Trivago gets ready to IPO

Expedia is moving ahead with exploring an IPO of Trivago, it’s hotel meta-search unit (Reuters), and started rounding up investment banks. Expedia acquired a 62% stake in Trivago in December 2012 for about $ 650M ($1 billion valuation). Expedia will not sell any shares in the IPO, but the Trivago founders (38%) will exit.

A successful investment by Expedia

Expedia paid a hefty acquisition multiple in December 2012 of 8x revenues and 56x EBITDA (both LTM). The acquisition was part of a push by Expedia to expand its presence in Europe in its rivalry with Priceline / Booking. Trivago’s revenues have grown by more than 5x in the last 4 years; that’s about a 53% cumulative annual growth rate (CAGR). In Q2 2016 Trivago reported 40% YoY growth. In the last 4 quarters combined, Trivago posted revenues of $ 660M and EBITDA of $ 22M.

Expedia is expecting to float $1 billion of stock, implying a total valuation of around $2.6 billion. This would be a 2.6x increase versus the $1 billion valuation in December 2012 and implies roughly a 25% annual increase in value. The multiples at IPO would be roughly 3-4x revenues and roughly 27x 2017 EBITDA. To see how these multiples compare with other public travel companies check out Dealroom’s valuation page of the Trivago profile.

So why the IPO?

Likely, the Trivago founders had negotiated a right to pursue exit via IPO if Expedia would not buy them out within a certain time-frame. Expedia did not exercise its right to buy the founders out. This could be because Expedia is satisfied with its majority stake (it already controls and consolidates Trivago). Expedia thus prefers to use its cash for new investment opportunities. If successful, the IPO could create another $1 billion liquidity event for the Trivago founders. This is on top of the € 434M in cash and the remaining $ 200M or so in Expedia stock received in 2012 (in the meantime, the Expedia stock also roughly doubled in value).

Will Trivago be a good investment?

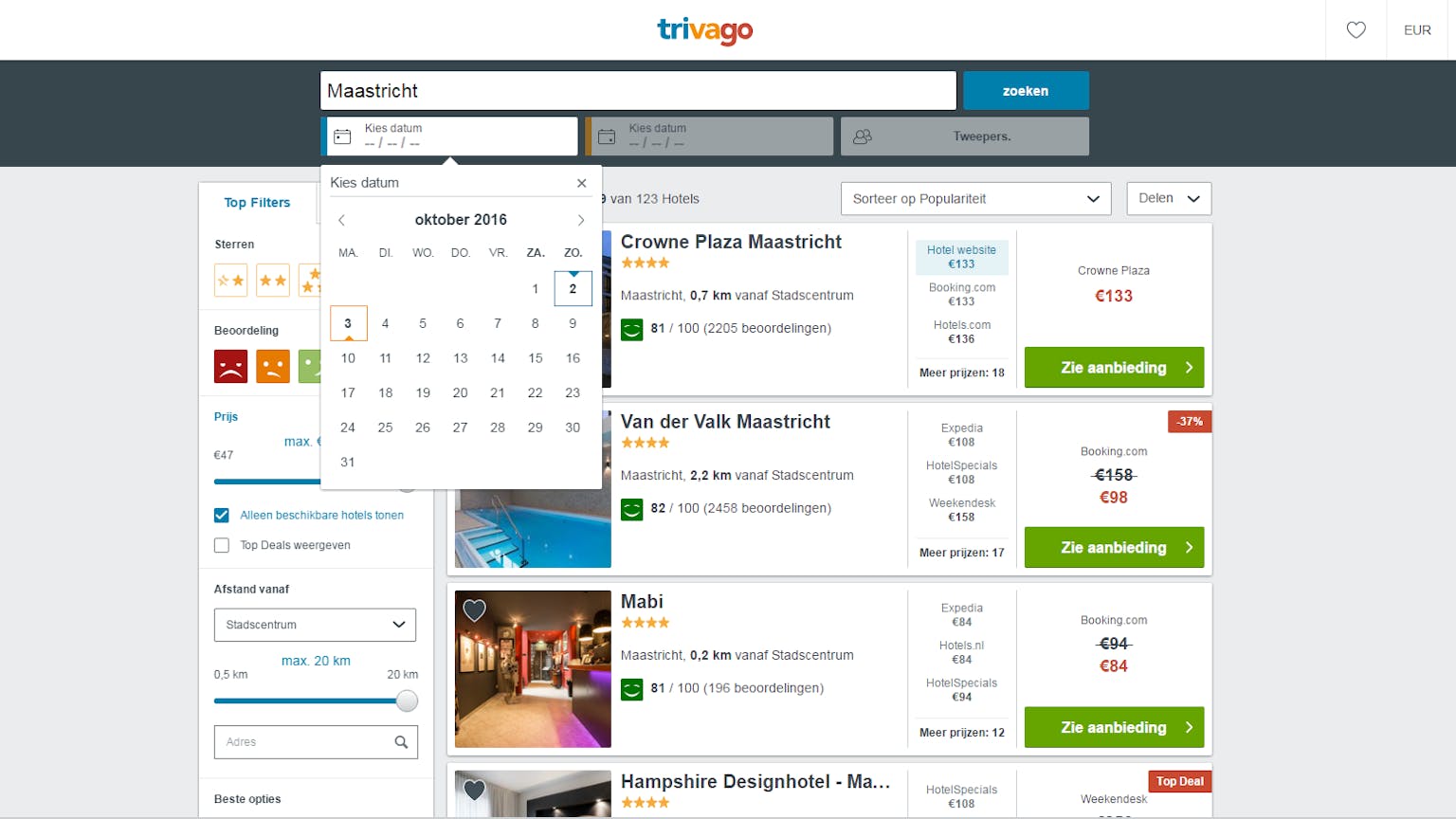

Clearly Trivago’s financial performance has been impressive. Hotel meta-search generally has continued to be on the rise. As our recent Travel deep-dive noted: consumers now look to compare across all types of accommodations, not just hotels. And Booking.com’s forced abandonment of price parity clauses means price comparison becomes more useful for consumers, as single properties may offer different prices on various sites. Trivago also started to experiment with Direct Connect, its direct booking platform for hoteliers. Direct Connect allows hoteliers to bid for direct bookings on CPA basis instead of paying commissions (Booking.com model).

On the other hand, meta-search has become very crowded, as search technology has become easier to replicate. Also, there are some intra-company expenses with Expedia which are not completely straightforward to understand for outsiders.

More big travel exits on the horizon

Trivago is not the only European online travel company likely to seek an exit. Check out the below list of other sizable travel companies which may be ripe for an exit or other strategic move soon.