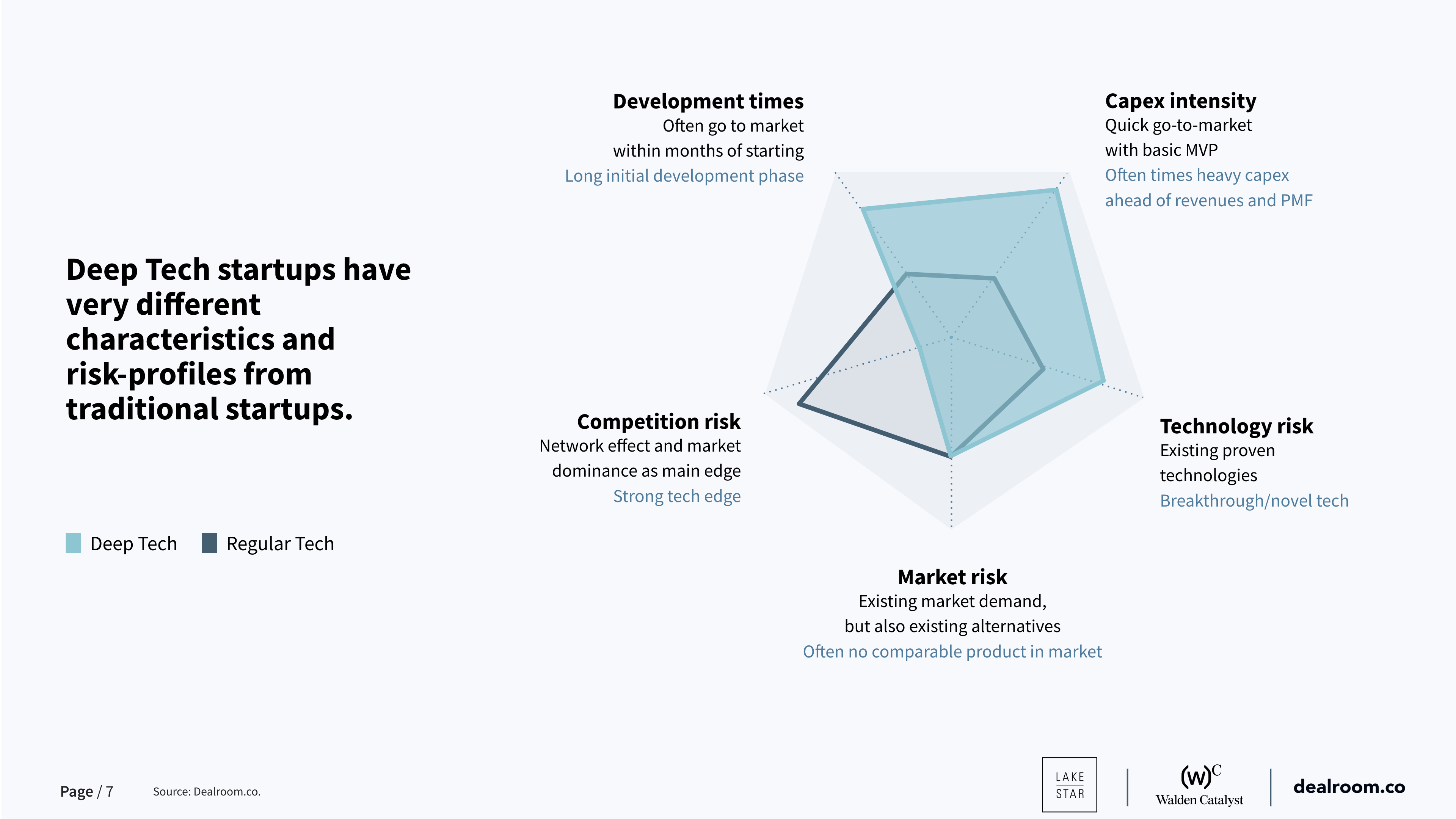

Due to their R&D intensiveness, Deep Tech startups have widely different characteristics and risk profiles compared to “traditional” startups.

Deep tech startups tend to have:

- Longer development times: due to a complex initial development phase and longer time-to-market

- Higher Capex intensity: often, times Deep Tech startups are capex intensive, requiring substantial investment ahead of any sizable revenue and demonstrated product-market fit (PMF)

- Higher technology risk: Deep Tech startups exploit breakthrough or novel tech that is not yet proven in the market

- Comparable market risk: while there is definitely a higher risk of market demand since Deep Tech startups bring to the market a completely new product, not comparable to anything else already existing, this also means that less competitive alternatives exist.

- Lower competition risk: while traditional startups often rely on network effects and market dominance as the main hedge against new competitors, Deep Tech startups have a stronger hedge in the tech itself which is hardly replicable. The risk of “copycats” is strongly reduced.

It is not forever

Some topics might have been Deep Tech in the past but have by now become mainstream.

This is exactly the essence of Deep Tech. Almost anything used today had its roots in Deep Tech at a certain point, from electricity to the telephone and the Internet, to cars and planes.

What’s Deep Tech today is not necessarily Deep Tech tomorrow. Once the technology or product is no longer novel and as the company scales, what was once Deep Tech becomes regular tech.

Why do Deep Tech startups matter?

Over the next five years, 60% of revenue in “Technology” will come from Hardware, with only 40% coming from software.

And by contrast, just slightly over 20% of VC funding went to Hardware since 2016.

Not all Deep Tech is Hardware. AI, blockchain, AR/VR, quantum computing software and much more are all software-based Deep Tech.

However, Deep Tech is by far more Hardware oriented than the rest of Tech.

Almost 60% of Deep Tech funding since 2016 has been directed to hardware-related startups, 3x more than the nearly 20% for the rest of Tech.

Why Deep Tech is exciting for investors

Deep Tech startups can often target applications in multiple markets and, unlike traditional startups, have a stronger moat towards competition thanks to technology edge and IP portfolio.

Deep Tech startups can also generate higher ROI thanks to lower initial valuations and high attractiveness as acquisition targets.

Furthermore, Deep Tech is instrumental in tackling today’s biggest challenges, from climate change and food security to intractable disease and by doing so, creates new markets and unlocks societal growth.

"As investors in Deep Tech, we are looking for the next Marie Curie or Max Planck, scientists and entrepreneurs taking disruptive technologies out of the lab and turning them into commercial products. Distributed at global scale, these technologies eventually make their way into everyone's life, and have the potential to solve some of the many challenges humanity is facing.”

This is also recognized by LPs in Europe, who see Deep Tech as the 2nd most promising segment in venture capital, behind only Planet Positive, according to the survey in The State of European Tech 2021 by Atomico (Chapter 2.2).

Deep Tech and Impact

In most cases, we cannot solve the world’s biggest challenges without Deep Tech advancements.

However, not all Deep Tech is Impact in our definition. At Dealroom, we classify a startup as impact (or sustainable) if it addresses at the core of its activity at least one of the UN Sustainable Development Goals (SDGs).

Examples are Newcleo (next-gen nuclear fission), H2 Green Steel (fossil-free steel manufacturing), Climeworks (direct-air carbon removal), Northvolt (next-gen EV batteries) and Mosa Meat (cell-based meat).

Furthermore, the % of Deep Tech tackling climate tech has increased massively from just 7% in 2016 to 38% in 2022.

However, Deep Tech does not address any SDGs in many other cases. A lot of Deep Tech is actually "neutral."

We do not consider Open AI or generative AI and LLMs as Impact. Similarly, we do not consider quantum computing to be Impact.

In fact, even though quantum computing can be an enabler in discovering new materials for the sustainable transition or new medical therapies, it can also be used to optimize oil & gas extraction and exploration or develop financial portfolio optimization.

We consider enablers like this as Impact only if they have a declared and exclusive focus on impact applications.

Other segments of Deep Tech, such as defence applications (e.g. Anduril), are also not regarded as Impact.

European VC funding

Venture capital investment into European Deep Tech startups has been on a long run upward for more than a decade, accelerated further by the pandemic.

We are now seeing some adjustments. European Deep Tech startups raised $18B in 2022, 18% less than the 2021 total, but nearly 2x 2020.

Though a little lower than in recent years, 2024 levels are still significantly higher than pre-pandemic.

Monthly investment trends

By investment stage

Below we break venture capital into three distinct stages:

- Startup stage ($0-15M rounds)

- Breakout stage ($15-100M rounds)

- Scaleup stage($100M+ rounds).

This provides more consistent and timeless segmentation of the startup & venture capital landscape (more so than self-reported round labeling, which are applied inconsistently, especially between business cycles).

Early Stage

Explore these European Deep Tech funding rounds here

Breakout Stage

Explore these European Deep Tech funding rounds here

Late Stage

Explore these European Deep Tech funding rounds here

Deep Tech vs Rest of Tech

Deep Tech has been slowing down in respect to 2022 but less than the overall market.

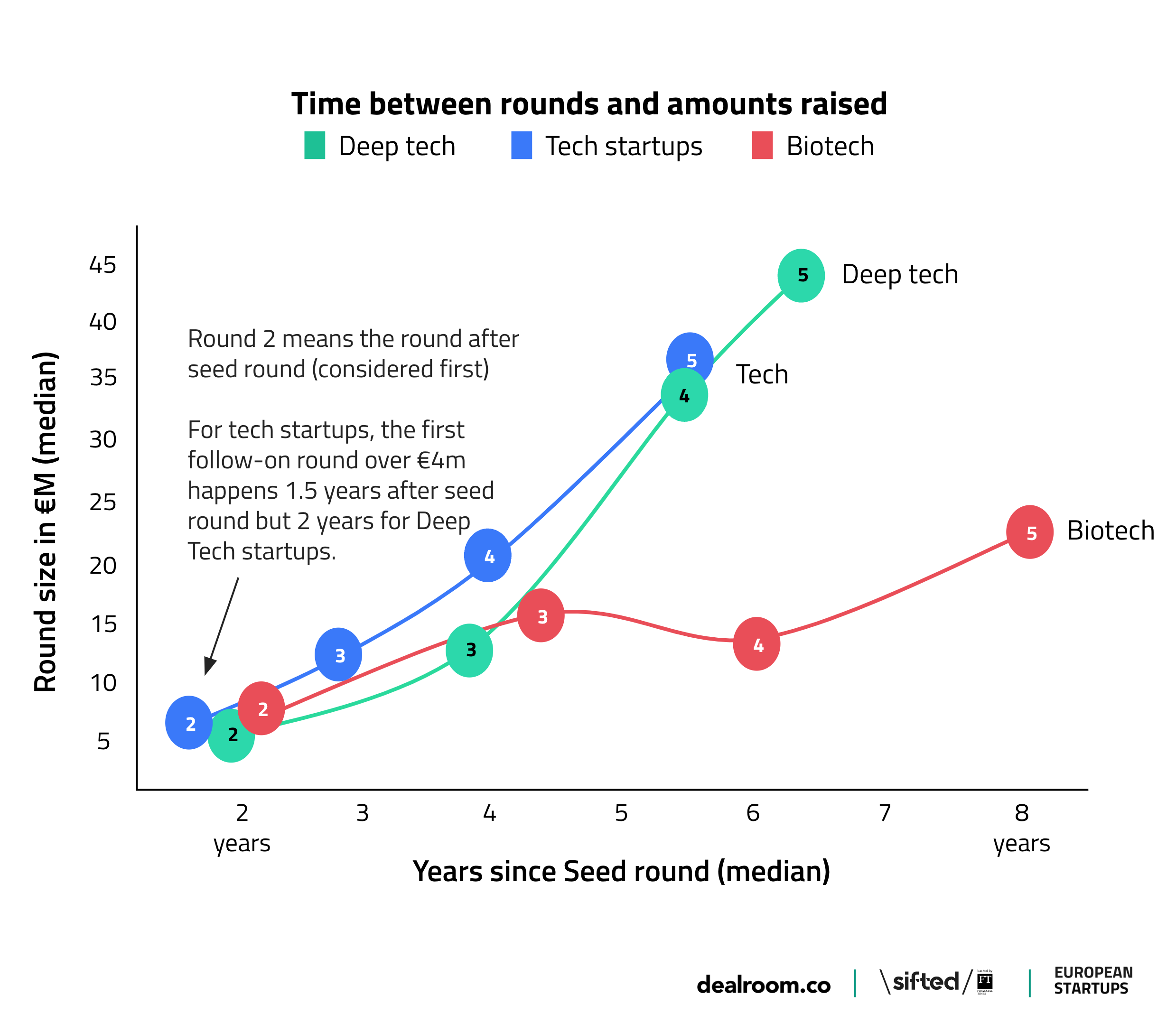

It takes (a bit) more time and capital to build a Deep Tech startup.

Deep Tech startups raised, on average, their Series A 2 years after their Seed, compared to 1.5 years for the rest of the startups. Similarly, they raised their third round almost 4 years after Seed compared to less than 3 years for normal startups.

Deep Tech startups raised less capital at early stages compared to normal startups, but more in later rounds.

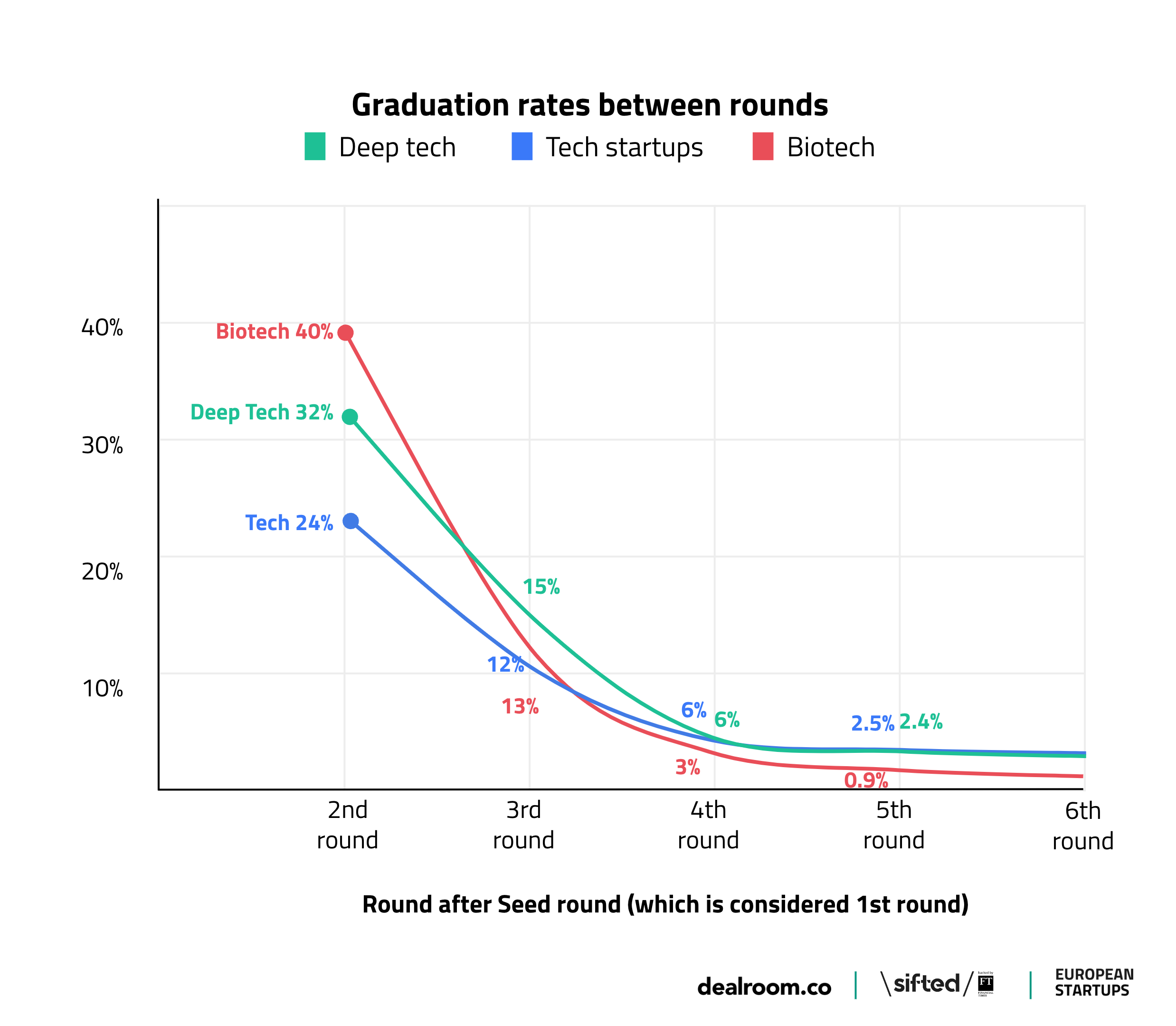

Graduation rates of Deep Tech startups are higher initially but then fall in line with the broader market.

The pattern could be explained by the fact that Deep Tech startups need more rounds before they can be validated.

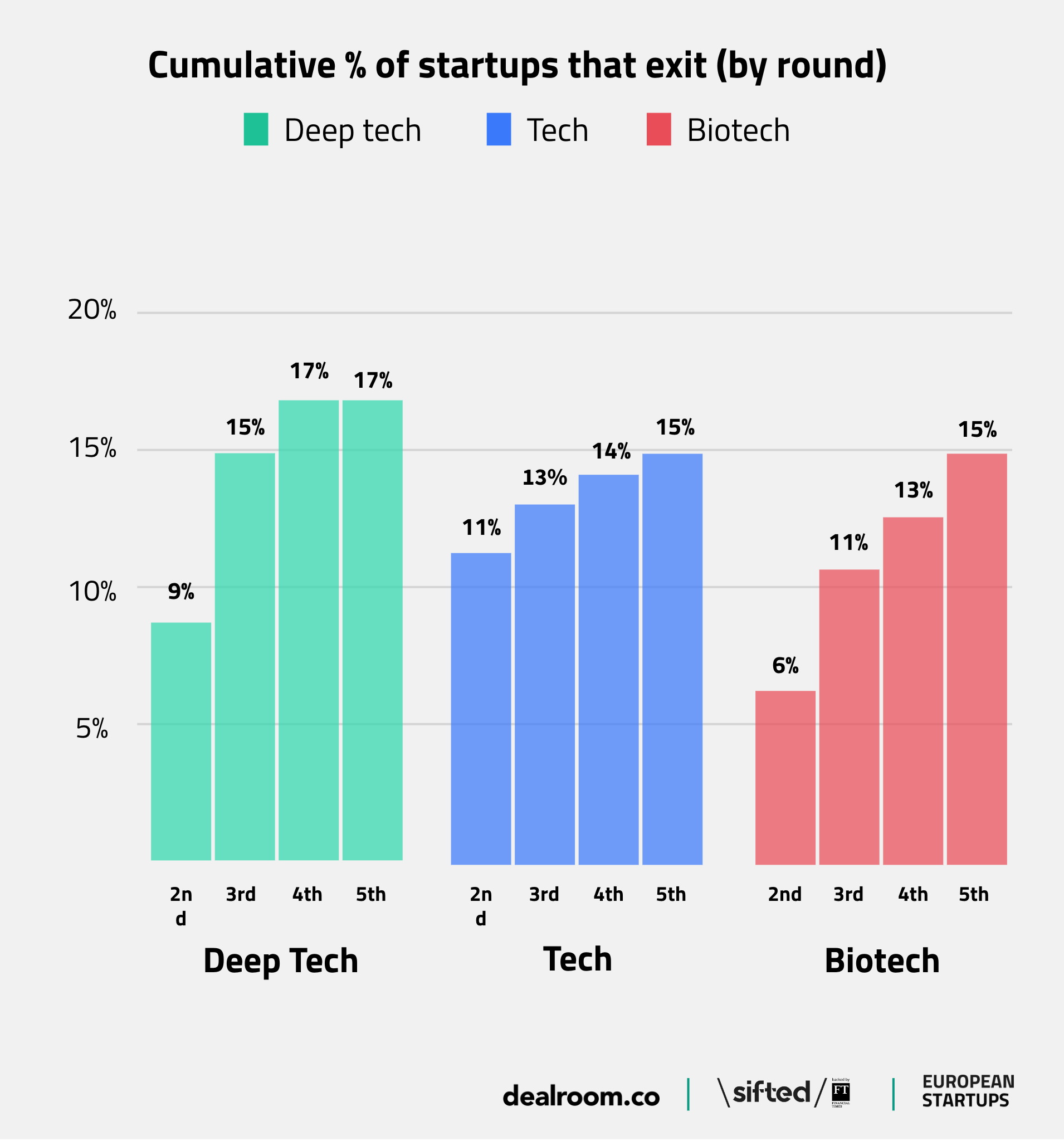

Deep Tech companies have the same or even higher probability of exiting than traditional startups.

Leading sectors

Europe is well-positioned in Quantum Computing and Health applications, as well as partially in Space tech and Climate tech.

In AI, Semiconductors and Defense, Europe's investments are dwarfed by US or China, depending on the segment.

Looking deeper at some key areas, we see Europe's strength across the different quantum computing areas (Quantum Cryptography, Quantum Computers and Quantum Computing Software), as well as some Climate Tech areas such as Hydrogen and Carbon Removal, Capture & Storage.

Europe is instead far behind in AI Chips and Generative AI, Nuclear fusion and Launch Rockets.

It is to be noted that this comparison only looks at VC funding. For instance, China is a leader in Quantum Cryptography as from patents and research.

On the other hand, Europe has a strong early-stage ecosystem of startups in nuclear fusion and leading research such as ITER, but has not invested resources on the scale of the US to scale it up yet.

Hardware vs software

Almost 60% of Deep Tech VC funding has to hardware-related startups, compared to less than 20% for the rest of tech startups.

Industries

Health & Techbio have attracted the most VC funding in Deep Tech since 2016, closely followed by SaaS & AI and Transportation. Robotics, Energy, Space and Semiconductors have also attracted considerable funding.

So far, in 2023, SaaS & AI have been the industry with the most investment led by the generative AI wave.

AI is the technology that attracted the most Deep Tech funding, followed by hardware, biotech & biology and Big Data.

Note: Deep Tech startups are often associated with more than one technology. For instance, robotics is often both hardware and AI related.

We normally do not consider biotech and pharma as Deep Tech. Biotech & biology is intended as a transversal technology in TechBio, synthetic biology, and other sectors. For more details on biotech, see the next section Biotech vs Deep Tech.

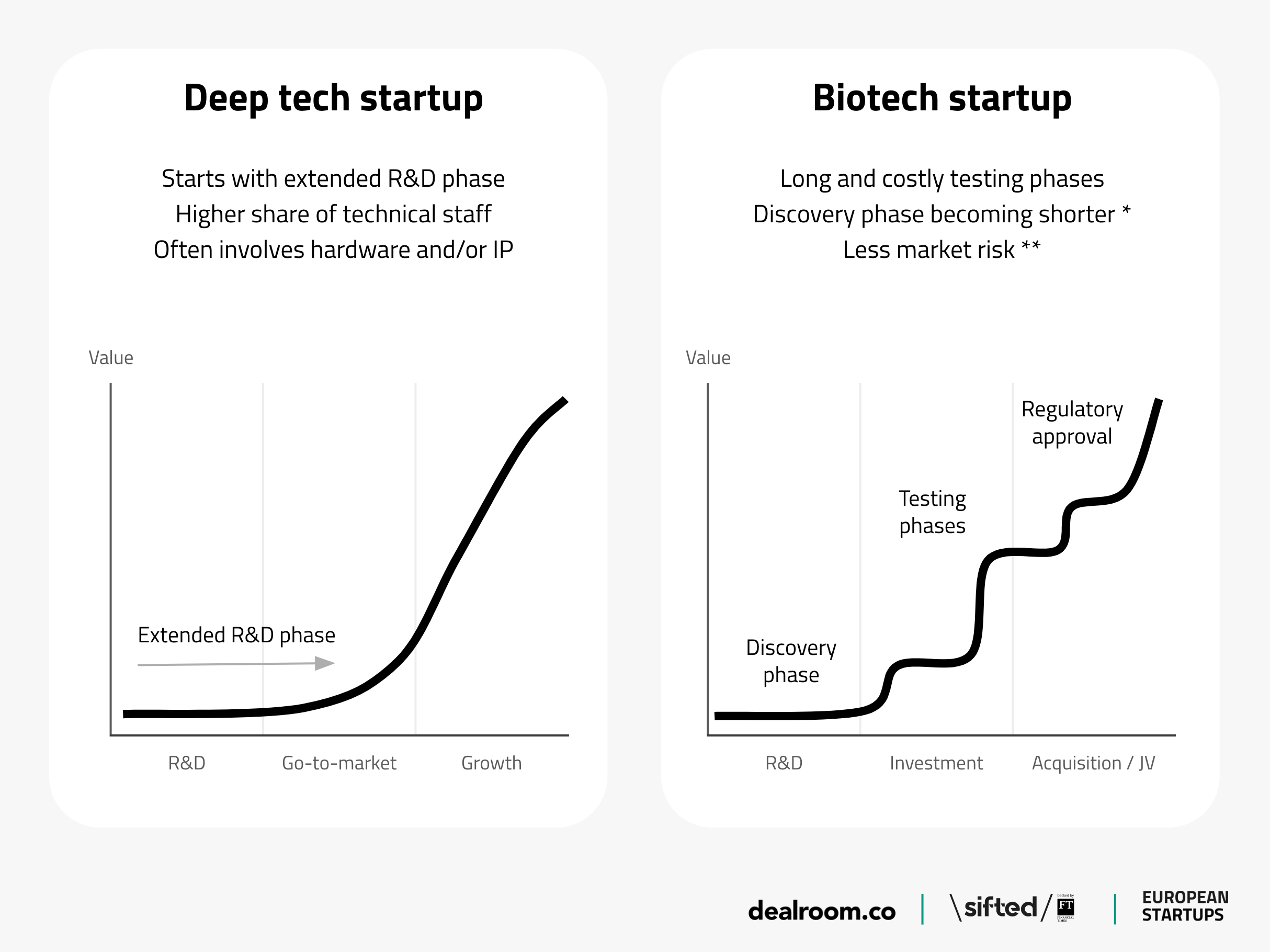

Biotech vs Deep Tech

We mostly do not consider biotech to be part of Deep Tech.

In fact, while it is true that biotech is also capital intensive and requires a long time to market, biotech is an established asset class where the longer time frame is mostly due to testing and regulatory approval more than the initial discovery phase.

Examples of this are AI drug discovery startups such as Benevolent AI and Exscentia (and in general high-throughput screening), as well as companies such as Oxford Nanopore (nanopore sequencing) and synthetic biology DNA Script.

Key segments in European funding

Some of the Deep Tech segments which have attracted the most funding in 2023 so far include launch rockets, quantum computing, generative AI, hydrogen, autonomous mobility, Photonics Tech and Blockchain infrastructure.

You can visualize the trends in these areas in this investment heatmap in Dealroom.

Generative AI

For more insights on this topic, see our global Generative AI guide.

Space Tech

Further details on key segments in Space Tech, main hubs in Europe and top investors can be found in our European Space Tech report 2022 in partnership with ESA (European Space Agency) and Fondazione E. Amaldi.

Geographical insights

The US leads Deep Tech funding by a large margin, with 2.5x more funding than Europe in 2022.

European Deep Tech was more resilient than US and China in 2022 and has grown the most since 2020.

The Rest of Europe, beyond the EU and the UK, grew the most in the last two years.

Top countries in Europe

The UK has attracted the most funding in Europe, followed by France, Germany and Sweden.

Switzerland is the most Deep Tech focused ecosystem in Europe, followed by Sweden, France, Finland and Norway.

Investors

The funding journey

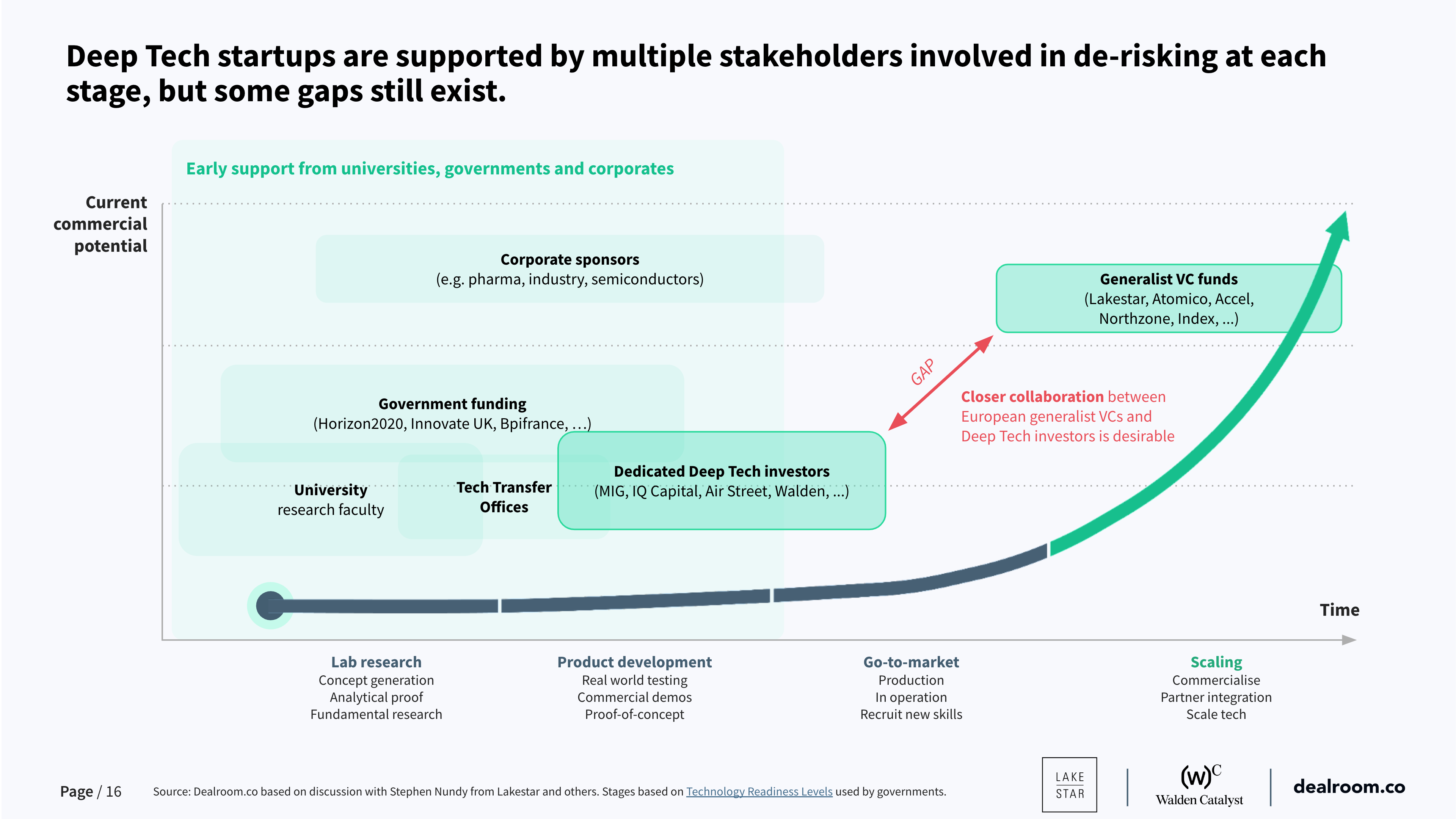

Deep Tech startups are supported by multiple stakeholders involved in de-risking at each stage.

At the earliest stages, university research and government support (such as grants) often finance lab research. Then dedicated Deep Tech investors take the leading role in financing product development till early-go-to market. Corporates can also be active in both supporting lab research and product development.

A key gap is though present in the advanced go-to-market and scaling & commercialization phase.

In this phase, Deep Tech needs to gain the support of generalist VC funds that can provide breakout and late-stage financing, which are not always comfortable with pre-revenue startups at this late stage. To smooth this phase, more collaboration would be desirable between early-stage Deep Tech specialists and Generalist VC funds.

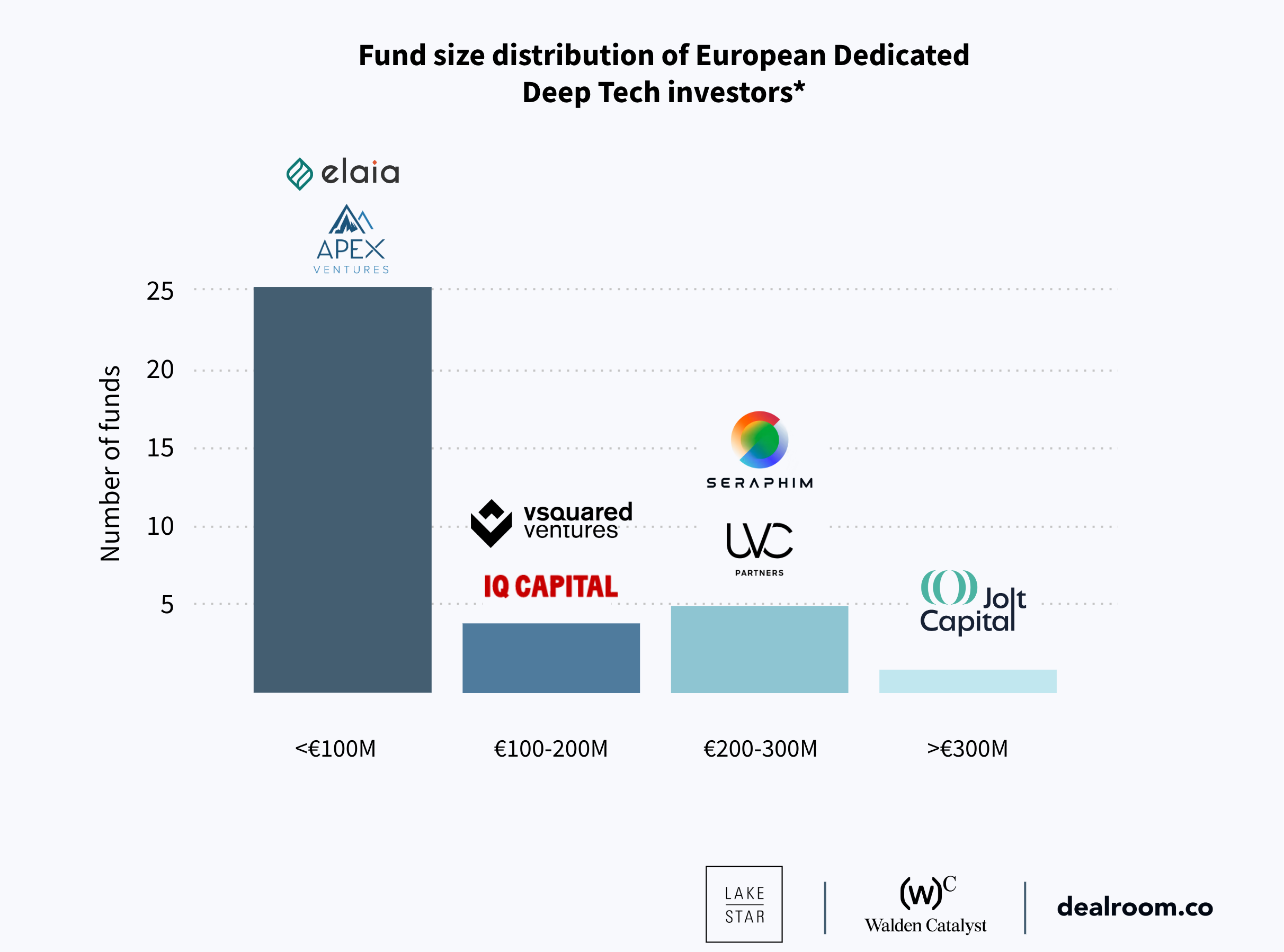

Our analysis of 50+ Deep Tech specialist funds in Europe supports these considerations.

Most Deep Tech specialist investors in Europe focus on the early stage and don’t have the firepower to lead at Series B+.

In fact, based on Dealroom data, the average Deep Tech Series B is €30M and assuming a 50% capital share by the lead investor, this would require a commitment of €15M.

Assuming a fund to target around 20 investments at that stage, a fund of €300M would be needed (€15M x 20 fund investments = €300M).

But over 90% of European Deep Tech specialist investors have fund sizes below €300M. Therefore Deep Tech specialist funds in Europe largely cannot lead Series B+ rounds.

One way to bridge this gap is the creation of Deep Tech focused teams inside generalist funds.

"To properly invest in Deep Tech you must build a dedicated team. The approach and process used to invest in Deep Tech is often quite different from traditional SaaS investing. It requires a unique investor skillset, a specialized bottoms-up investment strategy and the ability to operate independently.”

This is overall true worldwide, but less in the US than in Europe. In fact, the US has a much more robust ecosystem of multi-stage Deep Tech VCs capable of supporting from early to late stage.

An example is Lux Capital, active from Seed to Series D, which raised a new $1.2B fund in Apr 2023.

VC funding by investor location

Deep Tech VC funding in Europe comes almost entirely from domestic investors at the (pre) seed stage, but the share of funding coming from the US and Asia increases to nearly 50% at the late stage.

This could pose risks to Europe's technological independence as a third pole in respect to the US and China.

A key initiative trying to increase the late-stage capital availability for Deep tech in Europe is the European Tech Champions Initiative.

The initiative seeks to invest €3.75 billion as fund-of-funds in 10-15 funds which need to be €1B+ in size and target deep tech startups. Doing so, it aims to mobilise at least €10 billion in late-stage capital.

Top Investors

Explore the most prolific venture capital investors in European Deep Tech startups.

Filter by typical first-round stage by clicking on the labels below.

LPs

LPs in Europe see Deep Tech as the 2nd most promising segment in venture capital, behind only Planet Positive.

"Europe has a clear role to play as a leader in Deep Tech, and the future of fundamental research and innovation. At the frontier of innovation, Deep Tech’s disruptive technologies - such as AI, Space, Quantum, Hardware, and Cybersecurity - have population-level impact potential. Europe is already home to huge numbers of highly-skilled scientists and researchers. The EIF is now supporting an emergent community of Deep Tech VCs, to bring their smart money and know-how to this underserved segment. The Deep Tech breakthroughs of the next decade will shape our societies well into the next century. It is therefore essential for Europe to lead from the front in shaping these revolutionary technologies and their real-world applications."

Public Support

There is strong public support for Deep Tech startups in Europe across multiple instruments, both at the EU and national levels.

Horizon Europe, EIC, EIT Innoenergy, UK Research and Innovation, and many other national agencies award grants to Deep Tech startups.

Equity investments are carried out by EIT InnoEnergy, but also by national public-supported investors such as BPIFrance.

EIF (European Investment Fund) is also the main LP in most European Deep Tech funds, providing nearly 40% of the capital allocation.LPs in Europe.

Exits

The European Deep Tech saw an unprecedented nearly $100B in exit value in 2021, spurred by a wave of IPO & SPACs, such as UiPath, Arrival, Roivant Sciences, Oxford Nanopore and Lilium.

The public exit activity then reduced strongly in 2022.

However, the exit count instead reached its highest level in 2022, led by small M&A.

M&A

European Deep Tech startups are often targets of acquisitions by large industrial groups and Big Tech.

The most active acquirers are tech US companies, led by Apple and Meta, but also Snap, Microsoft, Google, Intel and Qualcomm.

Looking back, one of the most notable examples is the Deepmind acquisition by Google in 2014 for £400M.

A clear valuation cannot be assigned today, but DeepMind is today one of the leading AI research labs globally and in April 2023, Google's AI research team (Brain) has been joined under its lead.

In 2022, for instance, Meta acquired AI sound processing startups Audio Analytic and Accusonus, as well as haptic technology for AR/VR Lofelt and 3D lens printing technology provider Luxexcell, Google acquired AI-avatar startup Alter, Snap acquired brain-computer interfaces startup Nextmind, and Intel acquired developer tools provider Codeplay Software.

European industrial groups are also active in acquisitions. For instance, in 2022, Stellantis acquired ADAS provider AImotive, while Bosch acquired autonomous driving startup Five AI.

Startup leaders are also active acquirers. Notable in 2023 is the acquisition of AI acceleration startup Instadeep by BioNTech to accelerate drug discovery.

R&D, patents and spinouts

Science hubs

“We, Europeans, are excellent at making science with money. But we are not so good at making money out of science.”

Ursula von der Leyen, President of the European Commission

15 of the top 30 science hubs globally are located in Europe in our ranking from The Next Generation of Tech Ecosystem, based on a per capita analysis of Deep Tech funding at early, breakout, and late stages; unicorn creation; and patents.

University spinouts

Many European Deep Tech startups' successes have their roots in academia.

Among the most notable examples of spinouts are: BionTech from Johannes Gutenberg University Mainz, Celonis from TU Munich, ClimeWorks from ETH Zurich, DarkTrace from Cambridge, Oxford Nanopore from Oxford, and Mindmaze from EPFL (Lausanne).

Universities in the UK created the most spinout value, followed by Switzerland and Germany. ETH, Oxford, and Cambridge are the top universities overall by spinout value creation.

Corporates have also been the starting point for some of the largest tech companies in Europe.

Notable examples are Infineon which spun out of Siemens in 2000, and Veoneer spun out from Autoliv and was then acquired by Qualcomm.

Diversity and inclusion

Notable achievements have been reached in gender inclusion in higher education studies, with women now near to reaching gender parity among doctoral graduates (48.1% in 2018), but are still heavily underrepresented in STEM, making up just about a quarter of the total (24.9% in 2018).

Unsurprisingly, the Deep Tech startup ecosystem needs to catch up on inclusion.

Just 11% of Deep Tech VC funding went to startups with at least one female founder in 2022, and little-to-no improvements have been seen in recent years.

Similarly, just 10% of EU patents are obtained by females.

Notable examples of female-founded startups in Europe include Darktrace, BioNTech and Promixie.

"More must be done to avoid unconscious bias. Last year only 3% of VC funding in Deep Tech was invested in startups that were female-only founded. However, diversity of thought, opinion and creativity is essential for our Deep Tech ecosystem to thrive. To that end, we must strive towards inclusivity, across all backgrounds and genders, for the space to reach its full potential.”

Note: We have been referring mostly to gender and especially female inclusion since it is the diversity aspect where most data are available, but other diversity aspects such as ethnicity, age, physical disabilities and much more are all of key importance.

Partners![]()

Lakestar invests with a long term view across all stages from seed to growth.

We care about Europe. We understand its regulations and politics. We speak the languages and appreciate its cultures. Yet we have a global mindset and like to build bridges between continents, through our deep relationships in many different ecosystems.

Lakestar’s Deep Tech team focuses on novel scientific and engineering breakthroughs that are making their way into companies and products for the first time. We live on the bleeding edge and are constantly looking for contrarian views on how the world is going to change for the better.

Walden Catalyst Ventures is helping early-stage companies in the U.S., Europe, and Israel build the next generation of category-defining businesses in Deep Tech. We back the bold and the daring—trailblazers who are changing the world and making life better for all of us.

Walden Catalyst invests in innovators and entrepreneurs passionate about disruptive technologies and committed to excellence.

For startups, this translates into unparalleled access to operational expertise, global reach, and a network of industry captains eager to help build and scale the companies of the future.