Climate tech

Introduction

Climate Tech refers to an array of technology solutions designed to address climate change and its environmental effects. This can be done by reducing GHG emissions or adapting our systems to environmental changes.

Within the broad spectrum of climate tech, we find different types of technology, such as hardware, software, API, IoT, and biotech. Climate applications span a wide set of industries and sectors.

Here below, you can find some of the main applications for these technologies.

Combined enterprise value

In 2022, the combined enterprise value of global climate tech startups dropped by 20% to $2.0T, before recovering and reaching a record high $3.4T in 2024.

The climate tech ecosystem has increased its combined value by 33x in a decade.

[premium-cutoff]

Current Investment trends

Below we break venture capital investment into three distinct stages:

- Startup stage ($0-15M rounds)

- Breakout stage ($15-100M rounds)

- Scaleup stage($100M+ rounds).

This provides more consistent and timeless segmentation of the startup & venture capital landscape (more so than self-reported round labeling, which are applied inconsistently, especially between business cycles).

Early-stage

Explore early-stage funding rounds into Climate tech startups here

Breakout-stage

Explore breakout-stage funding rounds into Climate tech startups here

Scaleup-stage

Explore scaleup-stage funding rounds into Climate tech startups here

Investment by geography

Climate tech VC funding is not being immune to the slowdown in the VC market. 2024 saw a ~50% decrease in respect to 2021/2022 levels.

Notably, Europe surpassed the US for Climate Tech VC funding in 2023. Europe held its best quarter to date in Q3 2023, with $8.8B poured into European climate tech solutions.

Zooming out, climate tech funding reached a record of $76B of VC funding in 2021, the $38B in 2024 did not reach these levels but surpassed 2020 and any previous years.

Overall, climate tech VC investment increased by 6.5x within the last decade (2024 vs 2014).

The big picture on climate tech

On one side, 2023 was the hottest year on record, with global temperatures close to the 1.5°C limit, and February 2024 was the warmest month on record with 1.8°C more than pre-industrial average.

Wildlife biodiversity has declined 69% since 1970 and we have already trespassed 6 out of the 8 planetary boundaries for earth stability.

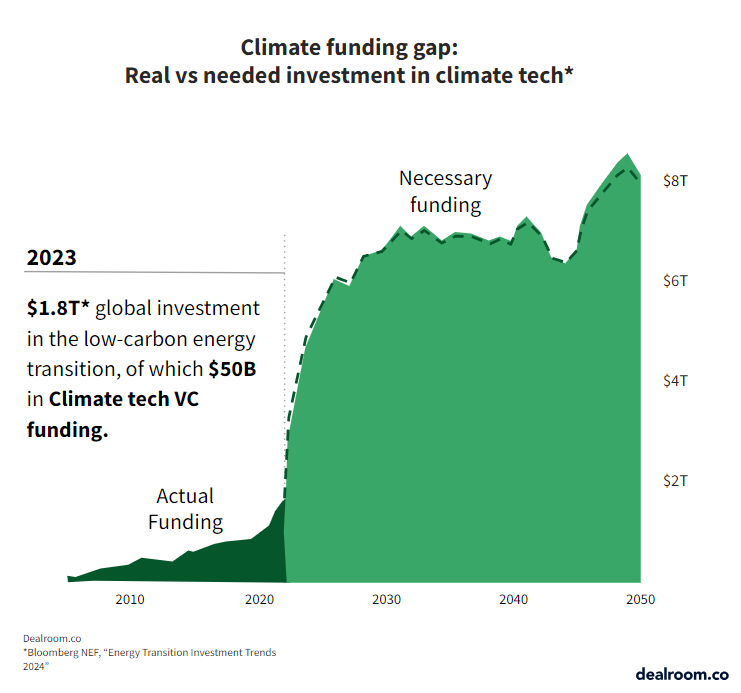

On one side, global investment in the energy transition rose 17% to $1.8 trillion in 2023, a new all-time high and clean investments are outpacing fossil fuels by 80%. But net zero investments need to grow more than 170% if we are to get on track for net zero in the coming years.

Climate Tech VC funding is a small (~3%) but key piece of this, since it can scale emerging technologies and catalyze billions in down the line by the public markets, asset managers and lenders

Looking beyond equity, Climate Tech companies are also raising large amounts of PE, project financing and debt, totalling $72B in 2024.

Leading countries

The US remains the top country by climate tech funding in 2024, followed by China, UK and Germany.

Cumulatively, the US has invested $147B in Climate Tech startups since 2018, 2.4x more than China. UK, Sweden, Germany and France follow with $15-20B in funding.

Leading hubs

Bay Area and Boston have attracted the most funding in 2024, followed by Shangai and London. Shangai, Sao Paulo and Paris have experienced massive growth in the past few years.

Cumulatively since 2018, the US has claimed 3 of the top 7 hubs. Top European hubs include London and Stockholm.

Share of total investment

The shares of global VC funding going to Climate Tech have more than tripled within the last ten years.

Despite Climate Tech VC funding decreasing by ~50% , as seen above, its share of VC funding kept rising from 14 to 16%.

This indicates that while the market crunch has slightly hit climate tech startups, their popularity among VCs is increasing.

Climate tech and Impact

Looking more closely at the wider impact ecosystem, the numbers considerably change. Here, climate tech attracts the bulk of the impact investment between 80% and 90%.

This indicates that impact startups focusing on climate and the environment are considerably more attractive than startups with a social focus.

Median round sizes

If we look at median rounds sizes in recent years, we can notice an upward trend for both climate tech and the overall startup ecosystem in recent years, except for rounds above Series C.

Climate tech startups show values similar to the rest of the ecosystem, demonstrating that impact does not come at the expense of attractiveness for VCs. Median round sizes are a good proxy for valuations and can even be more meaningful than valuations at early stages.

Looking at the changes in 2022 and 2023 with the market downturn, early-stage round sizes have held for both categories, while at later stages, performances diverge strongly.

Climate tech remained more resilient at Series B and Series C+ than the rest of the ecosystem.

Top industries and segments

Climate tech ranks 3rd most funded industry globally and has shown more decline than the average VC growth of 3%.

Within climate tech, transportation has been by far the most invested segment in 2024 with $19B allocated, Energy closely follows. However, Real estate has been the fastest-growing among the top climate tech verticals in the past years.

Overall, energy + transportation still accounts for over half of the funding though both have remained rather stable in the past year whilst other sectors have been growing their share.

By segment

Energy and mobility dominate the top Climate Tech segments.

Many of the most heavily funded Climate Tech segments, including EV battery, solar energy, and building energy efficiency contribute significantly to the climate sector.

Moreover, segments such as steel, solar energy and electric mobility are among the fastest growing Climate Tech categories.

Electric mobility has attracted the highest share of global investment since 2019. However the segment has registered a 40% decrease between 2024 and 2023 and an 54% decline since 2022.

In 2024, Hydrogen was the second top-funded segment, overcoming other prominent verticals such as Urban tech and circular economy.

In the last 24 months, hydrogen startups registered a 111% growth.

The fastest-growing segment in the last 12 months has been methane with a 327%+ growth to $779M.

Other segments showing strong growth in the past years have been biochar and nuclear fusion.

Early stage by vertical

Looking at early rounds, the ranking changes considerably. This time, circular economy

is the top funded segment with $778M in 2024, followed by and Electric mobility and urban tech.

The bulk of verticals registered a decrease in investment in the last 12 months, albeit remaining relatively stable compared to 2021.

nuclear fusion has experienced over +100% growth in the past year.

Energy

Climate Tech funding in the energy sector reached $24B in 2024, a 30% decrease from 2023. Solar energy attracted the most funding, followed by stationary-energy storage, hydrogen (mainly green hydrogen production) and grid technology.

Nuclear energy (both SMR and fusion) decreased strongly after the strong investments in 2021-2022.

Mobility

Climate tech funding in mobility reached $13B in 2024, a 27% decrease from 2023. Mobility is still the most investment segment in climate tech but nearly halved since 2021 and other climate tech segments have been expanding.

The vast majority of funding (~85%) has gone into electrification for ground transportation led by EV car manufacturing, EV battery manufacturing, EV battery recycling and second use and EV charging. Electric mobility investments outpaced hydrogen-transport investments by 48 to 1 in the ground transportation segment.

Micromobility and shared mobility investments have decreased dramatically from the 2021 peak.

Funding to decarbonize marine shipping has been growing, directed to a vast array of technologies from electrification to hydrogen, ammonia and biofuels, fouling prevention, auxiliary wind and fouling prevention.

For more explore our Blue economy guide.

Sustainable aviation investments have also been starting up in the latest years, focus on electric aircraft and batteries, hydrogen aircraft and sustainable aviation fuels (e-fuels and biofuels)

Circular economy

Despite the increased amount of discussions, debates and articles on the circular economy, global circularity of the economy (the share of secondary materials in global consumption) has decreased 21% in the last five years, from 9.1% in 2018 to 7.2% in 2023, according to the Global Circularity Gap report. Conversely, consumption keeps increasing with 28% of all materials ever consumed since 1900 taking place in the last five years.

On the startup side, circular economy is a tale of two very different stories. Fashion and other consumer-oriented segments are strongly strolling with funding drying up in the last two years. On the opposite industrial-oriented circular economy has been growing strongly led by EV battery recycling, but also recycling of metals and other industrial materials.

Blue economy

To explore blue economy funding trends, explore our dedicated Blue Economy deep dive.

Investors

Climate Tech startups raised over 2.8K rounds in 2023, a slight decline from 2021-2022, which saw over 3.5K rounds.

Below you can explore the range of unique investors into Climate Tech startups.

Top Investors

Top 500 investors in climate tech in 2023 and the share of their investments which were focused on climate tech in 2018-2023.

You can filter the table by preferred round type, which means the main stage at which the investor first invests in the company, so a Seed investor is most likely to invest at Seed and then potentially follow up at Series A and Series B. But might, at times, invest in a new company in Series A.

Vice versa, a Series B investor is likely to first invest in Series B but might also invest earlier in Series A at times or later in Series C.

By clicking on each investor, you can see their portfolio breakdown by geography, stage, and investment sector, as well each portfolio company.

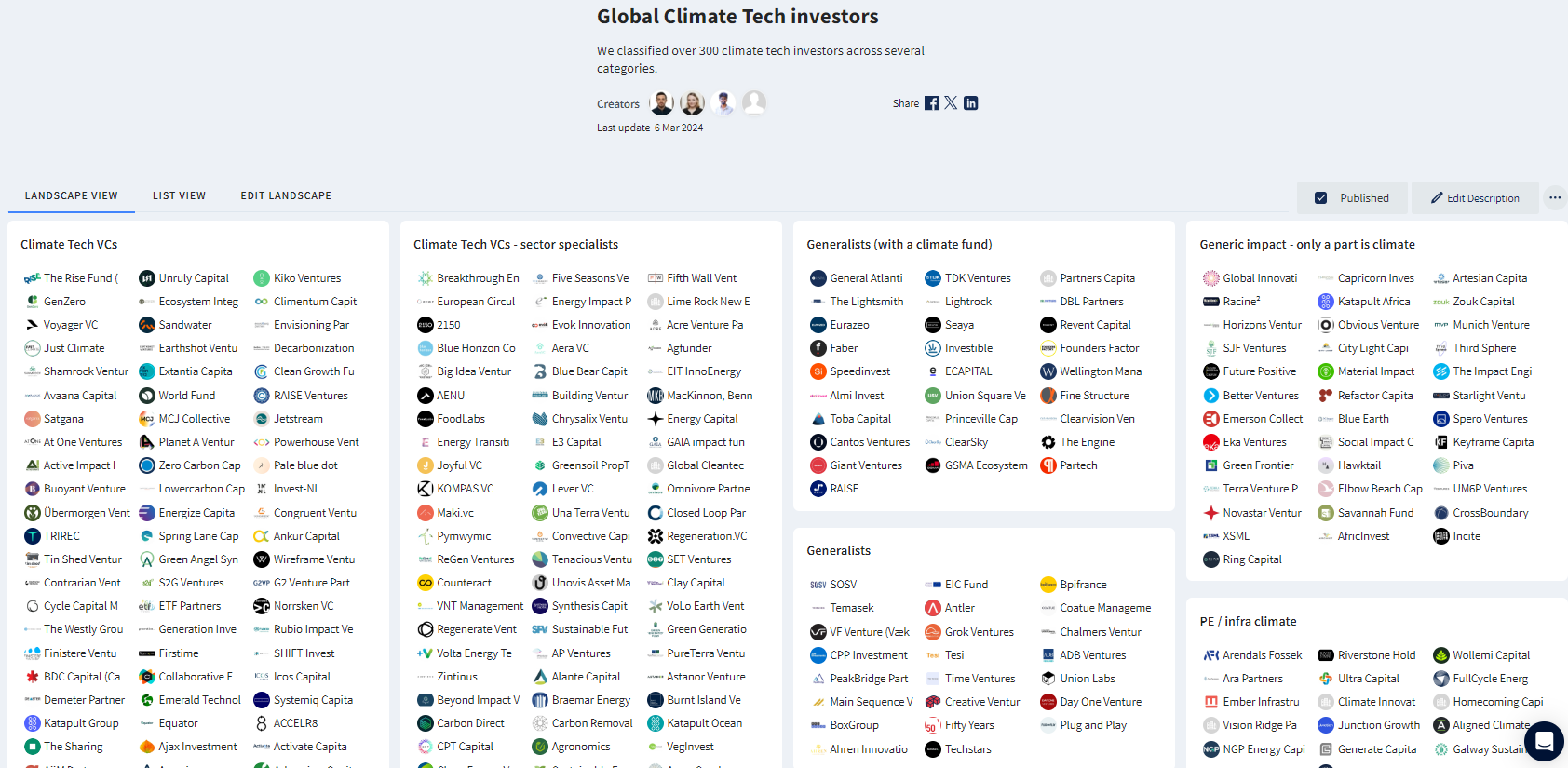

We have also classified over 300 Climate Tech investors ranging from Climate Tech VCs (fund with their main focus on climate tech), Climate Tech sector specialists (focusing on a specific climate tech segment from energy to food, but also water tech and circular economy), Generalists funds which raised a dedicated climate tech fund and much more.

Related content

Methodology & Definitions: Learn how Dealroom defines impact here.

Reports: Impact Startups: 2022 Review

Reports: The Rise of European Climate Tech

Reports: Urban Tech 2022

Reports: The State of Nordic Impact Startups 2022

Reports: Impact Festival 2022